AI dominates the daily headlines a lot like electric vehicles (EVs) did a few years ago.

Today, the hype around EVs feels like a story from the distant past. EV demand has slowed more than many anticipated, and the recent expiration of U.S. tax credits adds another headwind.

Despite the slowing demand, several EV-focused automaker stocks continue to trade at valuations which imply growth rates that are increasingly out of step with today’s reality.

This week’s Danger Zone pick is one of those stocks. And, it has all the characteristics of a Zombie Stock: continually dilutes shareholders, has never turned a profit, and faces growing industry headwinds. And yet the stock’s valuation implies the company will profitably sell more vehicles than the best-selling passenger car in America within the next 10 years.

We originally put Lucid Group (LCID: $25/share) in the Danger Zone and named it a Zombie Stock on April 10, 2023. However, we removed it from the Zombie Stock list on June 16, 2023, after the company raised capital through Saudi Arabia’s Public Investment Fund and a separate share issuance.

Good news ends there, though. Lucid recently executed a 1-for-10 reverse stock split on September 2, 2025. Its stock price was nearing $2/per share, and the NASDAQ requires a share price of at least $1/share to remain listed. It’s never a good sign when a company reverse splits to stay listed on the major stock exchanges.

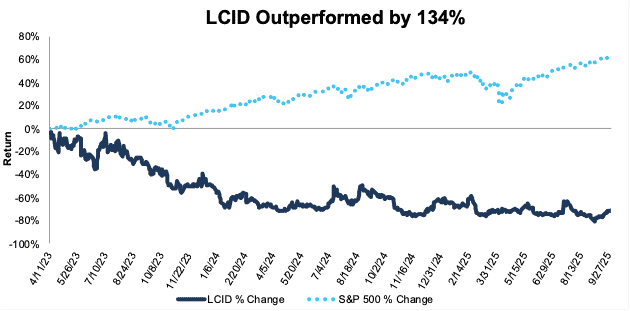

Since our original report, LCID has outperformed as a short by 134%, falling 71% while the S&P 500 is up 63%.

Despite the outperformance as a short, this stock remains Unattractive. After a $300 million investment from Uber (UBER), Lucid’s stock is up 40%+ over the past month. Traders may win the momentum battle, but diligent investors beware. We’re here to remind you that some very unprofitable businesses remain highly overvalued, and Lucid provides a perfect case study.

Lucid’s stock could fall further based on:

- consistently high cash burn,

- heavy shareholder dilution,

- the projected plummet in electric vehicle (EV) demand,

- much more profitable competitors, and

- a stock valuation that implies Lucid will sell more vehicles than the best-selling passenger car in America.

Figure 1: Lucid Outperformance as a Short From 4/11/23 Through 10/3/25

Sources: New Constructs, LLC

What’s Working

In the first half of 2025, Lucid’s vehicle deliveries grew 47% year-over-year (YoY), from 4,361 to 6,418. 2Q25 was the company’s sixth consecutive quarter of record deliveries. The increase in deliveries helped Lucid grow its revenue 32% YoY in 1H25.

Additionally, in July 2025, Lucid announced a partnership with Uber, in which Uber will invest $300 million in Lucid as part of an autonomous robotaxi program. Uber plans to deploy at least 20,000 Lucid vehicles over the next six years through the partnership.

What’s Not Working

Beyond the headlines, we find that the company’s fundamentals are still bad, and the stock remains overvalued, especially as experts project U.S. electric vehicle demand to fall. In its 2Q25 earnings call, management lowered its production guidance for the full year 2025, which could be the least of the company’s concerns, as we’ll show below.

Losses Piling Up

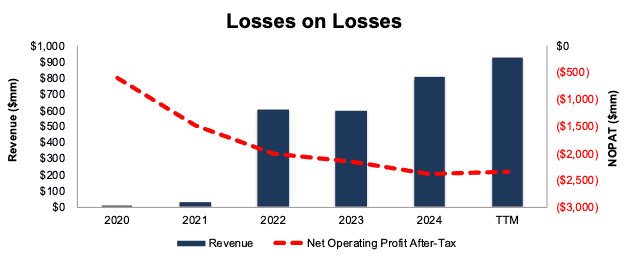

Bulls have long tried to justify Lucid’s, as with other EV makers, large losses by arguing the company is simply in a high-growth phase. While there is no doubt that Lucid is growing its top-line quickly, its losses are growing just as fast. So, it’s hard to see how the company will ever achieve economies of scale.

Lucid has grown revenue from just $4 million in 2020 to $929 million in the TTM ended 2Q25. The company’s net operating profit after-tax (NOPAT) fell from -$589 million to -$2.3 billion over the same time. See Figure 2.

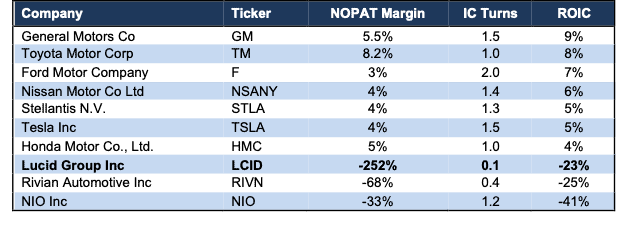

In the TTM, Lucid’s return on invested capital (ROIC) is -23% while its NOPAT margin sits at -252%.

Figure 2: Lucid’s Revenue & NOPAT: 2020 – TTM Ended 2Q25

Sources: New Constructs, LLC and company filings.

Still Need Cash Even After Uber Investment

We originally named Lucid a Zombie Stock in April 2023 as the company could sustain its cash burn rate for just 23 months at the time without additional capital or a significant slowdown in cash burn.

However, we removed the stock from our Zombie Stock List in June 2023, after Lucid raised upwards of $3 billion in cash from Saudi Arabia’s Public Investment Fund and a separate share issuance.

Fast forward to today, and Lucid still has all the markings of a Zombie Stock even after the recent Uber investment, as we’ll show below.

Zombie-Like Cash Burn

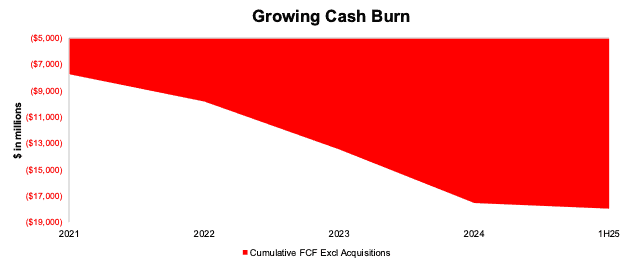

Since 2021, Lucid has burned $17.9 billion (148% of enterprise value) in free cash flow (FCF) excluding acquisitions. See Figure 3. Lucid burned $3.3 billion in FCF excluding acquisitions over the TTM.

Not surprisingly, the company’s economic earnings, the true cash flows of the business that take into account changes to the balance sheet, fell from -$671 million in 2020 to -$3.4 billion in the TTM ended 2Q25.

Despite having $3.6 billion of cash on hand as of June 30, 2025, Lucid can only sustain its TTM cash burn rate for 10 months from the end of September 2025. Even if we add the entire $300 million Uber investment to Lucid’s cash balance, it only increases the cash runway to a mere 11 months.

Given the large cash burn, and short cash runway, it is not surprising that the company is already preparing investors for an additional equity raise. In an interview with the Financial Times, Lucid’s interim CEO noted that (emphasis added) “the money that we have right now will take us until the second half of 2026, we’ll have to raise additional funds before we get profitable or breakeven on our own.”

Lucid meets all the criteria of a Zombie Stock, but we aren’t putting it back on the list because Saudi Arabia’s Public Investment Fund remains its largest shareholder. The Saudi PIF could stand ready to provide needed capital, especially as Lucid expands its manufacturing plant in Saudi Arabia.

If Lucid’s business doesn’t improve, and the Saudi PIF shows any unwillingness to re-invest in the company, we’ll be ready to add it back to the Zombie Stock list.

Figure 3: Lucid’s Cumulative FCF Excluding Acquisitions: 2021 – 1H25

Sources: New Constructs, LLC and company filings.

Shareholders Get More Diluted

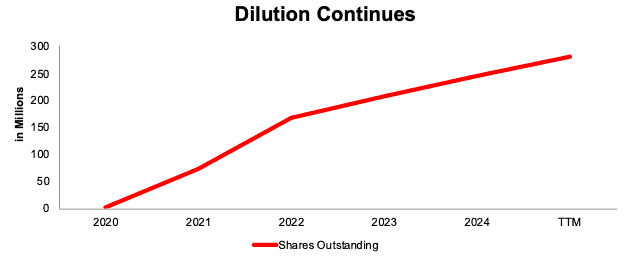

Lucid shareholders are no stranger to equity raises and ongoing dilution. Per Figure 4, Lucid’s shares outstanding increased from 3 million in 2020 to 282 million in 2Q25.

Whether through new share issuances or stock-based compensation, funding the business with new investors capital is not sustainable and not that different from a ponzi scheme.

Figure 4: Lucid’s Shares Outstanding: 2020 – 2Q25

Sources: New Constructs, LLC and company filings

Tax Credit Expiration Could Drive U.S. EV Demand Off a Cliff

Since 2008, consumers have been eligible for up to $7,500 in federal incentives when buying an EV. However, as of October 1, 2025, those credits are no longer available. While the impact on EV demand remains to be seen, industry experts expect a significant hit.

- Ford CEO Jim Farley noted on September 30 that U.S. EV sales could fall from 10-12% of sales to 5% without the incentive. He further noted that the EV industry is “going to be smaller, way smaller than we thought.”

- Chrisitan Meunier, chairman of Nissan Americas stated “the EV market is going to collapse in October” and “competition is going to be super-brutal.”

- General Motors’ CFO Paul Jacobsen said earlier in September that “we’re going to see some noise in October and November, and I expect that EV demand is going to drop off pretty precipitously.”

Importantly, automakers such as Ford, General Motors, and Nissan produce hybrid models that are more affordable and convenient for consumers, while Lucid, Rivian (RIVN), and Tesla (TSLA) do not. Falling EV demand will hit these pure play EV manufacturers particularly hard.

Profitability Significantly Lags Competition

Of the 55 Automobiles & Auto Parts companies under our coverage, only seven have a lower return on invested capital (ROIC) than Lucid. Fellow EV manufacturers and Danger Zone picks Rivian and Nio Inc. (NIO) are among those seven.

The legacy car makers have proven their ability to penetrate and take EV market share. For instance, Ford (F) and Chevrolet (owned by General Motors) hold 5.3% and 9.2% share of the U.S. EV market in 2Q25, respectively. For reference, Lucid holds a 0.8% share of the market in 2Q25.

These auto manufacturers generate billions in profits through their legacy and hybrid offerings that they can then pour into EVs to take market share while remaining profitable. However, when markets shift, as expected with the expiration of the EV credit, these manufacturers can shift production to ICE and hybrid vehicles to remain profitable. Once a post-incentive EV demand level is established, they can appropriately ramp up. Lucid and other EV makers lack that competitive advantage.

Per Figure 5, Lucid’s NOPAT margin, invested capital turns, and ROIC all rank near the bottom of the industry. The gap between the industry leaders and laggards is particularly stark. We don’t think it is a coincidence that the worst laggards are relatively new EV-focused vehicle manufacturers.

Figure 5: Lucid’s Profitability Vs. Competitors: TTM

Sources: New Constructs, LLC and company filings.

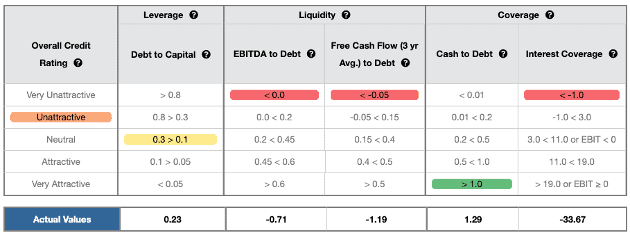

Credit Rating Looks Poor as Well

Lucid also earns a Very Unattractive Credit rating in three of the five metrics that drive our Overall Credit Rating, As a result, Lucid earns an overall Unattractive Credit Rating. See Figure 6.

With negative EBITDA to Debt, FCF to Debt, and Interest Coverage ratio, it could be more difficult for Lucid to raise additional capital without further diluting existing investors, especially given the current uncertain market conditions.

Figure 6: Lucid’s Credit Rating Details

Sources: New Constructs, LLC and company filings.

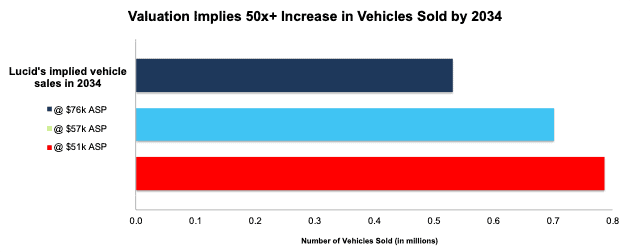

Valuation Implies Lucid Will Sell More Cars Than the Toyota Camry

Below, we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Lucid’s stock price. Lucid’s stock is priced as if it will significantly improve profitability while nearly selling more vehicles than the best-selling passenger car in the United States. We also present an additional DCF scenario to highlight the downside risk in the stock if Lucid fails to achieve these overly optimistic expectations.

To justify its current price of $25/share, our model shows that Lucid would have to:

- immediately achieve a 6% NOPAT margin (between General Motors and Toyota over the TTM, compared to Lucid’s TTM NOPAT margin of -252%) and

- grow revenue 48% compounded annually through 2034.

In this scenario, Lucid would generate $40.2 billion in revenue in 2034, which is nearly half of Nissan’s TTM revenue. It would also equal 43x Lucid’s TTM revenue.

This scenario also implies that Lucid would generate $2.4 billion in NOPAT in 2034, which would equal 76% of Tesla’s TTM NOPAT and 74% of Nissan’s TTM NOPAT, compared to Lucid’s -$2.3 billion NOPAT over the TTM. Contact us for the math behind this reverse DCF scenario.

The revenue in this scenario implies Lucid will sell the following number of vehicles based on these ASPs:

- 532,000 vehicles – Lucid’s TTM ASP of $76k

- 702,000 vehicles – ASP of $57k (equal to average new-EV price in August 2025)

- 786,000 vehicles – ASP of $51k (equal to average new-vehicle price in August 2025)

Lucid delivered 10,241 vehicles in 2024 and 12,298 vehicles over the TTM. Management guided for production (not deliveries) of between 18,000 and 20,000 vehicles in 2025.

For reference, the best-selling passenger car in America is the Toyota Camry, a position it has held for 20+ years. In 2024 Toyota sold just under 310,000 Camry’s in the United States. Keep in mind, the MSRP on a 2026 Toyota Camry is $29,000, or well below the ASPs in the scenario analysis above.

BMW sold 25,315 5 Series’ sedans in 2024, which is a luxury sedan with a similar MSRP to the base model Lucid Air.

For additional reference, as Lucid enters the SUV market, the best-selling SUV in the U.S. in 2024 was the Toyota RAV4, which sold just over 475,000 units.

In other words, to justify its valuation, Lucid must maintain an ASP well above average new-vehicle prices, while, in 2034, selling more vehicles than either the best-selling passenger car or SUV in America in 2024, all while fending off competition from all other automakers. At lower ASPs, Lucid must sell slightly more vehicles in 2034 (786 thousand) than the combined 2024 sales of the Camry and RAV4 (785 thousand).

Figure 7: Lucid’s Implied Vehicle Sales in 2034 to Justify $25/Share

Sources: New Constructs, LLC and company filings.

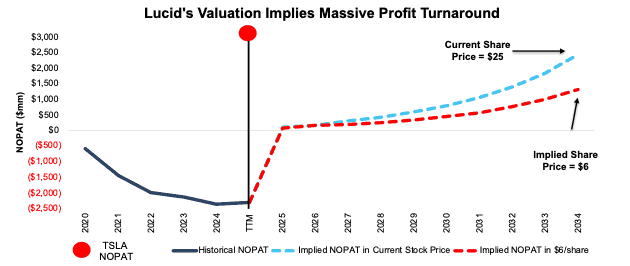

75%+ Downside If Revenue Grows Above the Projected Industry Growth Rate

If we instead assume Lucid:

- immediately improves NOPAT margin to 5.5% (equal to General Motors’ TTM margin) and

- grows revenue by 40% (vs. projected industry growth of 33% compounded annually through 2030) compounded annually through 2034, then

our model shows the stock would be worth just $6/share today – 75% downside to the current price. In this scenario, Lucid’s NOPAT would still grow to $1.3 billion, compared to -$2.3 billion in the TTM. Contact us for the math behind this reverse DCF scenario.

At its current ASP, this scenario implies Lucid will sell over 314,000 vehicles in 2034. In other words, Lucid would sell 2% more vehicles in 2034 than the Toyota Camry, the best-selling passenger car in America, sold in 2024.

Figure 8 compares Lucid’s implied future NOPAT in these scenarios to its historical NOPAT. For additional comparison, we include the TTM NOPAT of Tesla (TSLA).

Figure 8: Lucid’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

Even These Scenarios Might Be Too Optimistic

Scenario 1 and 2 assume Lucid’s invested capital grows 3% and 2% compounded annually through 2034 respectively. For reference, Lucid’s invested capital has grown 55% compounded annually since 2020. For reference, Tesla, which was more recently in the startup phase relative to legacy automakers, saw its invested capital grow by 53% compounded annually in its first 10 years as a public company.

In other words, an invested capital CAGR of 3% or 2% assumes Lucid can build future plants and produce cars significantly more efficiently than legacy manufacturers and EV competitors alike.

Lucid must build more plants if it is to have any chance of meeting the expectations baked into its stock price, which makes the low invested capital growth assumption even more unlikely, but allows us to create a “best-case scenario.” Its current factory can produce up to 90,000 vehicles per year after its expansion in 2024. The company is building a second facility in Saudi Arabia, which upon completion will add production capacity of 155,000 vehicles per year. Combined, the two plants will bring Lucid’s yearly total production capacity to 245,000 vehicles. However, as noted above, to justify the expectations baked into the current stock price, Lucid must sell 532,000 vehicles per year in 2034 at its current ASP.

If we assume Lucid’s invested capital increases at a similar rate in the DCF scenarios above to account for the required production capacity increases, the downside risk is even larger.

Stock Is Not Worth $1

Given that the performance required to justify its current price is overly optimistic, we dig deeper to see if Lucid is worth buying at any price. The answer is no.

The company has $2.8 billion in total debt, $1.9 billion in preferred stock, $37 million in outstanding employee stock options, and no excess cash. Lucid has an economic book value, or no-growth value, of -$90/share. In other words, we do not think equity investors will ever see $1 of economic earnings under normal operations, which means the stock would be worth $0 today.

This article was originally published on October 6, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.