Free Cash Flow And FCF Yield

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics.

Free cash flow (FCF) equals the amount of cash free for distribution to all stakeholders. Think of free cash flow as the real dividend that a company could pay investors. Not surprisingly, many of the world’s top investors focus on free cash flow when picking stocks.

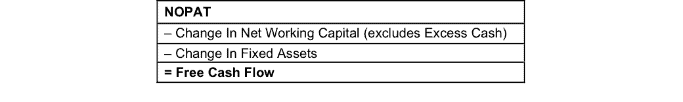

There are many ways to calculate free cash flow. Most approaches are short cuts that attempt to compensate for poor data. Our formula for FCF is in Figure 1.

Figure 1: How to Calculate Free Cash Flow

NOPAT – Change In Invested Capital

Or

Sources: New Constructs, LLC and company filings

No two companies are the same, and no single metric perfectly captures the economics of every company. That’s why we provide multiple versions of metrics using our proven-superior fundamental data.

For example, the FCF Yield calculation that we use in our ratings is:

2-Year Average Free Cash Flow (excluding cash) / Enterprise Value.

This version of Free Cash Flow Yield calculation improves the metric in two key ways:

- Removes the impact of cash from the calculation of Free Cash Flow: The original version of Free Cash Flow = NOPAT – Change in Invested Capital. This update eliminates the impact of all cash line items (e.g. new cash raised from selling shares, acquiring new debt, or changes to our required cash assumption) on Free Cash Flow. The goal for this update is to focus more on the underlying economics of the business.

- Uses a 2-year average for Free Cash Flow: A 2-year average limits the year-to-year volatility of Free Cash Flow and provides a more normalized assessment of the business. A single-year Free Cash Flow is more easily distorted by one-time events such as large asset purchases or other large outlays.

This version of the free cash flow calculation removes the impact of cash to focus more on the underlying economics of the business and limits the year-to-year volatility of FCF by using a 2-year average. More details here.

As with all things in life, building a solid investment strategy around Free Cash Flow (FCF) is not as simple as it may seem. While it is obvious that companies with larger and growing FCF should fetch higher valuations, making money with that strategy requires a bit more work.

Here are 3 rules to follow when building an investment strategy that uses FCF.

This paper compares our analysis on a mega cap company to other major providers.

Want To Learn More?

Sign up to receive free alerts about all our new research reports including Long Ideas and Danger Zone picks.

See our webinar on importance of ROIC and how to calculate it.

Get our report on "ROIC: The Paradigm For Linking Corporate Performance to Valuation."