For March 1, 2018, our forensic accounting red flag comes from an auto-parts retailer with questionable non-GAAP accounting.

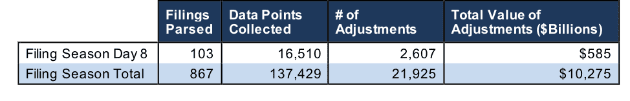

We pulled this highlight from yesterday’s research of 103 10-K filings, from which our Robo-Analyst technology collected 16,510 data points. Our analyst team used this data to make 2,607 forensic accounting adjustments with a dollar value of $585 billion. The adjustments were applied as follows:

- 1,134 income statement adjustments with a total value of $47 billion

- 1,060 balance sheet adjustments with a total value of $248 billion

- 413 valuation adjustments with a total value of $290 billion

Figure 1: Filing Season Diligence for Thursday, March 1st

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to meaningfully superior models and metrics.

Today’s Forensic Accounting Needle in a Haystack Is for Specialty Retail Investors

Analyst Lindsay Bohannon found an unusual item yesterday in O’Reilly Automotive’s (ORLY) 10-K.

On page 34, ORLY provides its calculation for Non-GAAP adjusted debt. This metric includes, among other things, a factor to account for off-balance sheet debt from operating leases. We support companies accounting for their off-balance sheet debt, but the calculation that ORLY uses significantly understates this obligation.

ORLY calculates its off-balance sheet debt as five-times rental expense, which is below the typical multiple of 6-8 used by other companies in the industry. It also understates the liability versus our more precise method, which discounts the required operating lease payments to their present value.

By using an unusually low multiple, ORLY understates its off-balance sheet debt by $335 million (2% of market cap). If investors use ORLY’s self-reported adjusted debt total, they would calculate a return on invested capital (ROIC) of 22% for the company rather than its actual 20%. This understated adjusted debt is just another example of how investors should not trust non-GAAP accounting without digging into the underlying methodology.

This article originally published on March 2, 2018.

Disclosure: David Trainer, Lindsay Bohannon, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.