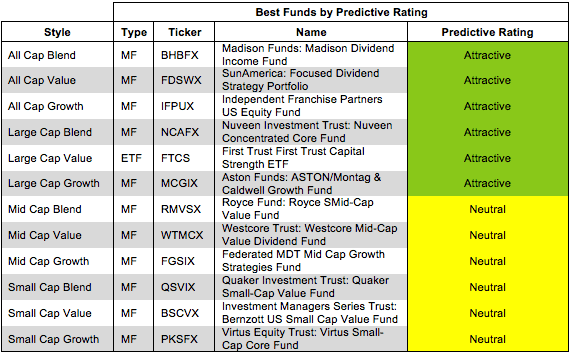

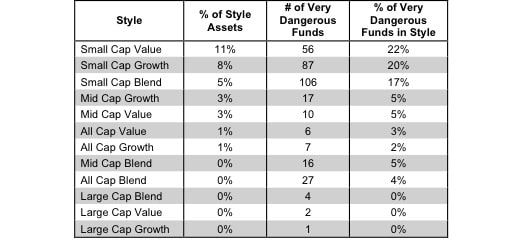

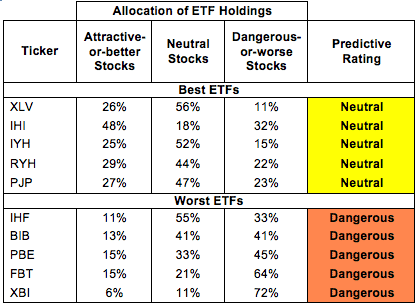

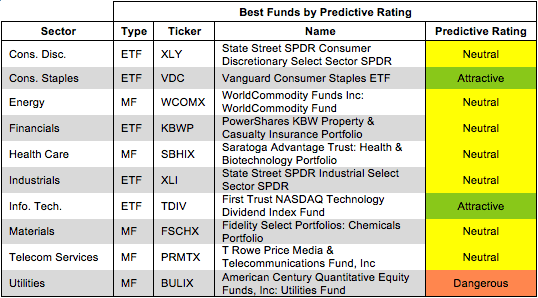

Rating Breakdown: Best & Worst ETFs & Mutual Funds by Style

This report identifies the “best” ETFs and mutual funds based on the quality of their holdings and their costs. As detailed in “Low-Cost Funds Dupe Investors”, there are few funds that have both good holdings and low costs. While there are lots of cheap funds, there are very few with high-quality holdings.

David Trainer, Founder & CEO