Cheap Funds Dupe Investors – 2Q13

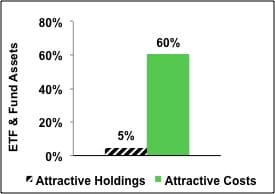

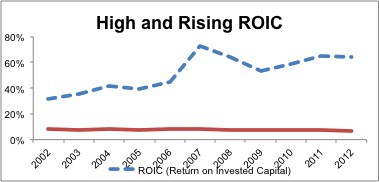

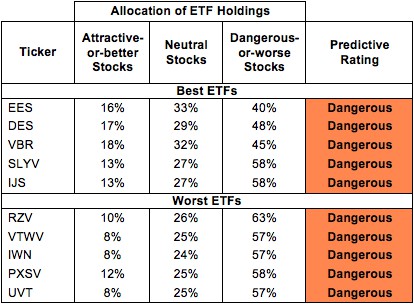

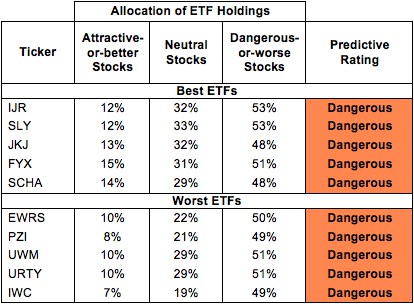

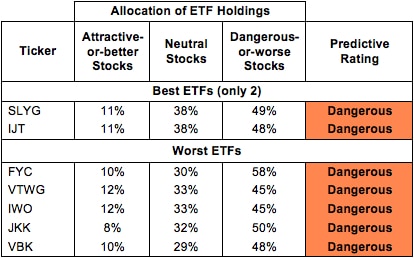

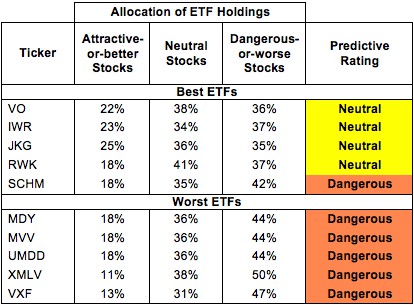

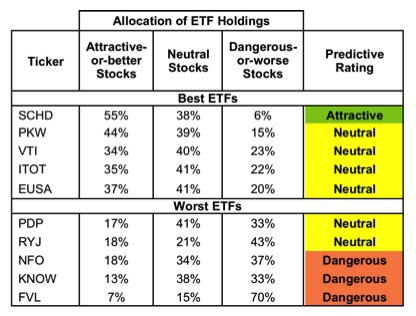

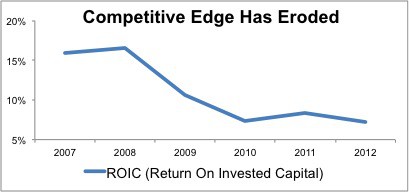

Fund holdings affect fund performance more than fees or past performance. A cheap fund is not necessarily a good fund. A fund that has done well in the past is not likely to do well in the future. Yet, traditional fund research focuses only on low fees and past performance.

David Trainer, Founder & CEO