We recently published our quarterly Best and Worst ETFs and Mutual Funds reports that rank all 11 sectors from Very Attractive to Very Unattractive. These reports provide a bottom-up assessment of the fundamental risk/reward in each sector based upon the stocks in those sectors.

This quarter, one sector in particular stood out, and not for good reasons.

We’ve all seen the headlines about the rising grip the Tech sector, especially a few tech giants, have on the market. Despite the high-growth and AI narratives that drive rising stock prices, a hidden danger grows: while reported earnings rise, cash flow is in major decline.

As a result, the outsized profits that Wall Street gushes over are not real. Because of this mirage, the Technology sector now earns our Unattractive rating, a downgrade from its Neutral rating, which it maintained from 4Q21 to 4Q25.

This recent downgrade, along with the falling cash flows and rising debt make the Technology sector look increasingly overvalued and land it in the Danger Zone.

Get all the details in our latest Danger Zone report.

Below we present a large excerpt from the report published this week to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the tickers from this report, but we are happy to share our hard work because we want you to see how good our research is.

Cash Flow Takes a Nosedive

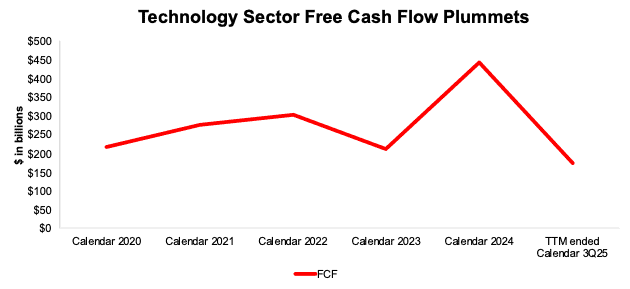

While earnings continue to rise, tech companies’ balance sheets, in particular total debt, are growing ever faster. As a result, the sector’s free cash flow (FCF) took a nosedive.

This trend is the ugly part of the AI race. As we detailed in a prior Danger Zone report: The Losers in the AI Arms Race, the spending required to stay in the AI race is gargantuan. We see that cash drain manifest in the steep decline in the overall sector’s free cash flow.

In the trailing twelve months ended calendar 3Q25, the Technology sector’s FCF fell precipitously since calendar 2024. See Figure 1.

Figure 1: Technology Sector Free Cash Flow: Last Five Years and TTM

Sources: New Constructs, LLC and company filings

Free cash flow data incorporates the financial data available as of January 20, 2026, which is the calendar 3Q25 10-Q for all companies with standard calendar years.

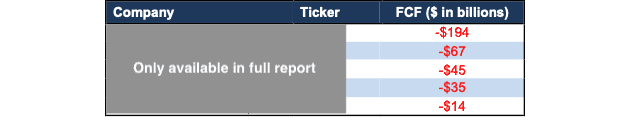

The Biggest Cash Burners

As the AI race forces companies to spend unprecedented amounts of capital to develop and scale AI capabilities, we’re seeing a clear line between the companies that can afford to stay in the race and those that cannot. We think with companies with negative free cash flow are at a significant disadvantage to those that can keep spending and keep FCF positive. See Figure 2.

Figure 2: Technology Sector’s Largest Cash Burners

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

I’ll keep sending information on low quality sectors, industries, or specific companies until you’re ready to start your membership.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.