We see a great opportunity unfolding.

The investor sentiment survey done by the American Association of Individual Investors (AAII) asks the same question to investors every week: Do you think the current market is bullish, neutral, or bearish?

Historically, on average, 31% of investors respond that they think we are in a bearish market. But, for the last three weeks, around 60% of investors indicated they’re feeling bearish. Investors haven’t been this scared since September of 2022, when interest rates were on the rise.

Now, is the time to be careful to pick stocks based on real due diligence so your portfolio can not only survive but thrive if the market remains volatile. For this week’s Long Idea report, we feature one of those stocks, where the current price implies a permanent 60% decline in profits while company profits are rising.

Below, we present a large excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

This stock offers favorable Risk/Reward based on the company’s:

- strong legacy businesses with increasing sales,

- quality cash flow generation,

- executive compensation plan that aligns managers’ interests with shareholders,

- high dividend yield, and

- cheap stock valuation.

Light Duty Vehicles Market Still Growing

2025 is expected to be a more difficult year for the automotive industry particularly due to the impact and uncertainty of tariffs and lower pricing across the industry. However, S&P Global Mobility still projects U.S. light vehicle sales of 16.2 million in 2025, which would represent a 1% increase over 2024.

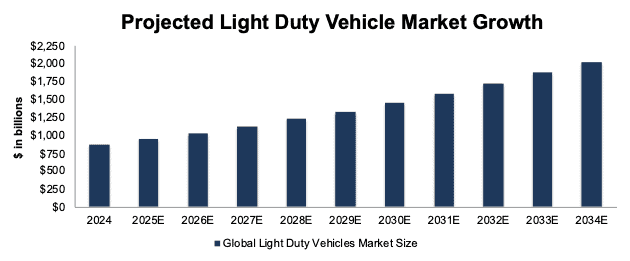

While 2025 might be slow going, the long-term trend of the automotive market remains promising. The global light duty vehicles market is projected to grow 8.8% compounded annually from 2024 to 2034, per Figure 1.

Figure 1: Global Light-Duty Vehicle Market: 2024 – 2034E

Sources: New Constructs, LLC and Precedence Research

Outstanding Corporate Governance

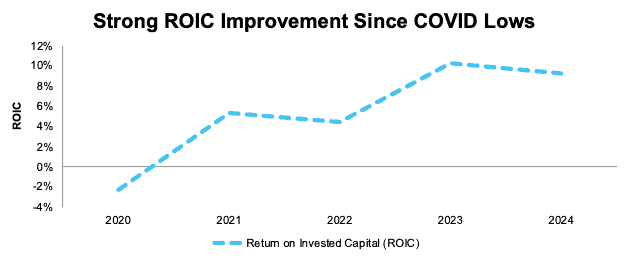

We are always on the lookout for companies that tie executive compensation to metrics that directly align with shareholders’ interests. There is no better metric for that purpose than ROIC. As we’ve shown, there is a strong correlation between improving ROIC and increasing shareholder value.

This company ties executives’ performance share grants to three metrics: adjusted return on invested capital, company-adjusted FCF, and company-adjusted EBIT margin. Though we would prefer more emphasis on ROIC in the company’s executive compensation plan, including ROIC (and even FCF) as one of the metrics shows that management has a genuine interest in creating shareholder value

Accordingly, it should come as no surprise that the company improved its ROIC from -2% in 2020 to 9% in 2024. Economic earnings, the true cash flows of the business, increased from -$6.0 billion to $899 million over the same time. See Figure 4.

Figure 4: ROIC: 2020 – 2024

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.