Our Most Attractive and Most Dangerous stocks for March were made available to the public at midnight on Wednesday. February saw some strong performances from our picks, led by small-cap Universal Insurance Holdings (UVE), which gained 42%. Our Most Attractive feature from last month, Myriad Genetics (MYGN), gained 18% since it joined the Most Attractive list. On the Dangerous side, Small Cap Wausau Paper (WPP) dropped 3% while the S&P 500 gained 5.4%.

After analyzing 1,284 new Form 10-K’s in February, we saw rating changes for lots of stocks. These rating changes resulted, at least in part, in 29 new stocks on our Most Attractive list and 35 new stocks on the Most Dangerous list.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied in their market valuations.

Most Attractive Stock Feature For March: Ford Motor Company (F)

Ford Motor Company (F: $15/share) is one of the new additions to the Most Attractive list this month. F makes the list due to the new filing data from February 18.

Ford had a very strong 2013 from an operational perspective. It grew after-tax profit (NOPAT) by 19% and increased its ROIC from 8% to 9%. Ford also increased revenues by 9%, which is significantly better than General Motors (GM), which only saw 2% top-line growth.

As good as Ford’s 2013 looks on the surface, it’s even better when you dig deeper. As an investor, you always want to see a company executing well in key markets, which Ford did in 2013. Most impressively, Ford grew wholesales to China by 49% in 2013 and improved its market share from 3% to 4%. That low market share number means Ford has more room to grow, and its 67% year-over-year sales increase in February shows that Ford’s growth is accelerating in the world’s largest auto market.

Other markets show improvement as well, as Ford has reversed its market share loss in South America and steadied its faltering sales in Britain and Germany.

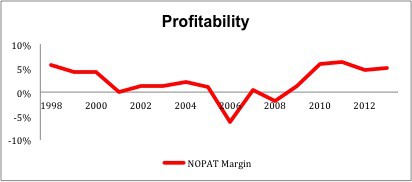

Figure 1 shows that Ford’s profit margins are near all-time highs as the company has dramatically increased efficiency since 2006.

Figure 1: Ford’s NOPAT Margins Near All-Time Highs

Throw in the fact that Ford has slightly increased its cash on hand and reduced its underfunded pension obligations by $10 billion (40%), and 2013 looks to have been a great year for Ford the company.

It was not a great year for Ford the stock, however. F lagged the market with a 19% increase in its stock price. Analysts still seem to be cautious about F as less than half give the stock a Buy or Strong Buy rating.

All this nervousness creates a buying opportunity for investors. At ~$15/share, F has a price to economic book value ratio of just 0.9, which means the market expects the company’s NOPAT will permanently decline by 10%. Given F’s strong growth last year, especially in emerging markets, such a pessimistic expectation seems unwarranted.

Such a low valuation means that with even modest profit growth, F has significant upside. If we give F credit for 6% compounded annual growth in NOPAT for 15 years, the stock has a fair value of nearly $27/share. Ford’s cheap valuation, combined with its strong recent growth, gives the stock an attractive risk/reward profile.

Most Dangerous Stock Feature For March: Royal Caribbean Cruises (RCL)

Royal Caribbean Cruises (RCL: $50/share) is one of the new additions to the Most Dangerous list this month. RCL’s 2013 10-K came out on February 20, and we did not like what we saw.

RCL managed slight NOPAT growth last year, but the long-term trend for the company is still stagnation in growth. Over the past eight years, RCL’s NOPAT has actually declined slightly, from $886 million in 2005 to $878 million in 2013. Over that same time frame, RCL’s ROIC has declined from 9% to 5%.

In addition to this lack of growth, investors should be concerned over the increasing amount of negative publicity cruises have received in recent years. RCL’s own “Explorer of the Seas” had an outbreak of Norovirus earlier this year that affected over 600 passengers and crewmembers. Last May, one of its ships caught fire. Data shows that cruises are still popular, but it can’t help RCL’s brand when some people now associate cruises with vomiting, diarrhea, and violent accidents.

Another concern is RCL’s highly leveraged balance sheet. The company has nearly $9 billion in total adjusted debt (77% of market cap) and no excess cash. Such a heavy debt burden put the entire business at risk.

While RCL doesn’t look great from an operational standpoint, the valuation is what really pushes this stock onto the Most Dangerous list. RCL is up 53% over the past year, and we don’t see anything to justify that huge run-up in a stock that was already overvalued.

RCL’s current valuation of ~$50/share implies that the company will grow NOPAT by 10% compounded annually for 29 years. That’s almost three decades of double-digit profit growth for a company with zero growth over the past eight years. The market’s expectation for RCL’s future growth does not line up with the company’s track record.

At a cheaper valuation, RCL could have some potential upside, but with so much growth already priced in we see little to like about this stock. Significant risks remain in the form of a large debt load and potential future accidents.

Momentum chasing is never a good strategy. RCL significantly outperformed the market last year, while F lagged it slightly, but don’t expect those trends to continue in 2014 for either stock. F has great growth opportunities in key markets and a cheap valuation, and RCL has stagnant profits and large growth expectations embedded in its stock price.

The Most Dangerous Stocks report for March can be purchased here, while the Most Attractive Stocks can be purchased here. To gain access to these reports one week earlier each month, visit our subscriptions page.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Feature Photo Credit: Woody Hibbard (Flickr)