How “Economic Earnings” Affect Trading – TD Ameritrade Network

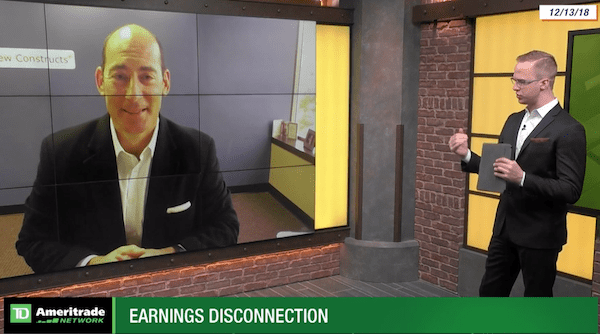

David Trainer joined Morning Trade Live on the TD Ameritrade Network to shine some economic earnings light on stocks reporting EPS over the next couple weeks.

Kyle Guske II, Senior Investment Analyst, MBA