Subscribers got access to this report one month early. For a limited time, you can get access to all our actionable reports before they are made available to the public, along with Most Attractive, Most Dangerous Stocks or Best & Worst ETFs & Mutual Funds newsletters for as little as $9.99/month.

The Consumer Discretionary sector ranks fourth out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 16 ETFs and 21 mutual funds in the Consumer Discretionary sector as of July 9, 2014. Prior reports on the best & worst ETFs and mutual funds in every sector arehere.

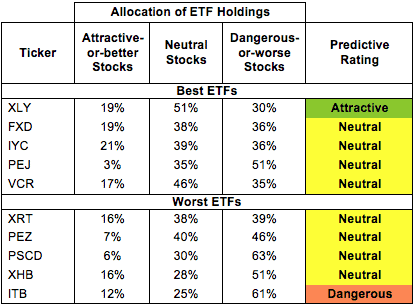

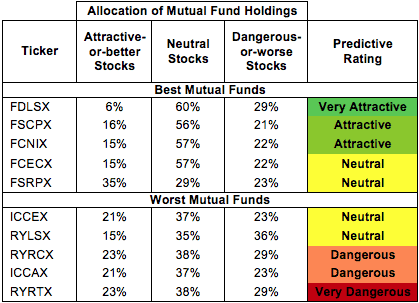

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the sector. Not all Consumer Discretionary sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 386). This variation creates drastically different investment implications and, therefore, ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worstETFs and mutual funds within the Consumer Discretionary sector, investors need a predictive ratingbased on (1) the stocks ratings of the holdings, (2) the all-in expenses of each ETF and mutual fund, and (3) the fund’s rank compared to all other ETFs and mutual funds. As a result, only the cheapest funds with the best holdings receive Attractive or better ratings. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the Consumer Discretionary sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Get my ratings on all ETFs and mutual funds in this sector on my mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Six ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Rydex Series Funds: Leisure Fund (RYLIX) and Rydex Series Funds: Leisure Fund (RYLAX) are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

State Street SPDR Consumer Discretionary Select Sector Fund (XLY) is my top-rated Consumer Discretionary ETF and Fidelity Select Portfolios: Leisure Portfolio (FDLSX) is my top-rated Consumer Discretionary mutual fund. XLY earns my Attractive rating and FDLSX earns my Very Attractive rating.

iShares Dow Jones U.S. Home Construction Index Fund (ITB) is my worst-rated Consumer Discretionary ETF and Rydex Series Funds: Retailing Fund (RYRTX) is my worst-rated Consumer Discretionary mutual fund. ITB earns my Dangerous rating and RYRTX earns my Very Dangerous rating.

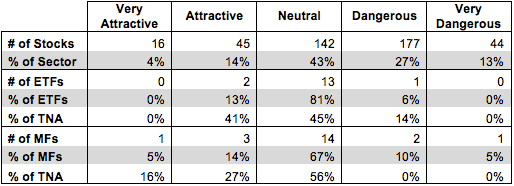

Figure 3 shows that 61 out of the 424 stocks (over 17% of the market value) in Consumer Discretionary ETFs and mutual funds get an Attractive-or-better rating. However, only 2 out of 16 Consumer Discretionary ETFs (less than 41% of total net assets) and 4 out of 21 Consumer Discretionary mutual funds (less than 43% of total net assets) get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Consumer Discretionary ETFs hold poor quality stocks.

Figure 3: Consumer Discretionary Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Consumer Discretionary ETFs and mutual funds, as it contains numerous Neutral-or-worse rated funds. Only two ETFs and four Consumer Discretionary mutual funds in the Consumer Discretionary sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive-or-better rating.

PetSmart Inc. (PETM) is one of my favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns my Attractive rating, and also makes it on the Most Attractive Stocks list for July. As I wrote last month, PETM has a long track record of profitability and earned a return on invested capital (ROIC) of 15% in 2014. In addition, PETM has grown after-tax profit (NOPAT) by 11% compounded annually since 2009. Since I first recommended PETM the stock price has run up 20%, but I believe there is still value to be had. At the current price of ~$70/share, PETM has a price to economic book value (PEBV) ratio of 1.3. This ratio implies the market expects PETM to increase NOPAT by 30% for the remaining life of the corporation. With a strong moat, including the growing services sales; PETM is well positioned to surpass these expectations. Multiple shareholders are now pressing for a sale, and PETM could likely command a significant premium in a private equity buyout.

J.C. Penney Co, Inc. (JCP) is one of my least favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns my Dangerous rating. The struggles of JCP have been well documented over the past couple of years. In 2011, JCP earned a NOPAT of $720 million, which has since declined to -$830 million. As expected, the stock price has declined drastically as well, but it still has more room to fall. To justify its current price of ~$10/share, JCP would need to achieve positive margins and grow revenue by 5% compounded annually for 13 years. To believe in this expectation, one must have not witnessed the downturn of JCP. Between multiple management shake-ups, failed promotional ideas, and overall sales declines, JCP does not seem poised to turn the ship around. Investors should stay far way from JCP.

447 stocks of the 3000+ I cover are classified as Consumer Discretionary stocks.

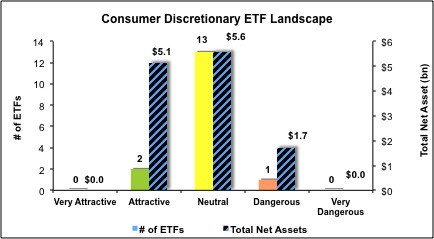

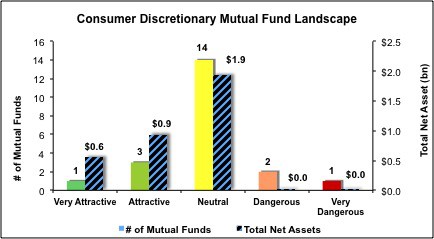

Figures 4 and 5 show the rating landscape of all Consumer Discretionary ETFs and mutual funds.

My Sector Rankings for ETFs and Mutual Funds report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with reports on all 16 ETFs and 21 mutual funds in the Consumer Discretionary sector.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector or theme.