Recap from April’s Picks

Our Most Attractive Stocks (+2.9%) outperformed the S&P 500 (+2.3%) last month. Most Attractive Small Cap stock Inteliquent (IQNT) gained 17% and Most Attractive Large Cap stock Seagate Technology (STX) was up 13%. Overall, 21 out of the 40 Most Attractive stocks outperformed the S&P 500 in April.

Our Most Attractive stocks for May were made available on May 6. Our Most Attractive stocks have high and rising returns on invested capital (ROIC) as well as low price to economic book value ratios.

Most Attractive Stock Feature for May: Kaiser Aluminum Corporation (KALU)

One of the new additions to our Most Attractive stocks list is Kaiser Aluminum (KALU), a fabricator that produces specialty aluminum products. Kaiser operates in three main product segments: Aerospace/HS products, Automotive Extrusions, and General Engineering products. These three markets require specialized end products and there are only a limited number of suppliers worldwide with the ability to fabricate such products. This small amount of suppliers has given Kaiser the ability to create longstanding business relationships with some of its largest customers. Many of these relationships have resulted in long-term contracts, providing Kaiser with recurring sources of revenue.

A Leader in a Highly Specialized Market

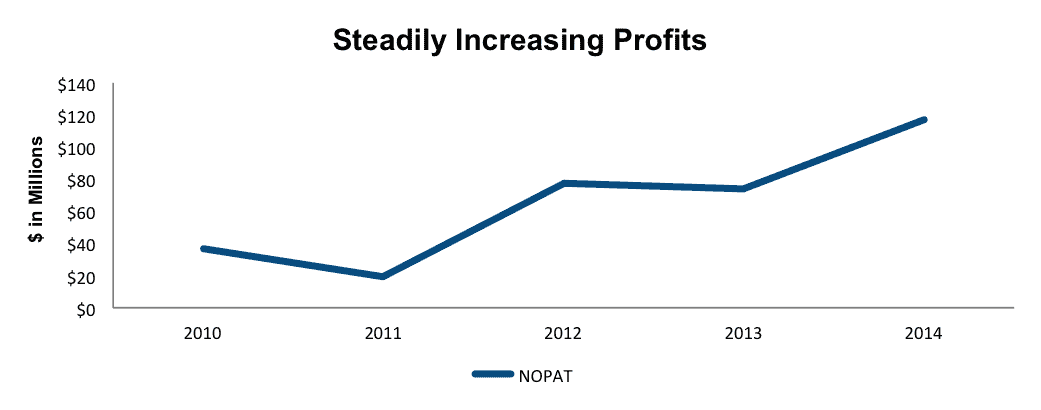

Since 2010, Kaiser has grown net operating profit after tax (NOPAT) by an impressive 33% compounded annually. The driving forces behind Kaiser’s increasing NOPAT have been strong growth in its Automotive Extrusions segment, higher pre-tax (NOPBT) margins, and its resilience in the Aerospace segment.

Figure 1 provides a look at how Kaiser has grown NOPAT since 2010.

Figure 1: Kaiser Generating Profit Growth

Source: New Constructs, LLC and company filings

Kaiser currently earns a ROIC of 11%. NOPBT margins are near historic highs, also at 11%. In addition, operating revenue grew 5% year over year (YoY) in 2014. This revenue growth has continued into 2015 as Kaiser reported 11% growth YoY in the first quarter.

Like many manufacturing and fabrication companies, Kaiser has taken large steps to efficiently increase their production capacity, differentiate their products, and maintain or even lower their cost of production. The continued success of these initiatives will be important for the future growth of Kaiser. With a lower cost base, Kaiser is better positioned to withstand the secular swings in aluminum prices that could occur in the future.

Looking to the Future

Kaiser generated 49% of revenues from it’s Aerospace segment in 1Q15. This segment has and will continue to be Kaiser’s most important due to its large impact on company operations. According to Deloitte, the global commercial aerospace sector is projected to grow at 8% in 2015. Along with this growth, a larger focus on fuel efficiency has emerged. With its emphasis on both stronger and lighter weight product offerings, Kaiser is well positioned to take advantage of this growth. In addition, both Boeing and Airbus have record backlogs for their newer, more fuel-efficient airlines. Kaiser’s ability to provide the aluminum plates needed in these applications bodes well for its future financial performance.

Much like the commercial airline industry, the automotive industry is continuing to focus on fuel efficiency as well. As aluminum is lighter than traditional metals used in automobiles, car manufacturers are looking at ways to increase aluminum usage. A great example of this initiative is Ford’s new all aluminum F-150. Kaiser began ramping up production for new aluminum auto parts in 2014 and stands to benefit from further adoption within the automotive industry in 2015. With the early success of the F-150, we wouldn’t be surprised to see other automakers take a similar approach as Ford.

Solid Fundamentals and Underpriced Shares

Strong profit growth coupled with industry demand is not the only thing to like about Kaiser. Although Kaiser’s NOPAT growth is very cyclical, reflecting the variability of aluminum input costs, the overall trend in NOPAT growth has been positive. One of the best fundamental signs of Kaiser’s success is its trend of generating positive economic earnings. Management has been able to deploy capital in a manner that is beneficial and accretive to shareholders. Since 2010, ROIC has expanded from 5% to a more robust 11% in 2014. This expansion of ROIC has contributed to the company’s ability to generate positive economic earnings and drive shareholder value creation.

As noted above, Kaiser has executed well on its strategy of providing differentiated products while also cutting costs. Kaiser’s cost of sales have declined by 1% compounded annually since 2007. Over this same time frame, Kaiser has grown NOPAT by 3% compounded annually. The firm’s business and competitive strategy are working but investors appear to be ignoring the upside potential of the business.

At its current price of ~$81/share, Kaiser has a price to economic book value (PEBV) ratio of 0.7. This ratio implies that the market expects Kaiser’s NOPAT to permanently decline by 30% over its lifetime. This seems highly unlikely, given the future growth of the industries Kaiser operates in, as well as Kaiser’s recent history of profit growth.

The current economic book value, or no growth value of Kaiser Aluminum is $112/share. This value assumes the company does not grow NOPAT into the future. This is the perfect instance of a true value stock, one in which the market has failed to properly value the underlying operations of the business.

If we give Kaiser credit for 3% compounded annual NOPAT growth for the next five years, the stock is worth $121/share today –– a 50% upside. Add in the current 2% dividend yield and its clear that Kaiser could be an excellent long-term staple in your portfolio.

Disclosure: David Trainer, Kyle Guske and, Allen Jackson receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo Credit: S2art (Flickr)