Danger Zone 5/20/2013: Amazon.com (AMZN)

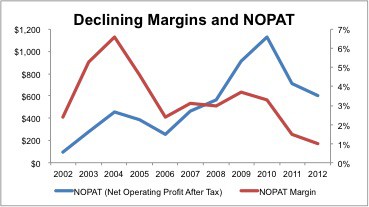

The belief that Internet retail is or will be more profitable than traditional retail is untrue. Amazon is in a competitive, low margin business that cannot justify the profit growth implied in its valuation.

David Trainer, Founder & CEO