Artificial intelligence for stock picking has arrived. Introducing FinSights, an AI agent built on and by Google Cloud – based on New Constructs’ data – to help investors pick stocks that dramatically outperform the S&P 500. Press release here.

Here’s how FinSights works:

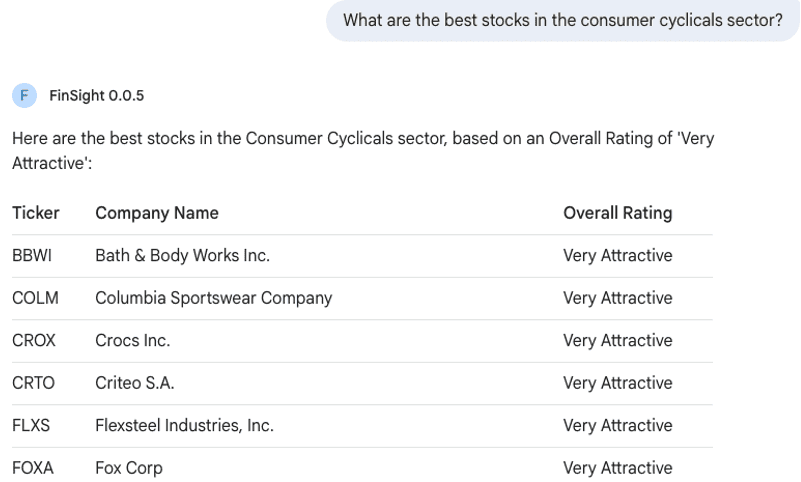

If you ask, “What are the best stocks in the consumer cyclicals sector,” within seconds, a list of attractive stocks appears.

The Stock Rating system that powers FinSights is the same as that which drives the outperformance of the Very Attractive Stocks Index, officially known as the Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND).

You can ask FinSights to find the best stocks in any sector, industry or, even, the entire market.

Sources: FinSights as of November 4, 2025

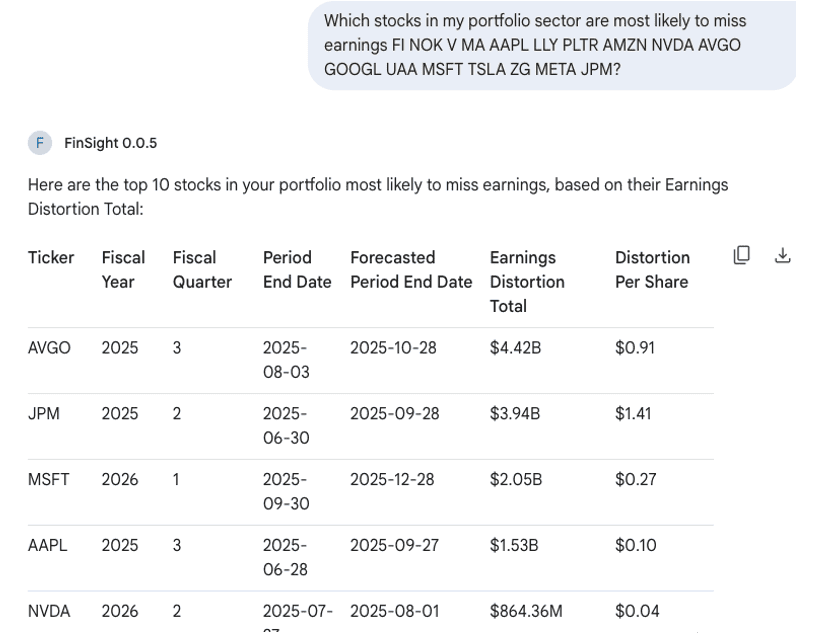

FinSights can go even deeper and tell you which stocks are at the highest risk of missing consensus earnings:

Sources: FinSights as of November 4, 2025

FinSights can also do deep dives into individual companies. For example, if you’re curious on just how profitable Tesla is, FinSights can tell you:

Sources: FinSights as of November 5, 2025

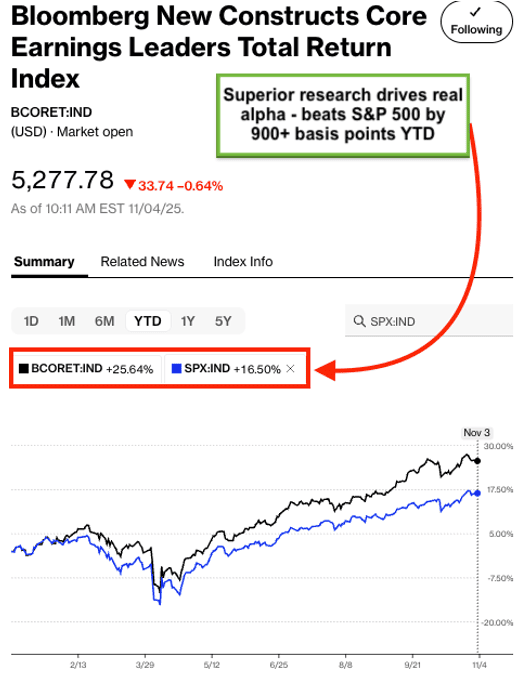

Grounded In Real Alpha-Producing Signals

FinSights provides insights and answers based on research that produces real alpha and drives outperformance of live-traded indices. The intelligence is based on the same data that powers the Bloomberg New Constructs Core Earnings Leaders Index (BCORET:IND), which recently turned 1-year old and is beating the S&P 500 by more than 900 basis points so far in 2025.

Over the last 5 years, the index (up 142%) outperforms the S&P 500 (up just 95%) even more strongly and beats it by 14,700 basis points. Bloomberg provides two other indices based on New Constructs research: Bloomberg New Constructs 500 Total Return Index (B500NCT:IND) and the Very Attractive Stocks Index, officially known as the Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND). Both strongly outperform as well.

Sources: Bloomberg as of November 3, 2025

Note: Past performance is no guarantee of future results.

Some of the stocks in the index that have outperformed include: NVIDIA (NVDA), Apple (AAPL), International Business Machines (IBM), General Motors (GM), Eli Lilly (LLY), AT&T (T), and JP Morgan Chase (JPM).

Build with Us and Google Cloud

Finsights is built on and by Google Cloud. The holy grail for AI Agents is delivering real insights. As detailed above, we’ve gathered unrivaled experience in endowing machines with the subject matter expertise to perform like human experts. And, we’ve developed excellent relationships with the super talented engineers at Google Cloud who built FinSights.

FinSights demonstrates the power of AI when using high quality data. But, the bigger vision has always been to include other datasets or Small Language Models (SLMs) like sentiment, insider buying/selling and technical analysis. It’s awesome that our fundamental signals are good enough to generate alpha on their own, but there’s no doubt that the signals can be further enhanced by adding complimentary and customizing FinSights to suit the needs of your organization.

Get Access

To learn more about New Constructs, our research and FinSights, be sure to join out mailing list here.

We also put together a short live demo of FinSights in action here.

This article was originally published on November 5, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.