Best & Worst ETFs and Mutual Funds: Mid Cap Blend Style

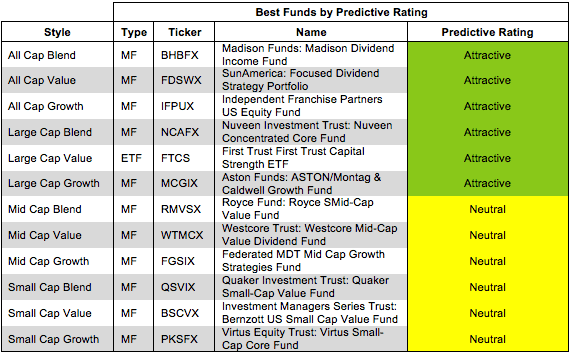

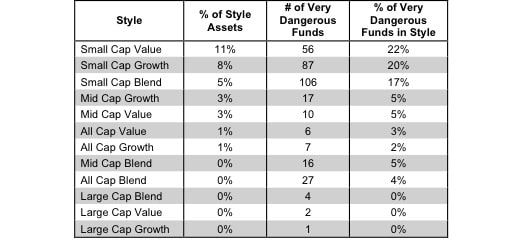

The Mid Cap Blend style ranks seventh out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Dangerous rating, which is based on aggregation of ratings of 16 ETFs and 324 mutual funds in the Mid Cap Blend style as of October 18, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

David Trainer, Founder & CEO