AI models like ChatGPT have captured most of the AI spotlight, for good and bad reasons. The real problem with these “answer anything” services is that they cannot answer everything correctly. We are a long way from anything that can accurately answer any question.

In the meantime, the only way to get reliable answers from AI is to build specialized Agents that are focused on smaller bodies of information, specific topics or industry processes.

When we narrow the scope of an AI, we’re tackling a much more manageable challenge in a smaller dataset and range of processes that we need the AI to fully understand. So, small enough that we can have confidence that the data driving it is 100% accurate and reliable. AI models are like any other model: garbage in-garbage out.

For an AI Agent to be as reliable as a human expert, we must be able to endow it with the subject matter expertise to produce results on par with human experts. How do we do that? How do we know when an AI Agent is working?

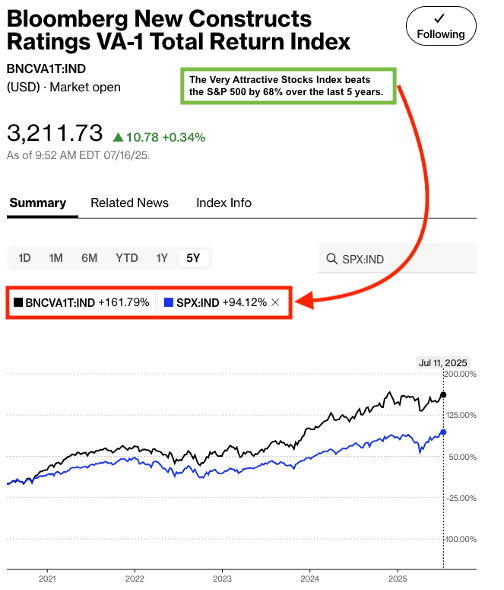

There is no better proof that our AI Agent works than the alpha it is delivering via the outperformance of the Very Attractive Stocks Index, officially known as the Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND). This index holds the stocks in the Bloomberg US 1000 that get our Very Attractive rating. Thus, we refer to it as the Very Attractive Stocks Index. The index’s outperformance over the short- and long-term is garnering more and more attention. See more details below.

Below, we share one of the stocks in the Index along with a brief overview of why we think Very Attractive stocks provide quality risk/reward. Enjoy this free stock pick. Feel free to share it with friends and family. We are proud of our work and want more people to see it.

Featured Stock from Bloomberg New Constructs Ratings VA-1 Index: Ituran Location and Control (ITRN)

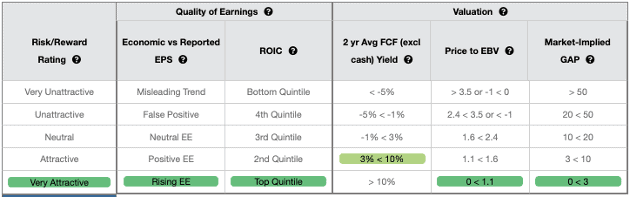

Ituran Location and Control (ITRN: $39/share) earns an overall Very Attractive rating, with Very Attractive ratings in four of the five criteria that drive our overall Stock Rating. See Figure 1.

Figure 1: Ituran Location and Control’s Stock Rating

Sources: New Constructs, LLC and company filings

Quality of Earnings Analysis

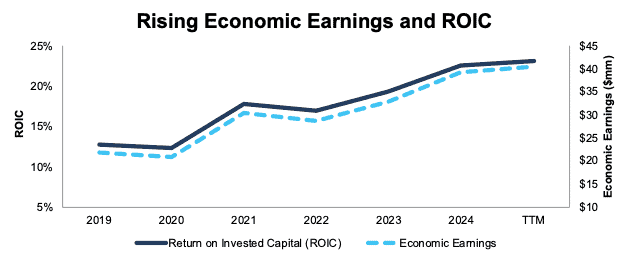

Ituran Location and Control earns a Very Attractive rating for the Economic vs. Reported Earnings metric and a Very Attractive top-quintile return on invested capital (ROIC).

We like to see companies grow their economic earnings, the true cash flows of a business, and Ituran Location and Control increased its economic earnings from $22 million in 2019 to $40 million in the TTM. See Figure 2.

Figure 2: Ituran Location and Control’s Economic Earnings and ROIC: 2014 – TTM

Sources: New Constructs, LLC and company filings

ITRN Is Undervalued

Ituran Location and Control has a 2-year average FCF (excl. cash) yield between 3% and 10%, which earns an Attractive rating. Additionally, the stock has a price-to-economic book value (PEBV) ratio lower than 1.1, and a market-implied growth appreciation period (GAP) of less than three years, both of which earn Very Attractive ratings.

More specifically, at its current price of $39/share, ITRN has a PEBV ratio of 0.8. This ratio means the market expects Ituran Location and Control’s NOPAT to permanently decline by 20% from TTM levels. This expectation seems overly pessimistic for a company that has grown NOPAT by 11% compounded annually over the last five years and 6% compounded annually over the last ten years.

The low expectations baked into Ituran Location and Control’s stock price, along with strong quality of earnings, drive its Very Attractive Overall Stock Rating.

Background on our Stock Ratings

Five criteria drive our stock ratings. We divide those criteria into two categories: quality of earnings and valuation.

Quality of earnings criteria:

- Economic vs. Reported EPS: compares both the level and trend of Economic Earnings, the true cash flows of the business, vs. reported earnings.

- Return on Invested Capital (ROIC): measures how much profit a company generates for every dollar invested in the company.

Valuation criteria:

- 2-year Average Free Cash Flow (excluding cash) Yield: measures the true cash yield of a company.

- Price to Economic Book Value: measures the growth expectations implied by the company’s stock price.

- Market-Implied Growth Appreciation Period (GAP): measures the number of years of future profit growth required to justify the current valuation of the stock.

Stocks that get an overall Very Attractive rating are poised to outperform in any market.

Real-Time Proof of Superior Stock Ratings

The strong outperformance of the Very Attractive Stocks Index proves the superiority of our Stock Ratings. BNCVA1T outperformed the S&P 500 by 68% over the last 5 years, rising 162% compared to the S&P 500 rising 94%. See Figure 3.

Figure 3: Very Attractive-Rated Stocks Strongly Outperform the S&P 500 Over the Last Five Years

Sources: Bloomberg as of July 11, 2025

Note: Past performance is no guarantee of future results.

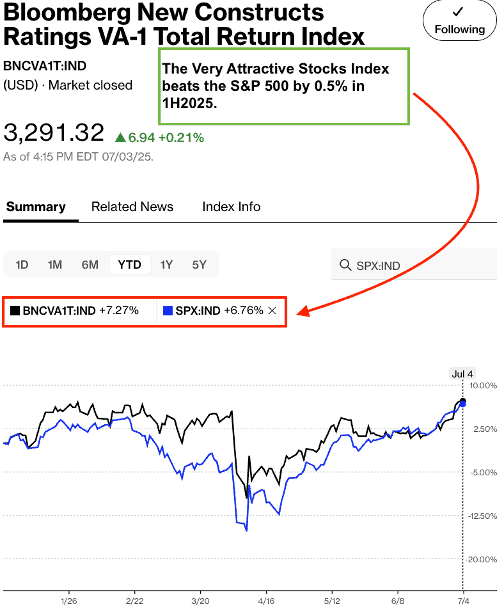

Wondering how the index has done more recently? See Figure 4 for details on the strong outperformance of the Very Attractive Stocks Index in the first half of 2025. BNCVA1T was up 7.3% while the S&P 500 was up 6.8%.

Figure 4: Very Attractive-Rated Stocks Strongly Outperform the S&P 500 in 1H25

Sources: Bloomberg as of July 4, 2025

Note: Past performance is no guarantee of future results.

This article was originally published on July 17, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.