Spectrum Brand Holdings (SPB: $104/share) – Closing Long Position – down 23% vs. S&P +16%

Spectrum Brand Holdings was originally selected as a Long Idea on 5/15/17. At the time the report, the stock received an Attractive rating. Our investment thesis highlighted consistent after-tax profit (NOPAT) growth, improving return on invested capital (ROIC), a focused effort to expand into higher margin segments, and a low PEBV ratio that implied immediate profit decline.

Despite the strong fundamentals and cheap valuation, SPB underperformed, falling 23% while the S&P rose 16% during the subsequent 288-day holding period. SPB has since been downgraded to Neutral on 2/9/18 after our Robo-Analyst parsed the most recent 10-Q. While SPB’s valuation remains attractive, the stock was downgraded due to a false positive trend in economic earnings vs. reported earnings.

Furthermore, it was announced on 2/26/18 that SPB would merge with its majority stockholder, HRG Group (HRG). The merger means investors no longer get exposure to SPB’s consumer goods segments without exposure to HRG’s other holdings. Due to the rating change and merger with HRG, we are closing this position.

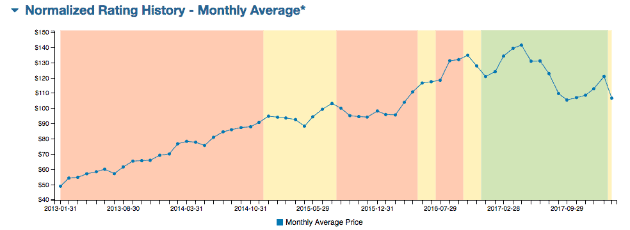

Figure 1: SPB Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

This article originally published on February 27, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.