While the capital markets enhance economic development, they are not perfect. Sometimes, certain companies achieve a valuation they do not deserve and hold it for a long time. So long, that investors begin to think that maybe the market has it right…

The market is not currently right about this week’s Danger Zone pick. The company’s profitability lags peers, it has burned through $9 billion in free cash flow since 2019 and yet, its stock is up 13% year-to-date.

Now, its current valuation implies it will take nearly 50% share of its total addressable market. High cash burn and an extremely expensive valuation make this stock one to avoid.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our Professional and Institutional members. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings.

Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- lagging profitability,

- large cash burn,

- increasing shareholder dilution, and

- stock price that implies the company will own nearly half its total addressable market (TAM).

Adjusted Earnings Metrics Mislead

Investors that don’t look beyond the surface may think this company is more profitable than it actually is.

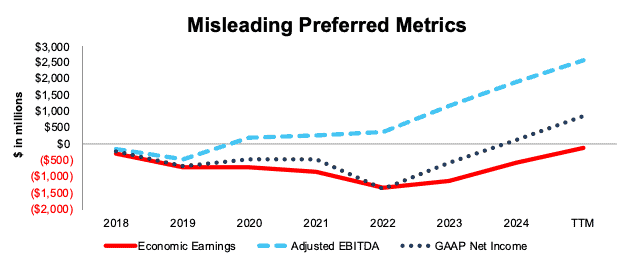

The company’s preferred earnings metric, adjusted EBITDA, and even its GAAP net income, paint a much rosier picture of its underlying business.

When we analyze the company’s economic earnings, the true cash flows of the business, we see just how misleading this non-GAAP metric is.

In the TTM ended 3Q25, the company reported adjusted EBITDA of $2.6 billion and GAAP net income of $863 million, while its economic earnings were -$104 million over the same time. Figure 6 shows the discrepancy between the three earnings metrics.

In the first nine months of 2025, management removed $1.3 billion in net expenses to calculate adjusted EBITDA. The largest adjustment removes $780 million in “stock-based compensation expense and certain payroll tax expense” to calculate adjusted EBITDA. This expense is 109% of the company’s reported GAAP net income in the same period.

Figure 1: Adjusted EBITDA, GAAP Net Income, and Economic Earnings: 2018 – TTM

Sources: New Constructs, LLC and company filings

Zombie-Level Cash Burn Continues

The company has burned a cumulative $9.0 billion (9% of enterprise value) in free cash flow (FCF) excluding acquisitions from 2019 through 3Q25. See Figure 2.

In the lead up to a recent acquisition, the company issued $2.75 billion in convertible notes in May 2025 and classified $3.9 billion in cash as restricted cash, because it was held in escrow for the purchase. Because the company closed on the acquisition after the fiscal 3Q25 quarter ended, these actions impact the company’s free cash flow excluding acquisitions.

We remove acquired invested capital from FCF excluding acquisitions to get a sense of the company’s FCF had it not taken on an acquisition. While we normally calculate FCF with acquisitions, this analysis provides additional insight into the cash burn of a business.

Even if we exclude the entire $3.9 billion acquisition from invested capital, the company’s FCF excluding acquisitions would be -$1.1 billion over the TTM. With the acquisition, FCF sits at -$5.1 billion over the same time.

Figure 2: Cumulative Free Cash Flow Since 2019

Sources: New Constructs, LLC and company filings

Diluting Shareholders to Fund Cash Burn and Reckless Spending

The company’s recent capital raise via convertible notes continues a long-running trend of shareholder dilution.

The company’s shares outstanding have increased YoY in every year since its IPO. Per Figure 3, the company’s shares outstanding increased from 62 million in 2020 to 434 million in 3Q25.

In February 2025 the company authorized a $5.0 billion share repurchase program, which on paper sounds like a great way to reduce shareholder dilution. However, the company has not repurchased shares through the first nine months of 2025. Meanwhile, shares outstanding increased from 412 million at the end of 2024 to 434 million at the end of 3Q25.

A large repurchase authorization may create nice headlines, but it means nothing if no shares are repurchased.

Figure 3: Shares Outstanding Since 2020

Sources: New Constructs, LLC and company filings.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.