Pluralsight, Inc. (PS) – Closing Short Position – up 17% vs. S&P up 18%

We put Pluralsight, Inc. (PS: $20/share) in the Danger Zone on March 2, 2020. At the time, PS received an Unattractive rating. Our report focused on Pluralsight’s misleading GAAP and non-GAAP metrics, rising competition, negative profitability, lack of economies of scale, and the high expectations baked into Pluralsight’s stock price.

This report, along with all of our research[1], utilizes our superior data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

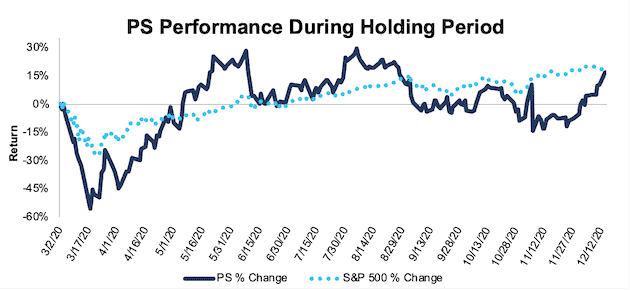

During the 287-day holding period, PS outperformed as a short position, rising 17% compared to an 18% gain for the S&P 500.

While the firm’s fundamentals remain poor, with negative economic earnings and return on invested capital (ROIC), the Wall Street Journal reports private-equity firm Vista Equity Partners has agreed to acquire Pluralsight for $20.26/share. As a result, we are closing this short position.

Figure 1: PS vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on December 14, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Our Core Earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. Recently accepted by the Journal of Financial Economics, the paper proves that our data is superior to all the metrics offered by S&P Global (SPGI).