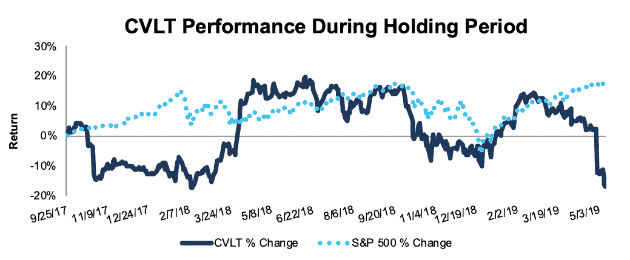

CommVault Systems (CVLT: $50/share) – Closing Short Position – down 17% vs. S&P up 15%

CommVault Systems (CVLT) was originally selected as a Danger Zone Idea on 9/25/17. At the time of the initial report, the stock received a Very Unattractive rating. Our short thesis noted the firm’s lack of profitability, subpar corporate governance, and overvalued stock price.

During the 592-day holding period, CVLT outperformed as a short position, declining 17% compared to a 15% gain for the S&P 500.

We upgraded CVLT’s Overall Risk/Reward Rating to Unattractive in October 2017 and, then, to Neutral, on 5/3/19. The stock remains overvalued, but its risk/reward profile shifted. CommVault recently appointed a new CEO and board members after facing pressure from activist investor Elliott Management. The company has also improved its once negative return on invested capital (ROIC) to a top-quintile 20%.

Given the management change, along with improved profitability in 2019, we believe it is time to take the gains in this stock as it trades near its 52-week low. As a result, we are closing this position

Figure 1: CVLT vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on May 13, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.