Have you ever purchased a product or service and thought to yourself, “there’s no way this business can make money?”

This week’s Danger Zone pick is a perfect example of such a business. The problem is that the company reports rising non-GAAP profits; so, we’re concerned that many investors think the business is better than it is. Certainly, the valuation of the stock implies the company is and will do much better than we think is reasonable to bet on. Our AI-driven research reveals the company is:

- growing top-line with less profitable users while actually losing its more profitable users,

- burning significant amounts of cash,

- diluting existing shareholders, and

- highly unprofitable.

Worst of all, its stock is highly overvalued.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings. We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

Keeps Losing Money

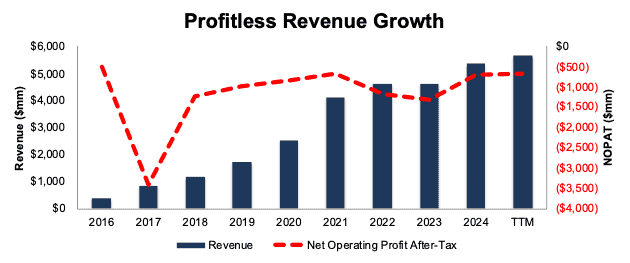

The company’s revenue has grown from $404 million in 2016 to $5.6 billion in the TTM, while its net operating profit after tax (NOPAT) has fallen from -$499 million to -$668 million over the same time.

The company’s NOPAT margin of -12% and invested capital turns of 0.8 drive the company’s -10% return on invested capital (ROIC) in the TTM ended 2Q25.

Persistently negative profits combined with slowing growth paints a bleak picture for this company’s turnaround.

Figure 1: Revenue & NOPAT: 2016 – TTM

Sources: New Constructs, LLC and company filings

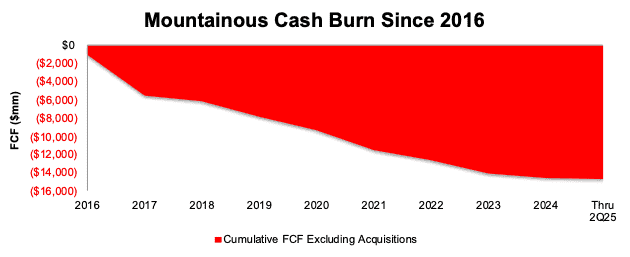

$14.6 Billion Up in Smoke

From 2016 through 2Q25, this company burned through a cumulative $14.6 billion (82% of enterprise value) in free cash flow (FCF). See Figure 2.

In October 2024, we removed this company from the Zombie Stocks List, due to the company’s shrinking FCF burn and large cash balance.

The company’s FCF has deteriorated from an already large -$663 million in the TTM ended 2Q24 to -$722 million in the TTM ended 2Q25. Additionally, the company’s cash on hand fell from $3.1 billion to $2.9 billion over the same time.

However, the company’s growing FCF burn and falling cash balance aren’t enough to put it back on the Zombie Stocks List…yet.

The company has a 45-month runway from the end of September before it runs out of cash, based on TTM FCF burn and cash on hand as of 2Q25. We’ll be watching the company’s cash burn closely. Should the burn accelerate, this company could find itself back on the Zombie Stock list.

Figure 2: Cumulative FCF Excluding Acquisitions: 2016 Through 2Q25

Sources: New Constructs, LLC and company filings

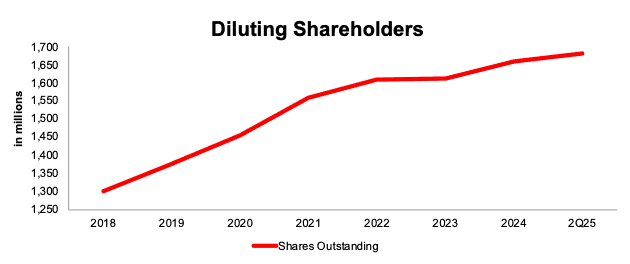

Diluting Shareholders to Fund the Cash Burn

To keep from running out of cash, this company has sold more stock. Per Figure 3, the company’s shares outstanding increased from 1.3 billion in 2018 to 1.7 billion in 2Q25.

Figure 3: Shares Outstanding: 2018 Through 2Q25

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

I’ll keep sending information on low quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this Danger Zone pick to underperform.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.