We recently highlighted how legacy automakers are well positioned to generate profits while EV-only manufacturers face mounting challenges as global demand for electric vehicles rapidly declines.

This week’s Danger Zone pick has two businesses. Both drive headlines and hype, but not profits.

Neither have built any meaningful market share compared to top competitors.

This company has burned over $17 billion in cash since its IPO. Yet, its valuation implies it will generate more profit while selling the same number of vehicles as Tesla. That seems a little too optimistic to us.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our Professional and Institutional members. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings.

Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- steep competition,

- low and stagnant market share,

- profitability far below peers,

- large cash burn, and

- valuation that implies the company will suddenly make as much profit as Tesla.

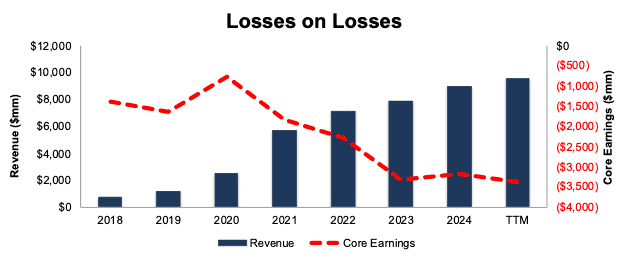

Losses Keep Piling Up

Given the industry backdrop, investors are likely not surprised to learn that this company is highly unprofitable.

The company has not generated positive Core Earnings in any annual or quarterly period since 2018. The company’s Core Earnings have fallen from -$1.4 billion in 2018 to -$3.4 billion in the TTM. See Figure 1.

Figure 1: Revenue & Core Earnings: 2018 – TTM ended 2Q25

Sources: New Constructs, LLC and company filings

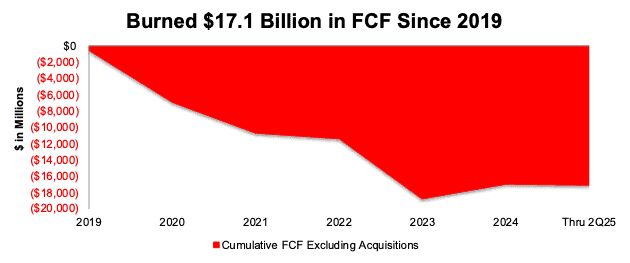

Zombie-Like Cash Burn

Alongside growing losses, the company consistently burns billions in cash. From 2019 through 2Q25, the company burned a cumulative $17.1 billion (81% of enterprise value) in free cash flow (FCF) excluding acquisitions. In the TTM alone, the company’s FCF was -$916 million. See Figure 2.

The company’s cash on hand has fallen rapidly, from $8.6 billion in 2021 to $2.9 billion over the TTM. Based on its cash on hand and TTM cash burn, the company has a 34-month runway from the end of October 2025 before it runs out of cash.

With more than 24 months of cash runway, the company doesn’t currently qualify as a Zombie Stock. However, if the company’s cash burn continues at the current rate, it could find itself on the Zombie Stocks list.

Figure 2: Free Cash Flow: 2019 – 2Q25

Sources: New Constructs, LLC and company filings

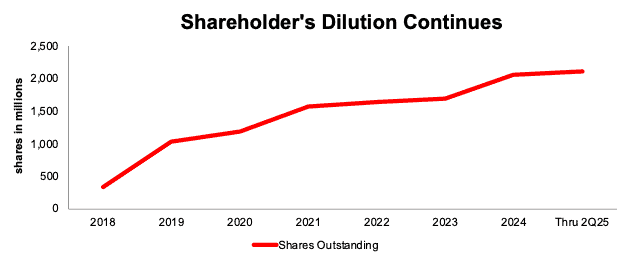

Diluting Shareholders Since Its IPO

This company has consistently diluted existing shareholders to fund its large cash burn since it went public in 2018.

The company’s shares outstanding have increased from 332 million in 2018 to 2.1 billion as of 2Q25, or a 6.4x increase. See Figure 3.

Figure 3: Shares Outstanding: 2018 – 2Q25

Sources: New Constructs, LLC and company filings.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.