With the announcement of a 90 day pause in tariffs on most countries, the S&P 500 recorded its biggest one-day gain since 2008 and third biggest since World War II. Markets cheered the news, to say the least.

However, with no clear signs that the tariffs will not be put back in place 90 days from now, today’s reaction is another move driven by speculation.

We’re not here to speculate or ride the hype train. One good day doesn’t mean every stock is a good stock… again.

We firmly believe that the best way to navigate this volatile market is to do your diligence. Uncertain markets create opportunities, but only if you know the true risk/reward of stocks.

When you’ve done your diligence, you know which stocks to buy and sell in any kind of market. Look no further than the outperformance of our Bloomberg New Constructs Ratings VA-1 Index (ticker BNCVA1T:IND) for proof.

This week’s Long Idea is a stock that provides uniquely excellent risk/reward. The company is the most profitable among its peers, benefits from long-term demand tailwinds, offers a 12%+ potential yield, and its stock is undervalued.

Below, we present a large excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

This stock offers favorable Risk/Reward based on the company’s:

- diversified business in an industry with long-term tailwinds,

- industry leading profitability,

- strong financial footing,

- high capital return to shareholders, and

- cheap stock price.

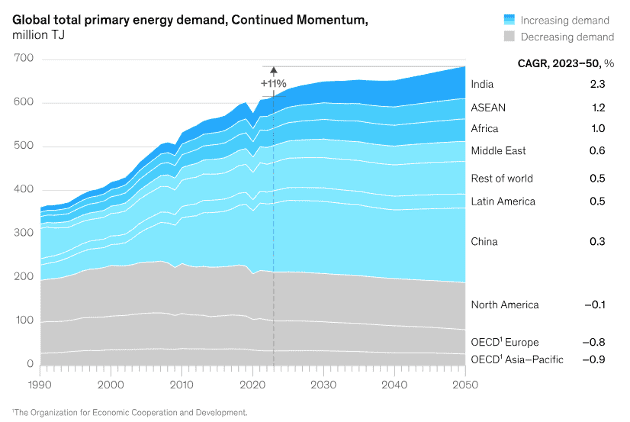

Energy Demand Charging Forward

Despite the many calls for peak oil and gas, global energy demand is forecasted to rise between 11% and 18% from 2023 to 2050 per McKinsey’s Global Energy Perspective 2024. This company, with operations across the entire global energy markets, is in a prime position to take advantage of growth in energy demand.

Liquified natural gas (LNG), a growing portion of the company’s sales, is projected to make up the majority of natural gas usage around the world, rising from 43% in 2022 to an expected 64% in 2050.

Renewables, a growing focus at this company, are projected to make up between 65% to 80% of the global energy generation in 2050, which represents an increase from just 32% in 2023.

Figure 1: Global Energy Demand (Conservative Scenario): 1990 – 2050

Sources: McKinsey Global Energy Perspective 2024

Potential for 12%+ Yield

Since 2019, this company has paid $48.4 billion (36% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.72/share in 1Q19 to $0.85/share in 1Q25. The company’s current dividend, when annualized, provides a 6.2% yield.

The company also returns capital to shareholders through share repurchases. From 2019 through 2024, the company repurchased $27.6 billion (21% of market cap) of shares.

The company disclosed that it plans to buy back $2 billion worth of shares per quarter in 2025 “assuming reasonable market conditions.” Should the company buy back $8 billion worth of shares, that would equal 6.3% of the company’s current market cap.

When combined, the dividend and share repurchase yield could reach north of 12%.

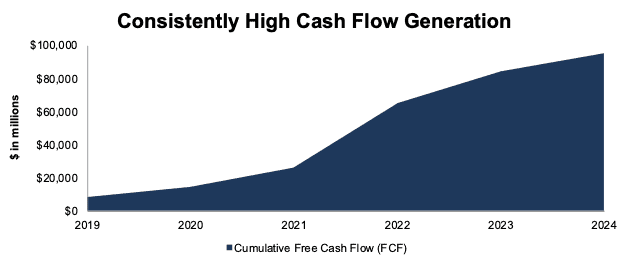

Quality Cash Flow Generation

This company generates enough free cash flow (FCF) to cover both its share repurchases and total dividend payments.

From 2019 to 2024, the company generated $95.6 billion in FCF while spending $76.0 billion on capital return: $48.4 billion in dividends and $27.6 billion in repurchases. See Figure 6.

Figure 6: FCF: 2019 – 2024

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.