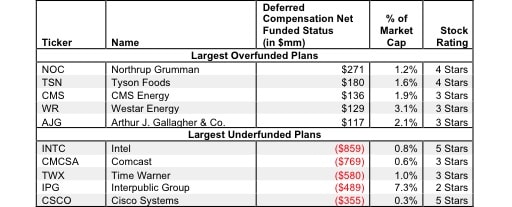

Deferred Compensation Assets and Liabilities – Valuation Adjustment

The net amount of deferred compensation is included in shareholder value. If a company has a net liability, future cash flows will be diverted to pay for that obligation. If a company has a net asset, then any future increases in the obligation will not need to be met with new contributions from the company. Instead, the company can return that cash to shareholders.

David Trainer, Founder & CEO