Markets are off to a shaky start this year following two years of record returns. It looks as if some of the highest flyers are ready to give back some of their big gains. These corrections are healthy, especially when you know which stocks need to come down. After the long bull rally, too many stocks trade well above prices that are justified by the business’ cash flows.

So how can you know if a stock you own is due for a correction? Timing the market based on news and hype is for suckers, but timing the market based on true fundamentals and valuation is smart. Hype can’t outpace the facts forever, and stocks can’t outpace their cash flows forever, either. At some point, cash is king, and market values reconciles with true business value.

These facts mean that the best thing you can do to protect your portfolio is to understand the true cash flows of businesses and the expectations baked into a stock’s price. And, that research is exactly what we do better than any other research firm in the world. In fact, we update our stock ratings every day based on the latest stock prices so we can alert clients as soon as we see that a stock had outpaced its fundamentals.

This week’s Danger Zone is one such stock. The stock increased 200%+ in 2024, but this move is not supported by the fundamentals of the business.

Some investors seem to be catching on, as the stock is down 15%+ over the past 30 days. Nevertheless, we think the stock has much further to fall, especially after taking a deep dive into the business’ fundamentals.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and the smartest warnings.

We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

We first put this stock in the Danger Zone in November 2021 prior to its IPO and later named it a Zombie Stock in March 2023. Since our original Danger Zone report the stock has outperformed as a short by 61%, falling 35% compared to a 26% gain for the S&P 500.

What’s Working

This stock soared in the last six months after the company showed signs of reaccelerating growth. The company reported 13% year-over-year (YoY) top line growth and a 175% YoY Adjusted EBITDA growth in 3Q24.

However, when we look at the company’s fundamentals and beyond misleading metrics like Adjusted EBITDA, the picture looks less optimistic. The disconnect between true fundamentals and a rising stock price means the stock’s valuation was driven by speculation more so than a profitable business.

What’s Not Working

We’ve been pointing out many issues with this business since we first wrote about the company.

To start, the company’s preferred metrics are misleading. From 2019 to the TTM the company’s Adjusted EBITDA improved from -$46 million to $16 million, while its GAAP net income fell from -$68 million to -$89 million. Over the same time, the company’s economic earnings, the true cash flows of the business, fell from -$126 million to -$201 million. It is a big red flag when the company’s preferred non-GAAP metric is rising while its economic earnings are declining.

The discrepancy between the metrics should come as no surprise since the company openly admits in its filings “Adjusted EBITDA should not be viewed as substitutes for, or superior to, loss from operations or net loss prepared in accordance with GAAP as a measure of profitability.”

Figure 2: GAAP Net Income vs. Economic Earnings vs. Adjusted EBITDA

Sources: New Constructs, LLC and company filings.

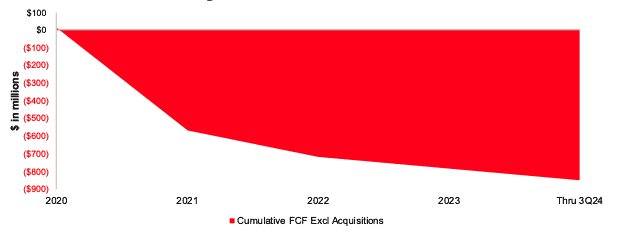

Despite the top-line improvement and positive Adjusted EBITDA, the company hasn’t achieved a positive free cash flow (FCF) in any full year since 2020. In fact, the company has only achieved a positive FCF in three quarters (2Q22, 3Q22, and 1Q24) out of ten in our model. The company has burned $848 million (19% of enterprise value) in free cash flow (FCF) excluding acquisitions since 2020. See Figure 3.

This cash burn remains unsustainable. If the company burns cash at the two-year average rate, it only has enough cash to sustain operations for 17 months from the end of 2024 before having to raise additional capital.

Figure 3: Cumulative Free Cash Flow Since 2020

Sources: New Constructs, LLC and company filings.

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.