Short VMware (VMW) As Hedge for Euro Recession

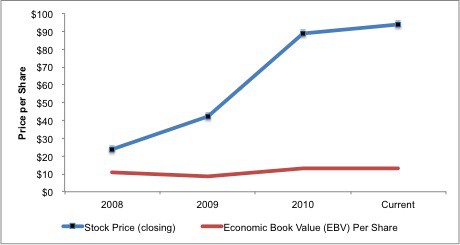

VMW’s valuation has its head in the clouds.

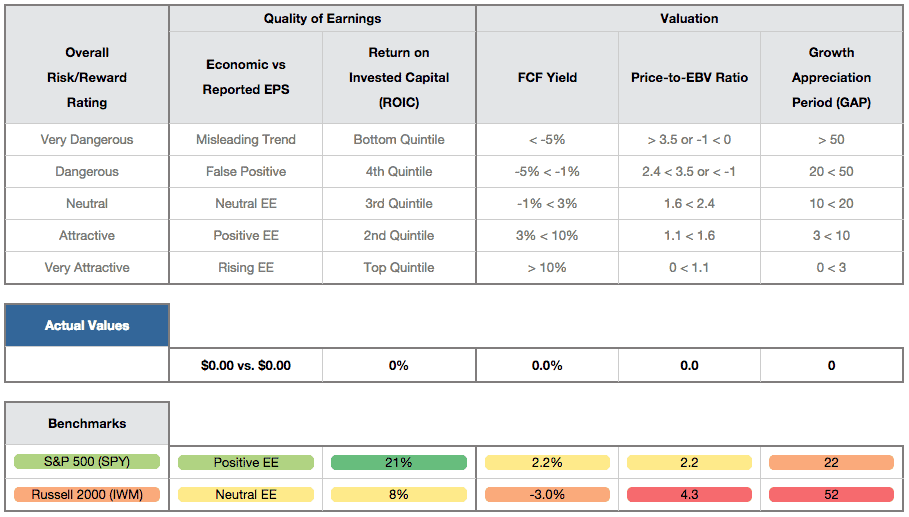

This stock is a great short in most any scenario and is especially attractive in the event of a global economic slowdown led by a recession in Europe.

David Trainer, Founder & CEO