We hope you’re having a great week.

If you have even a passing interest in cinema or the show industry, you’re likely familiar with the Cannes Film Festival, where the top actors, actresses, and directors gather. Even those who don’t actively follow the festival may have noticed the distinctive, or sometimes provocative fashion choices gracing its red carpet.

This week, however, Cannes took a definitive step toward preserving decorum by updating its dress code to maintain a refined standard.

We share a similar commitment to upholding high standards – though in a different arena. Our mission is to bring transparency and proper diligence to fundamental research to help investors pick better stocks.

Our track record proves that our superior research creates alpha in any kind of market.

This week, we identified a Long Idea that generates consistently high cash flows and returns much of that cash back to shareholders. This company has repurchased nearly 64% of shares outstanding since its IPO. We think the company’s stock has a potential 20%+ upside even if its profits never grow from current levels.

Below, we present a large excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

This stock offers favorable Risk/Reward based on the company’s:

- diversified business model and end customers,

- long-term growth tailwinds across segments,

- strong track record of revenue and profit growth,

- high capital return backed by consistent cash flows, and

- undervalued stock price.

Dominating Market Share in Largest Segment

This company holds majority market share in its core addressable market (which includes class 4 through 8 vehicles) within its North America on-highway segment. For example, as of 2024, the company holds a market share of:

- 81% in School Bus,

- 79% in Class 8 Straight,

- 77% in Classes 6 and 7, and

- 50% in Motor Home.

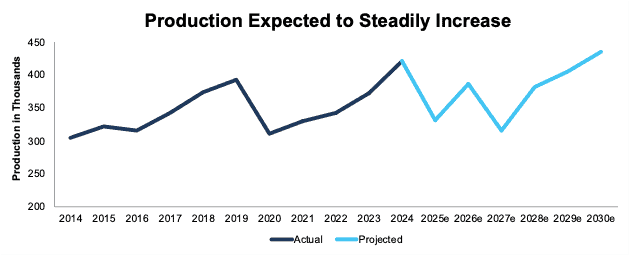

The North American production in the company’s core addressable market is projected to grow 1% compounded annually through 2030. See Figure 2.

With its strong expertise, product development, service network, trusted brand name, and leading market share, this company is poised to grow alongside the broader industry.

Figure 2: North American Production in Core Addressable Market: 2014 – 2030E

Sources: New Constructs, LLC and company filings

Potential for 8% Yield

Since 2019, this company has paid $506 million (6% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.15/share in 1Q19 to $0.27/share in 1Q25. The company’s current dividend, when annualized, provides a 1.0% yield.

This company also returns capital to shareholders through share repurchases. During the first three months of 2025, the company repurchased $150 million worth of shares. In 2024, the company repurchased $254 million in shares.

The company has $1.4 billion authorized repurchases remaining under its current authorization. Should the company repurchase shares at the 1Q25 pace for the rest of the year, it would buy back $600 million of shares in 2025 and provide a 6.9% repurchase yield. When combined, the dividend and share repurchase yield could reach 7.9%.

Even if the company only repurchases shares at its 2024 pace, it would repurchase an additional $104 million of shares in 2025, which would represent 1.2% of the company’s current market cap.

Strong Cash Flows Support Shareholder Return

The company has generated positive free cash flow (FCF) every year since 2013 (earliest data available).

Investors should take comfort in knowing the company will be able to afford to pay its dividends and repurchase shares due to its large FCF generation. From 2019 through 1Q25, the company generated $3.4 billion in FCF, which equals 31% of the company’s enterprise value.

Figure 5: Cumulative Free Cash Flow: 2019 – 1Q25

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this pick to outperform.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.