Sell BAC: Management Is Running Out of Gimmicks

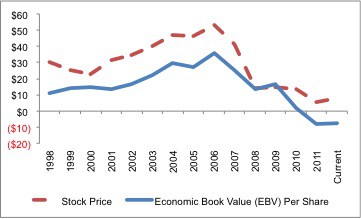

Year to date, Bank Of America (BAC) stock is up nearly 45% compared to the S&P at +about 8%. BAC stock has bounced back nicely after dropping precipitously at the end of last year.

I would call the 45% bounce a “dead cat” bounce because I expect the stock to fall right back to $5/share, where it bottomed last Thanksgiving, or lower.

David Trainer, Founder & CEO