This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation of economic book value and our discounted cash flow model.

We’ve already broken down the adjustments we make to NOPAT and invested capital. Many of the adjustments in this third and final section deal with how adjustments to those two metrics affect how we calculate the present value of future cash flows. Some adjustments represent senior claims to equity holders that reduce shareholder value while others are assets that we expect to be accretive to shareholder value.

Adjusting GAAP data to measure shareholder value should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

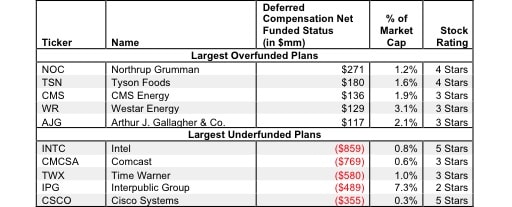

Companies and employees will sometimes agree to defer compensation until a later date. The company then holds assets in trust to pay out later to their employees. However, there is no requirement for the amount of assets held in trust to be equal to the value of future obligations. Often, companies will have a significant difference between assets and liabilities in their deferred compensation plans.

We discussed the treatment of deferred compensation plans for invested capital in a previous report.

The net amount of deferred compensation is included in shareholder value. If assets are greater than liabilities, we add the net asset to shareholder value. If the liabilities are greater than the assets, we remove the net liability from shareholder value. If a company has a net liability, future cash flows will be diverted to pay for that obligation. If a company has a net asset, then any future increases in the obligation will not need to be met with new contributions from the company. Instead, the company can return that cash to shareholders.

4 replies to "Deferred Compensation Assets and Liabilities – Valuation Adjustment"

Maybe the answer is so obvious and i don’t know it because i am new but may i ask why you you don’t take all liabilities into account but just some spesific ones such as deferred compensation. For example why we don’t take accounts payable into account.

Denise, thanks for your comment! Accounts payable is a non-interest bearing current liability (NIBCL), and like all NIBCLs, does not have a cost of capital associated with it. We do not include NIBCLs in our calculation of invested capital since NIBCLs do not represent capital invested in the business by the business, but rather by someone else such as a supplier. You can read more about invested capital here: https://www.newconstructs.com/education-invested-capital/.

Hi Matt,

You have written a very good article & its really helpful. I am thankful for that.

Also, I would like to ask if you can write a article on EBITDA vs Adjusted EBITDA, then it would be great. This terms in general are simple, but while calculating it at times it become difficult. You can even add an easy approach to calculate both EBITDA vs Adjusted EBITDA.

Hi Ketan,

Thanks for your comment. Please see this article on EBITDA vs Adj EBITDA.

You might be interested in our education section, as well, as it contains many articles on our metrics, methodologies, and models.

If you have any questions please don’t hesitate to reach out to us at support@newconstructs.com.

Best,

Tam