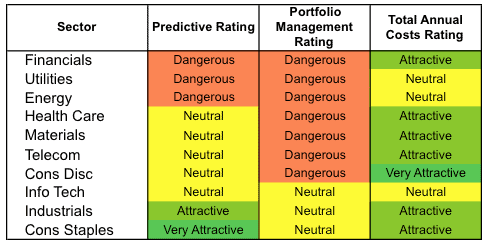

At the beginning of the fourth quarter of 2014, only the Industrials and Consumer Staples sectors earn an Attractive-or-better rating. My sector ratings are based on the aggregation of my fund ratings for every ETF and mutual fund in each sector.

Investors looking for sector funds that hold quality stocks should look no further than the Consumer Staples and Industrials sectors. These sectors house numerous Attractive-or-better rated funds. Figures 6 and 7 provide details. The primary driver behind an Attractive fund rating is good portfolio management, or good stock picking, with low Total Annual Costs.

Note that the Attractive-or-better Predictive ratings do not always correlate with Attractive-or-better

Total Annual Costs. This fact underscores that (1) cheap funds can dupe investors and (2) investors should invest only in funds with good stocks and low fees.

See Figures 4 through 13 for a detailed breakdown of ratings distributions by sector. See my ETF & mutual fund screener for rankings, ratings and reports on 7000+ mutual funds and 400+ ETFs. My fund rating methodology is detailed here.

All of my reports on the best & worst ETFs and mutual funds in every sector and investment style are available here.

Figure 1: Ratings For All Sectors

Source: New Constructs, LLC and company filings

To earn an Attractive-or-better Predictive Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only the top 30% of all ETFs and mutual funds earn our Attractive-or-better ratings.

State Street SPDR Consumer Staples Select Sector Fund ETF (XLP) is my top rated Consumer Staples fund. It gets my Very Attractive rating by allocating over 30% of its value to Attractive-or-better-rated stocks.

Wal-Mart (WMT) is, and has been, one of my favorite stocks held by XLP. A lackluster 2014 has presented investors with a great opportunity in WMT. Over the past decade, Wal-Mart has grown after-tax profits (NOPAT) by a steady 7% compounded annually. The company earns a consistently high return on invested capital (ROIC) around 12% and has generated positive and increasing economic earnings in every year of my model, which tracks back to 1998. With over $14 billion in free cash flow (FCF) in 2014 Wal-Mart has many options to generate profit growth, including its recent introduction of checking accounts and deeper foray into healthcare offerings. At its current price of ~$77/share, WMT has a price to economic book value (PEBV) ratio of 0.9. This ratio implies the market expects Wal-Mart’s NOPAT to permanently decline by 10% for the remaining life of the company. Its not often that investors get a chance to buy a high quality company at such a discount. Heading into the holiday shopping season, WMT should be on everyone’s list.

Hennessy Small Cap Financial Fund (HSFNX) is my worst-rated Financials fund. It gets my Very Dangerous rating by allocating over 55% of its value to Dangerous-or-worse-rated stocks, and to make matters worse, charges investors Total Annual Costs of 2.19%.

Radian Group (RDN) is one of my least favorite stocks held by HSFNX and gets my Dangerous rating. As with most financial institutions, RDN was hit hard back in 2008 and investors hoping for a turnaround may be waiting a while longer. In 2013 Radian earned a NOPAT of -$193 million. This is the sixth time in seven years that Radian has earned an operating loss. Similarly, Radian generated an ROIC of -18% in 2013, which places it in the bottom quintile of all companies I cover. In addition to Radian’s poor profitability, its core business remains in question with numerous new regulations and laws being proposed for the mortgage industry. Couple these factors with Radian’s highly optimistic valuation and it is tough to be bullish. To justify its current price of ~$14/share, RDN has to immediately achieve positive pre-tax margins of 5% (average before 2007), and grow revenue by 16% compounded annually for the next 38 years. Repeated losses, an industry with an uncertain regulatory future, and an alarmingly high valuation make RDN a stock to avoid.

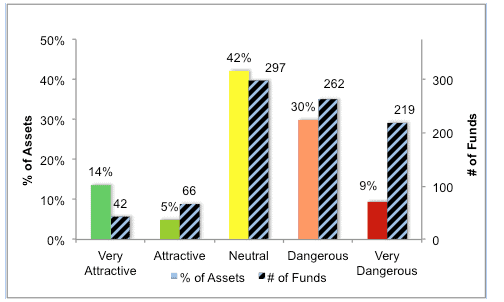

Figure 2 shows the distribution of our Predictive Ratings for all sector ETFs and mutual funds.

Figure 2: Distribution of ETFs & Mutual Funds (Assets and Count) by Predictive Rating

Source: New Constructs, LLC and company filings

Figure 3 offers additional details on the quality of the sector funds. Note that the average Total Annual Cost of Very Dangerous funds is over seven times that of Very Attractive funds.

Figure 3: Predictive Rating Distribution Stats

* Avg TAC = Weighted Average Total Annual Costs

Source: New Constructs, LLC and company filings

This table shows that only the best of the best funds get our Very Attractive Rating: they must hold good stocks AND have low costs. Investors deserve to have the best of both and we are here to give it to them.

Ratings by Sector

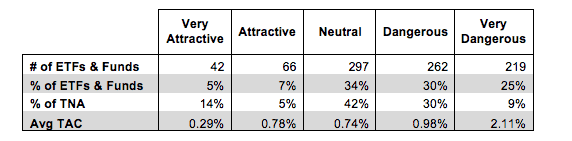

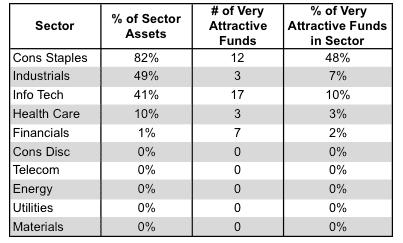

Figure 4 presents a mapping of Very Attractive funds by sector. The chart shows the number of Very Attractive funds in each sector and the percentage of assets in each sector allocated to funds that are rated Very Attractive.

As can be seen, five sectors contain funds that receive my Very Attractive rating. It should come as no surprise that the top rated sector, Consumer Staples, holds over 80% of assets in Very Attractive funds.

Figure 4: Very Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 5 presents the data charted in Figure 4.

Figure 5: Very Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

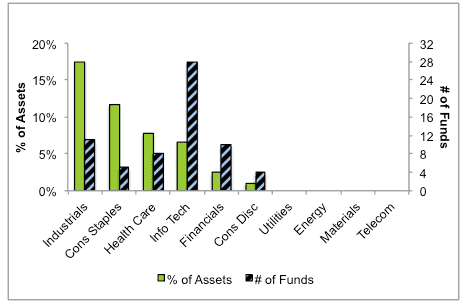

Figure 6 presents a mapping of Attractive funds by sector. The chart shows the number of Attractive funds in each sector and the percentage of assets allocated toAttractive-rated funds in each sector.

Take note of the difference between assets and number of funds in the Information Technology sector. This sector contains 28 Attractive funds, but these funds hold only 7% of sector assets.

Figure 6: Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 7 presents the data charted in Figure 6.

Figure 7: Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

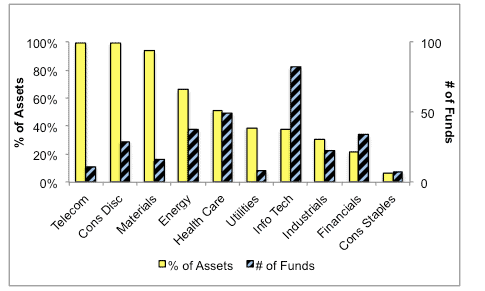

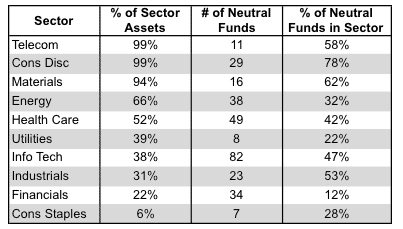

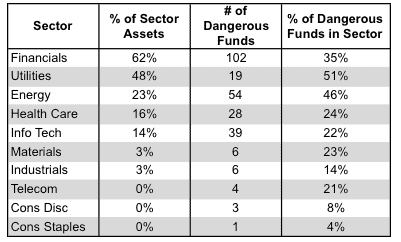

Figure 8 presents a mapping of Neutral funds by sector. The chart shows the number of Neutral funds in each sector and the percentage of assets allocated to Neutral-rated funds in each sector.

Figure 8: Neutral ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 9 presents the data charted in Figure 8.

Figure 9: Neutral ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

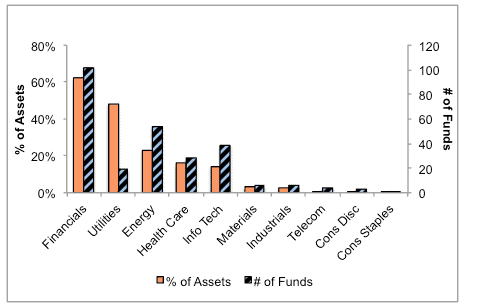

Figure 10 presents a mapping of Dangerous funds by fund sector. The chart shows the number of Dangerous funds in each sector and the percentage of assets allocated to Dangerous-rated funds in each sector.

The landscape of sector ETFs and mutual funds is littered with Dangerous funds. Investors in Utilities funds have put over 48% of their assets in Dangerous-rated funds.

Figure 10: Dangerous ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 11 presents the data charted in Figure 10.

Figure 11: Dangerous ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

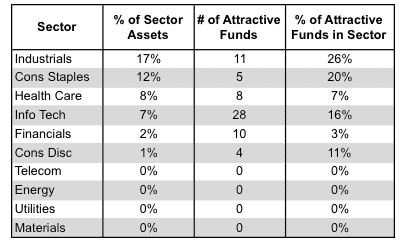

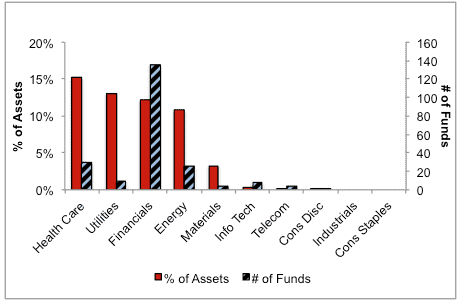

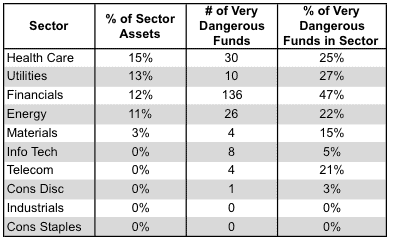

Figure 12 presents a mapping of Very Dangerous funds by fund sector. The chart shows the number of Very Dangerous funds in each sector and the percentage of assets in each sector allocated to funds that are rated Very Dangerous.

The takeaway here deals with the Financials sector, in which almost half (47%) of the funds receive a Very Dangerous rating.

Figure 12: Very Dangerous ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 13 presents the data charted in Figure 12.

Figure 13: Very Dangerous ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Kyle Guske II contributed to this report

Disclosure: David Trainer owns WMT. David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector or theme.