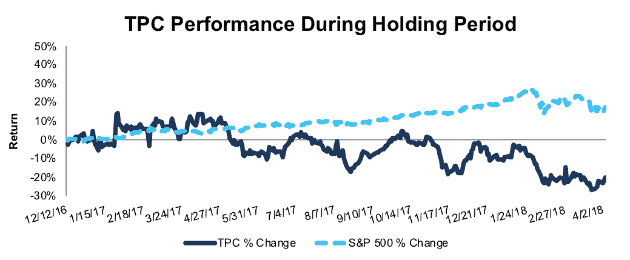

Tutor Perini Corp (TPC: $23/share) – Closing Short Position – down 20% vs. S&P up 17%

Tutor Perini was originally selected as a Danger Zone pick on 12/12/16. At the time of the report, the stock received a Very Unattractive rating. Our short thesis highlighted declining economic earnings, questionable shareholder value destroying acquisitions, a misaligned executive compensation plan, and low margins in a competitive industry.

During the 479-day holding period, TPC outperformed a short position, falling 20% compared to a 17% gain for the S&P 500. TPC was upgraded to Neutral on 3/15/18 as the stock price decline decreased the downside risk. While TPC’s fundamentals remain weak (bottom-quintile ROIC and negative economic earnings), the growth expectations implied by its valuation have become less unrealistic, especially factoring in the lower tax rate going forward. As a result, we are closing this position.

We hope investors were able to avoid a portfolio blowup or participate in the 20% fall in the stock price.

Figure 1: TPC vs. S&P 500 – Price Return: Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on April 5, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.