How Much Attention Should You Pay During Earnings Season?

While earnings season creates a stir in the financial media, smart investors understand that quarterly earnings reports provide relatively little information about the financial health of publicly traded companies.

Our advice for long-term investors is not to pay much attention to earnings season when making investment decisions. Earnings season tends to be filled with market overreactions to frequently manipulated earnings data.

When an Earnings Report is Worth Your Time

While investors should take quarterly earnings reports with a grain of salt, these earnings releases can serve as catalysts, snapping stock prices back to reality. For investors in a financially strong but undervalued company, a market correction can mean big time profits.

The Travelers Companies (TRV) is a stock that has experienced this kind of upward correction. Since the release of its third quarter earnings less than a month ago, the company’s stock price has risen 11% from $93 to almost $103/share.

Travelers Companies (TRV) is one of the United States’ largest insurance writers. It offers a wide portfolio of products, from car and property insurance to identity fraud coverage. Travelers Companies (TRV) has been extremely profitable but undervalued for several years. The good news for investors is that there is still plenty of value to be had in Travelers Companies (TRV), which makes it our stock pick of the week.

Ignore the Noise — Keep an Eye on These 3 Metrics

If you’ve read our research before, you know that companies frequently manipulate accounting data, and that only annual reports contain the full set of financial information for stock investors.

If you’re not familiar with our research, all you need to know for now is that the following three metrics should be your main guide when making investment decisions.

-

After-Tax Operating Profit (NOPAT):

Since merging with SPC in 2003, Travelers Companies (TRV) has grown its NOPAT by over 16% compounded annually. Travelers has also increased its profit margins from 10% in 2012 to over 14% in 2013.

-

Return on Invested Capital (ROIC):

In 2013, the company earned a healthy ROIC of over 12%.

-

Free Cash Flow (FCF):

Historically, Travelers Companies (TRV) has been a free cash flow (FCF) machine, generating positive free cash flow every year since 2005, which adds up to $25 billion. In 2013 alone Travelers Companies generated $3.7 billion in free cash flow. Travelers Companies’ balance sheet carries no debt whatsoever, ensuring that this cash is free to be redistributed to shareholders or reinvested in the company’s business.

For Travelers Companies’, these metrics assured us that the stock had excellent upside potential when it first made our Most Attractive list in March. The stock is up over 23% since then, outperforming the S&P 500 by almost 13%.

Why Travelers is an Undervalued Investment

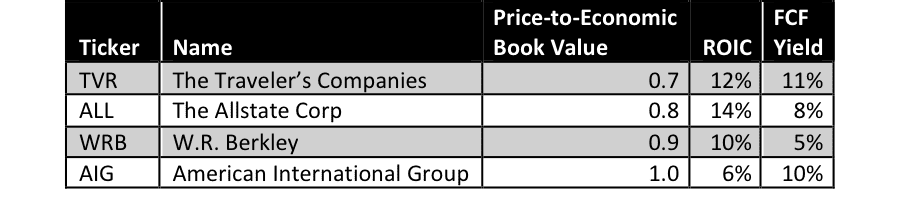

Figure 1 shows how Travelers Companies stacks up to its competition based on a few of the aforementioned key metrics.

Figure 1: Travelers Doesn’t Get the Respect It Deserves

Sources: New Constructs, LLC and company filings.

One thing to note is Travelers Companies’ price to economic book value ratio (PEBV), which is low relative to the company’s competition. PEBV reflects the ratio between the stock’s price and its true value per share based on the company’s current cash flows. At its current price of ~$103/share TRV has a PEBV of 0.7. This ratio implies the market expects Travelers Companies’ NOPAT to permanently decline by 30%. Sources: New Constructs, LLC and company filings.

After looking at the three key figures we discussed earlier, it becomes easy to see that this level of pessimism regarding Travelers Companies business is unwarranted. The company has consistently grown after-tax profit for a decade, generates outstanding free cash flow, and over time has achieved greater returns on the capital invested into its business than almost all of its competition. Last quarter’s earnings report shouldn’t have surprised diligent investors, who already knew that Traveler’s was well positioned to keep generating profits.

So just how undervalued is TRV? If we give Travelers Companies credit for only 10% annual NOPAT growth (below its historical average) for the next decade, the stock would be worth $174/share today. This represents a 74% increase from the current stock price. Investors who recognize this opportunity in Travelers could stand to make a great amount of money.

What Does Earnings Season Really Tell Us?

As we noted above, quarterly earnings season, while providing material for headline news, rarely gives much insight into a company’s financial health.

However, earnings season can provide a dose of relief to investors who have performed due diligence on their investments and are waiting for the market to catch up. Often, a quarterly report is just what the market needs to wake up to the realities of a highly overvalued or undervalued company. As we’ve seen with TRV, these realizations can have a sizable impact on an investor’s portfolio.

André Rouillard contributed to this report.

Disclosure: David Trainer owns TRV. David Trainer and André Rouillard receive no compensation to write about any specific stock, sector or theme.