AI is rapidly gaining traction in the investing business, with growing interest from both individuals and institutions seeking to integrate it into their workflows. Getting AI to pick stocks would be a major advancement for all involved, particularly as the utility of the current state-of-the-art data analytics continues to decline.

As enticing as the idea of getting AI to pick stocks is, it still appears a long way off. At this time, machines are not good at analyzing and interpreting financial data.

This article, published by XBRL, titled “Beyond the Hype: How Structured Data Can Save AI Financial Analysis”, illustrates just how poorly current large language models (LLMs) perform when interpreting financial data from corporate filings. Even when given sophisticated prompts and an answer key, this recent paper shows LLMs struggle to interpret complex financial disclosures.

The bottom line is that the machines cannot figure out anything that a human can’t teach it to figure out. In other words, without explicit guidance, LLMs can’t navigate the nuances of accounting. Consequently, they cannot generate meaningful insights or reliable signals.

At present, the only task LLMs perform somewhat accurately is locating where financial facts appear in filings. However, they fail miserably at understanding the meaning and significance. What good is that? One could just manually search for keywords and find data points in a filing without AI. That’s not financial analysis.

As noted in the report, a research team comprising members from The Fin AI, Columbia University, Georgia Institute of Technology, and Gustavus Adolphus College, created a new benchmark, called “FinTagging”, for evaluating how well LLMs can extract and structure financial information from corporate reports.

The study showed that even the best LLMs achieved only 17% accuracy when linking extracted numbers and text to correct concepts in US-GAAP taxonomy. In practical terms, these models fail to understand the meaning of data points more than 80% of the time.

The article goes on to suggest that feeding AI’s “structured” XBRL data will solve these challenges, but, as experts agree, it’s proven that is not the case. XBRL data is not as consistent as often assumed. Companies can extend or rename fields and data points, which creates flexibility that undermines standardization. It’s extremely difficult to maintain consistency when filings span hundreds of pages and contain thousands of data points with inconsistent naming across thousands of companies.

A broad LLM using unstructured or inconsistent data, like XBRL, can’t develop accurate and reliable financial analysis capabilities.

A Real Solution

Financial analysis is inherently a deep and complex field, and general-purpose AI models lack the expertise to navigate it effectively. If we expect an AI to produce reliable stock picks or insights of any kinds, we must endow it with the subject matter expertise (SME) required to operate with the skill of human experts.

Anyone who has ever studied for a PhD knows how hard it is for humans to endow other humans with deep SME. We think that endowing machines with deep SME is even harder.

Why do we believe this? Because we did it.

Don’t worry, you don’t have to take our word on the effectiveness of our AI Agent.

We have empirical evidence that proves we have unrivaled experience and success in endowing machines with the subject matter expertise needed to perform like human experts.

First, this paper from the Harvard Business School and MIT Sloan professors empirically proves the idiosyncratic alpha in our proprietary measure of Core Earnings.

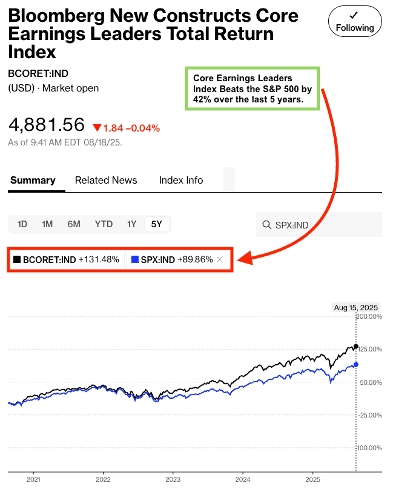

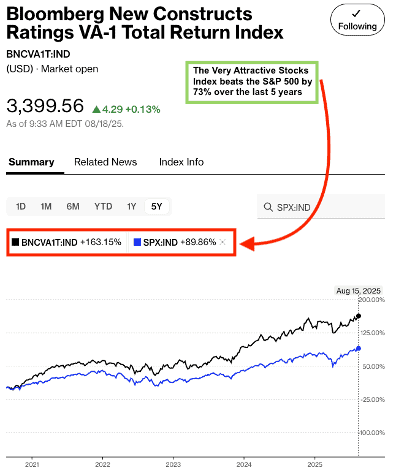

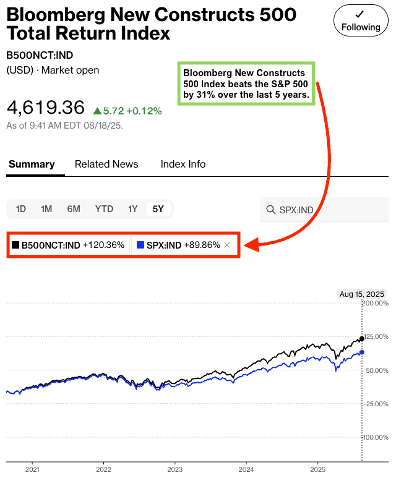

Second, all three of the indices based on our research and managed by Bloomberg, strongly outperformed the S&P 500 in over the last five years. See Figures 1, 2, and 3.

- Bloomberg New Constructs Core Earnings Leaders Index (ticker: BCORET:IND)

- Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND)

- Bloomberg New Constructs 500 Index (ticker: B500NCT:IND)

The Bloomberg New Constructs Core Earnings Leaders Index, which allocates based on Earnings Capture and Core Earnings, beat the S&P 500 by over 42% over the past five years. The Index (ticker: BCORET:IND) was up 131% while the S&P 500 was up 90%.

Figure 1: Bloomberg New Constructs Core Earnings Leaders Index Outperforms S&P 500: Last 5 Years

Sources: Bloomberg as of August 15, 2025

Note: Past performance is no guarantee of future results.

The “Very Attractive Stocks” Index, which allocates to stocks that get a Very Attractive rating by our AI Agent for Investing, beat the S&P 500 by 73% over the last five years. Bloomberg’s official name for the index is Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND). Figure 2 shows it was up 163% while the S&P 500 was up 90%.

Figure 2: Very Attractive-Rated Stocks Strongly Outperform the S&P 500: Last Five Years

Sources: Bloomberg as of August 15, 2025

Note: Past performance is no guarantee of future results.

Our “Core-Earnings Weighted S&P 500” Index, which weights the largest 500 U.S. companies by Core Earnings instead of market cap, beat the S&P 500 by 31% over the past five years. Bloomberg’s official name for the index is Bloomberg New Constructs 500 Total Return Index (ticker: B500NCT:IND). Figure 3 shows it was up 120% while the S&P 500 was up 90%.

Figure 3: Bloomberg New Constructs 500 Index Strongly Outperforms the S&P 500: Last Five Years

Sources: Bloomberg as of August 15, 2025

Note: Past performance is no guarantee of future results.

Note that these indices are not available to the public. The only way to build strategies that achieve this kind of outperformance based on superior fundamental data is to be a New Constructs member.

This article was originally published on August 18, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.