Another one of our Danger Zone picks is about to go to zero. This stock once traded as high as $511/share, and it stands as an excellent reminder of just how quickly and viciously the market can move on any given stock. And, I think there are more shoes to drop.

I think you’d be hard pressed to find a single investor who thinks the market is undervalued. Even harder to find someone who believes there are not terribly overvalued stocks.

We’re not the only people raising red flags. CNBC warned in this recent article: “Retailers like Peloton and Saks keep paying vendors late, signaling possible ‘financial distress’”. Uh, no duh. That’s what happens when your business doesn’t make any money for years on end.

With one of the most important earnings seasons of the last few years upon us, it is more important than ever that we help investors protect their portfolios. And, in this letter, I am not only going to share another Danger Zone stock to avoid. I am also letting you know of a special webinar next week at 6pmET on April 18: The Hottest Sectors In The Market Right Now. Register here. In this webinar, I am going to share specific sectors that are good investments in this environment along with specific stocks and sectors that are not. I recommend you join us.

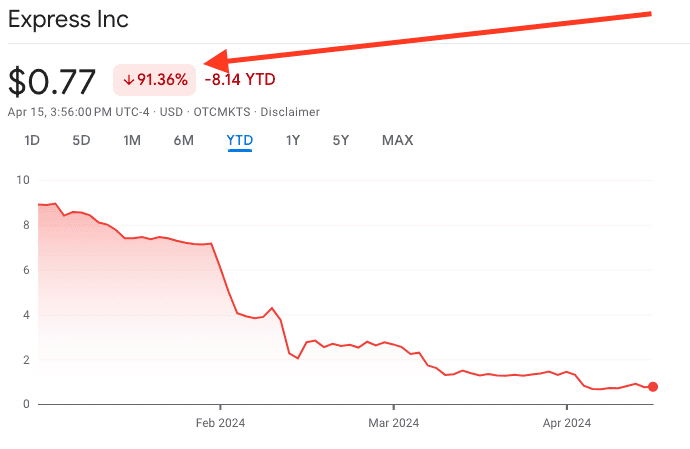

Investors who held Express (EXPR) coming into 2024 got a big punch in the face this year. Express (EXPR) was one of the original meme stocks. As mentioned above, it once traded as high as $511/share. Now, it is below $1/share. The stock is down over 90% year-to-date.

Mike Tyson’s famous quote “Everyone has a plan until they get punched in the face” is one of my favorites, and I think it applies to the stock market more than ever.

The stock is down over 30% in the last month. Another punch in the face for “HODLERS.”

If you’re still not convinced that Wall Street is not on your side, I’ve got another nugget for you. This one comes from a comment from Ryan Mitts to a recent post in our Society of Intelligent Investors:

“I did a quick search and how can the basic novice investor navigate search results of zombies? I mean look at the top Reddit result for zombie stock going into some weird thing about AMC shareholders being screwed can anyone translate this fiction novel lol?

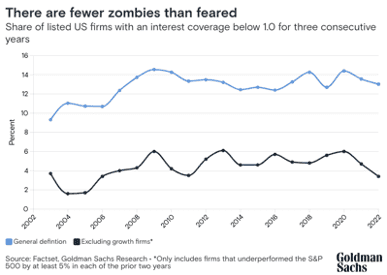

Also top result from Goldman Sachs, looking to shape the narrative: The Invasion of Zombie Companies that Wasn’t.”

Read that article and you will get a very clear view of how Wall Street spreads propaganda. Not coincidentally, Goldman published that report a few months after we started the Zombie Stock List. They are clearly trying to counter our narrative and keep unsuspecting investors buying bad stocks. Check out this quote from the Goldman piece:

“the enduring myth of the zombie firm is partly a classification error. ‘There are not nearly as many zombies as some of the headline data might suggest,’ Puempel says.”

I don’t agree with any of that rhetoric, but I do think Wall Street wants to make money, and they make more money when more investors are more bullish. The more stock you buy – the bigger their yacht. But that’s not what I believe in, and it’s not what’s best for the capital markets.

Source: Google Images and BOAT International

Wall Street is about benefiting Wall Street. In other words, the people that benefit most are the ones telling you what to do. It’s like a farmer telling his cows to eat more hay so they can get fatter and eventually slaughtered. If the cows were smart, they’d run away. That’s why our research is independent and honest. I don’t benefit when you buy any stocks – I benefit when you buy the right stocks and value our research.

Time for retail investors to get their gloves up. Luckily for our readers, you don’t have to take Wall Street or Mike Tyson head on. Just type in a ticker and get an honest answer from us. Now, that’s a good trade!

Best,

David

This article was originally published on April 15, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.