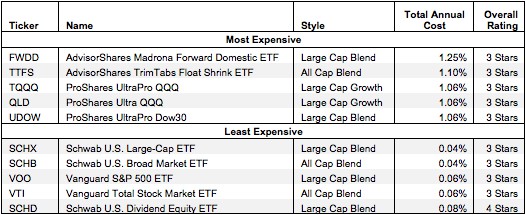

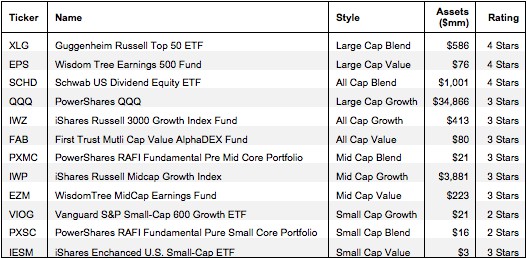

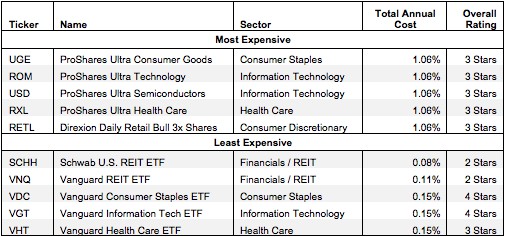

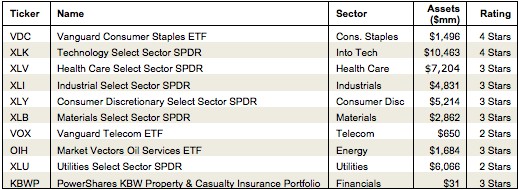

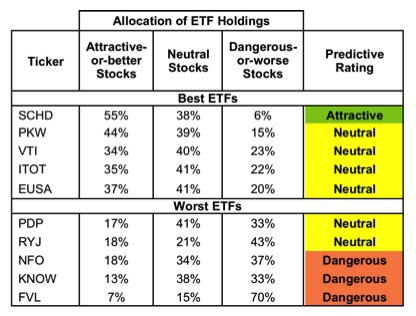

How To Avoid the Worst Style ETFs: May 2013

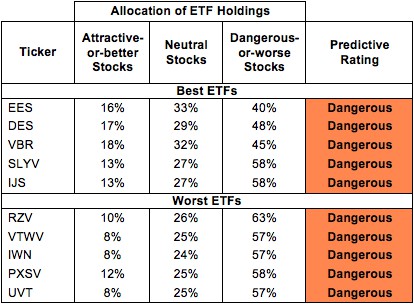

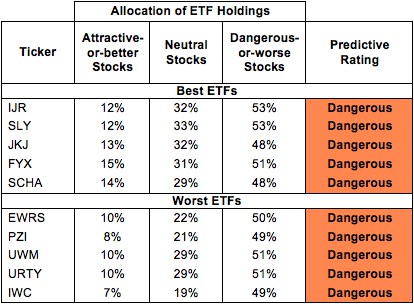

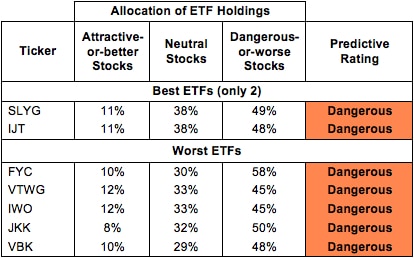

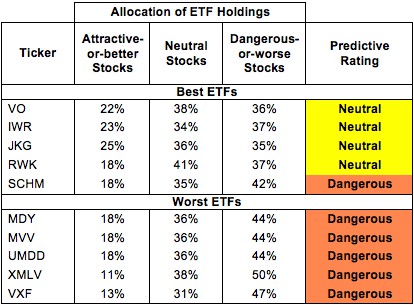

Picking from the multitude of style ETFs is a daunting task. There are as many as 40 in any given style and at least 221 ETFs across all styles.

David Trainer, Founder & CEO