This report focuses on providing investors the true costs incurred when investing in Information Technology ETFs and mutual funds. A key component of our fund ratings, Total Annual Cost (TAC) accounts for all the costs borne by investors, including transaction costs and many other fees. Expense ratios often drastically understate the total cost of a fund.

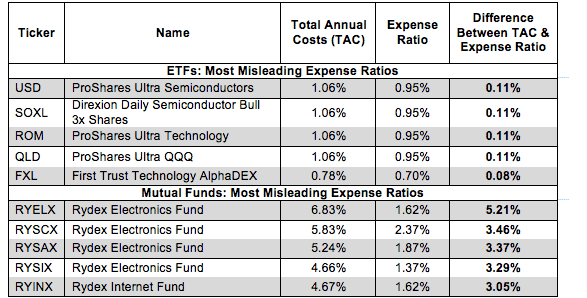

Figure 1 shows ETFs and mutual funds in the Information Technology sector whose expense ratios understate their TACs by the most.

Figure 1: Funds With Most Misleading Expense Ratios

Source: New Constructs, LLC and company filings

ProShares Ultra Semiconductors (USD) is the Information Technology ETF with the greatest disparity between its TAC and expense ratio. While the difference seems small now, over time that difference adds up. More importantly, investors deserve to know the true costs of being in any ETF. Rydex Electronics Fund (RYELX)has the most misleading expense ratio amongst mutual funds in the sector as its expense ratio is 5.21 percentage points lower than its actual Total Annual Costs.

5.21 percentage points is a large difference. Over just ten years, 5.21% compounds to 66%. I think most investors would like to know about such a large additional cost before they put their money into RYElX.

The key takeaway for fund investors here is that they should focus on the Total Annual Cost of funds rather than just the expense ratios, which can significantly understate the costs of being in a fund.

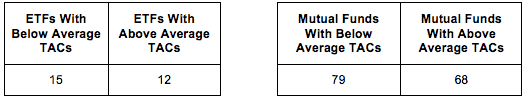

The average TAC for ETFs in this sector is 0.59% and for mutual funds it is 2.57%. We recommend investors focus on funds with TACs that are below these averages. See our ETF and mutual fund screener to get the TACs on 7200+ ETFs and mutual funds. I strongly recommend that investors avoid funds that charge far above-average TACs as it will be extremely difficult for these funds to consistently earn returns above a less-expensive benchmark.

Figure 2 shows the number of ETFs and mutual funds with TACs above the average and below the average.

Figure 2: Number of Funds With Above and Below Average Total Annual Costs (TACs)

Source: New Constructs, LLC and company filings

We provide predictive fund ratings for 7200+ ETFs and mutual funds according to the quality of each fund’s holdings (Portfolio Management Rating), its costs (Total Annual Costs Rating), and the fund’s rank relative to every other ETF and mutual fund.

Our Best & Worst ETFs and Mutual Funds: Information Technology Sector report reveals our predictive ratings on the best and worst funds in the sector.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector or theme.