Today’s stock market rebound just adds to the volatility of this uncertain market. The swift shift in tone suggests that markets have already moved past the weaker-than-expected jobs data, despite the report raising fresh concerns about the health of the U.S. labor market.

In this volatile and highly valued market environment, individual stocks remain especially vulnerable, even as broader indices continue to climb. A single negative earnings report or unfavorable development can quickly erase gains.

Understanding a company’s true financial position is critical to making informed and confident decisions. Our Danger Zone reports identify the most overvalued and fundamentally risky stocks, helping investors avoid potential pitfalls before they occur.

This week’s Danger Zone pick is also on the Zombie Stocks list. The company is selling off assets and diluting shareholders, sales are declining, it has persistently negative profit margins, and its stock is overvalued.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings.

We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- declining sales,

- high cash burn and selling off assets,

- shareholder dilution,

- persistently negative profit margins,

- a stock valuation that implies drastic margin improvement and rapid revenue growth.

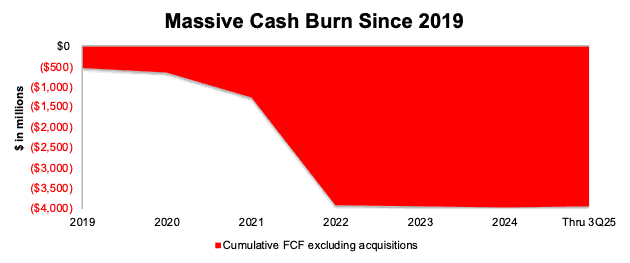

Large Cash Burn

We analyzed this company’s alarming free cash flow (FCF) burn in our original Danger Zone report. The heavy burn was one of the main reasons we named this stock a Zombie Stock in June 2022. Since fiscal 2019, the company has burned $3.9 billion (77% of enterprise value) in FCF excluding acquisitions. See Figure 1.

As we mentioned in our most recent update, this company technically doesn’t qualify as a Zombie Stock because its TTM FCF is positive. However, the positive FCF comes less from improved operations, and more from selling off assets. So, it remains a Zombie Stock.

The company’s TTM net operating profit after tax (NOPAT), at -$47 million, remains negative. Meanwhile, over the past year, the company’s invested capital fell by $222 million. In the TTM ended fiscal 3Q25, inventory declined $141 million YoY while net property, plant, and equipment fell $137 million YoY.

So, while this company generated $175 million in FCF over the TTM, this FCF comes from selling assets, not generating profits.

The company can only sell off assets for so long, though, and after generating positive FCF in four consecutive quarters from fiscal 3Q24 – 2Q25, FCF was negative again in fiscal 3Q25.

Selling off assets isn’t a sustainable way to generate positive cash flow, which is why we still believe this stock could go to $0.

Figure 1: Cumulative Free Cash Flow Since Fiscal 2019

Sources: New Constructs, LLC and company filings.

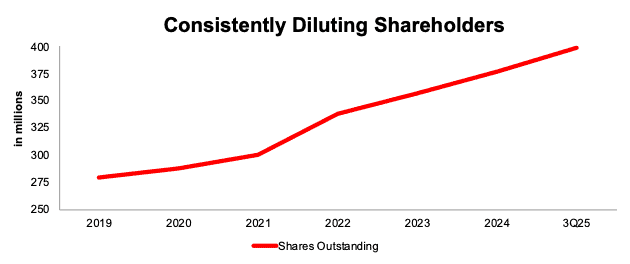

Large Cash Burn + Diluting Shareholders = Red Flag

Apart from selling off assets, this company is diluting existing shareholders. This company’s shares outstanding increased YoY every fiscal year since its IPO. Per Figure 2, the company’s shares outstanding increased from 280 million in fiscal 2019 to 399 million in fiscal 3Q25.

Figure 2: Shares Outstanding: Fiscal 2019 – Fiscal 3Q25

Sources: New Constructs, LLC and company filings

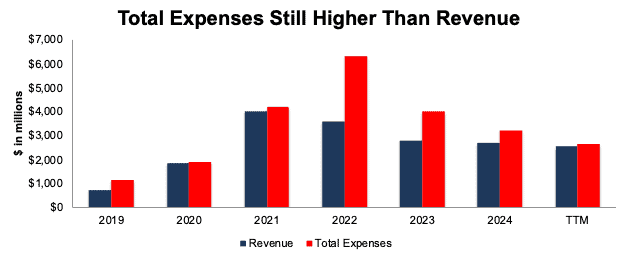

Expenses Falling, But Still Too High

This company’s total expenses, which include cost of revenue and total operating expenses, have declined over the last few years.

However, despite the improvements, the company’s total expenses are still higher than revenue. It’s worth noting that the company’s total expenses as a percentage of revenue have been higher than 100% in all fiscal years since the company’s IPO in 2019, including the TTM ending 3Q25 in which it was 105%. See Figure 3.

This company’s high expenses are one of the main reasons why the company hasn’t generated positive NOPAT since 2021.

The only time the company generated a positive NOPAT was during fiscal 2020 ($5 million) and 2021 ($73 million), when the company’s sales soared during COVID lockdowns. In both fiscal 2020 and 2021, the company’s revenue was just barely below total expenses, and the company was able to eke out some positive NOPAT only because we made adjustments that:

- removed expenses for implied interest related to off-balance sheet debt and

- added missed income from increases to off-balance sheet reserves.

For more details on these adjustments and all the adjustments we make, see the whitepapers on our website.

Figure 3: Total Expenses Vs. Revenue: Fiscal 2019 – TTM

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

I’ll keep sending information on low quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this Danger Zone pick to underperform.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.