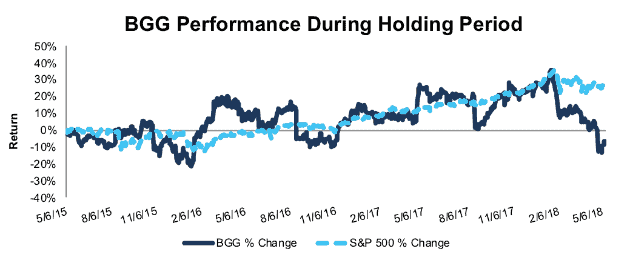

Briggs & Stratton Corp (BGG: $19/share) – Closing Short Position – down 8% vs. S&P up 29%

Briggs & Stratton was originally selected as a Danger Zone pick on 4/27/15. At the time of the report, the stock received a Very Unattractive rating. Our short thesis highlighted slowing sales, falling margins and return on invested capital (ROIC), questionable acquisitions, and an overvalued stock price.

During the 1113-day holding period, BGG outperformed as a short position, falling 8% compared to a 29% gain for the S&P 500. BGG was upgraded to Neutral on 5/6/18 after we parsed its latest 10-Q filing. While BGG’s fundamentals remain weak (bottom-quintile ROIC and negative economic earnings), the growth expectations implied by its valuation have become less optimistic. The stock now has a price-to-economic book value (PEBV) ratio of 2.2 and a growth appreciation period of just two years. As a result, we are closing this position.

We hope readers were able to avoid this stock while it declined 8% in a strongly rising market.

Figure 1: BGG vs. S&P 500 – Price Return: Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on May 15, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.