The “Core Earnings-Weighted S&P 500” (ticker: B500NCT:IND) isn’t the only index that generates alpha by using our superior Core Earnings metric. The Bloomberg New Constructs Core Earnings Leaders Index (BCORET:IND) is entirely built on Core Earnings. To illustrate, we’re featuring a stock from this market-beating index.

This index holds the top 100 companies that have high Earnings Capture[1], which equals Core Earnings minus GAAP earnings divided by total assets. In other words, this index allocates to the 100 companies whose Core Earnings exceed GAAP earnings by the most relative to the size of the company.

Core Earnings is a superior earnings metric because it removes unusual gains and losses found in the footnotes and MD&A in company filings.

Our AI Agent for investing produces metrics like Core Earnings in large part because of the high-quality data we’ve used to train it. Our AI Agent is able to gather data from financial filings, including and especially the footnotes, and produce signals that outperform human analysts at scale.

This paper from the Harvard Business School and MIT Sloan professors empirically proves the idiosyncratic alpha in our proprietary measure of Core Earnings. The outperformance of the Core Earnings Leaders Index is further proof, as we show later in this report.

Below, we share one of the stocks in our Core Earnings Leaders Index along with a brief overview of just how understated the company’s Core Earnings are. Enjoy this free stock pick. Feel free to share it with friends and family. We are proud of our work and want more people to see it.

Featured Stock from Bloomberg New Constructs Core Earnings Leaders Index: General Motors (GM)

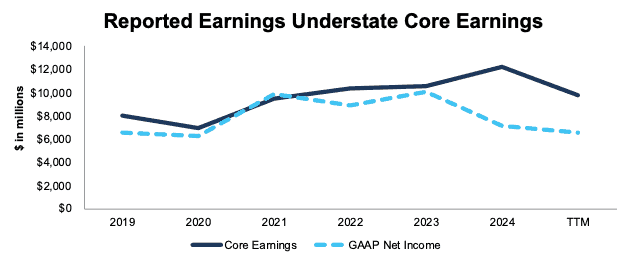

Over the trailing-twelve months (TTM), General Motors’ (GM: $54/share) Core Earnings equal $9.8 billion while its GAAP earnings are much lower, at $6.5 billion. The $3.3 billion in Earnings Distortion earns the company its place in the Core Earnings Leaders Index.

Per Figure 1, General Motors’s Core Earnings have increased while reported earnings (GAAP Net Income) have fallen over the past 5 years. Big green flag!

General Motors’ Core Earnings rose from $8.0 billion in 2019 to $9.8 billion in the TTM ending 2Q25, or 4% compounded annually. The company’s GAAP Net Income fell from $6.6 billion to $6.5 billion over the same time.

In the TTM ended 2Q25, General Motors Earnings Distortion is $3.3 billion, up from $1.4 billion in 2019. In other words, General Motors is much more profitable than investors relying on GAAP net income realize, and that disconnect is only growing.

Figure 1: General Motors’ Core Earnings vs. GAAP Net Income Since 2019

Sources: New Constructs, LLC and company filings

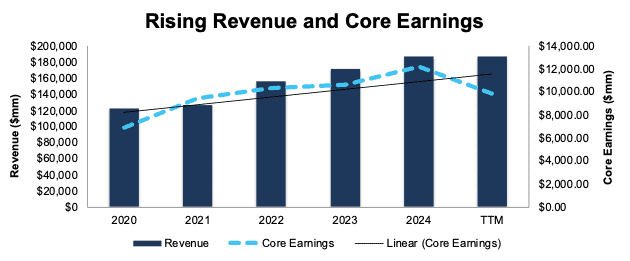

It should come as no surprise that General Motors has quality fundamentals, given its high and rising Core Earnings. The company has grown revenue and Core Earnings by 2% compounded annually over the last decade.

More recently, General Motors’ net operating profit after-tax (NOPAT) margin fell slightly from 5.6% in 2020 to 5.5% in the TTM while its invested capital turns rose from 1.3 to 1.5 over the same time. Rising invested capital turns offset the decline in NOPAT margin and drive the company’s return on invested capital (ROIC) from 7.4% in 2020 to 8.5% in the TTM.

Figure 2: General Motors’ Revenue and Core Earnings Since 2020

Sources: New Constructs, LLC and company filings

Real-Time Proof of Superior Earnings Metric

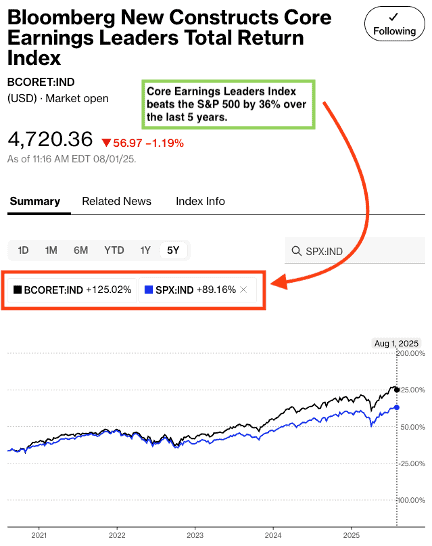

As noted above, you don’t have to take our word that allocating capital based on Core Earnings and Earnings Capture drives novel alpha. The outperformance of the Bloomberg New Constructs Core Earnings Leaders Index demonstrates real-time alpha.

Per Figure 3, the Bloomberg New Constructs Core Earnings Leaders Index (ticker: BCORET:IND) beat the S&P 500 by over 36% over the last five years, rising 125% while the S&P 500 was up 89%.

Figure 3: Bloomberg New Constructs Core Earnings Leaders Index Outperforms the S&P 500 Over 5 Yrs

Sources: Bloomberg as of August 1, 2025

Note: Past performance is no guarantee of future results.

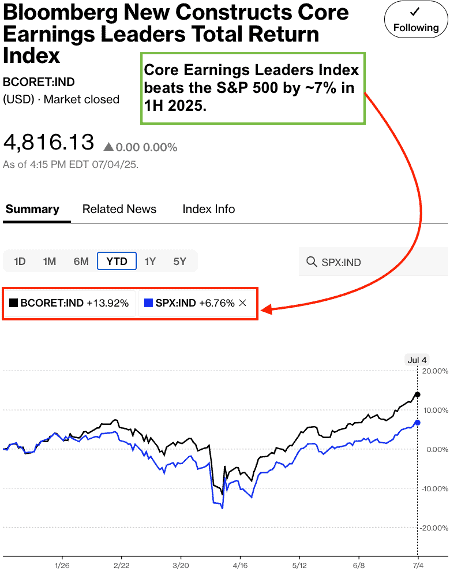

Wondering how the index has done more recently? See Figure 4 for details on the outperformance of the Bloomberg New Constructs Core Earnings Leaders Index in the first half of 2025. BCORET:IND was up 14% while the S&P 500 was up 7%.

Figure 4: Bloomberg New Constructs Core Earnings Leaders Index Outperforms the S&P 500 in 1H25

Sources: Bloomberg as of July 4, 2025

Note: Past performance is no guarantee of future results.

This article was originally published on August 11, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] Earnings Distortion equals GAAP earnings minus Core Earnings, or the opposite of Earnings Capture.