The High-Low Fallacy: Don’t Believe the Merger Hype

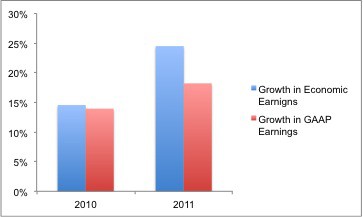

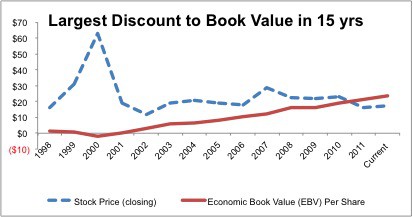

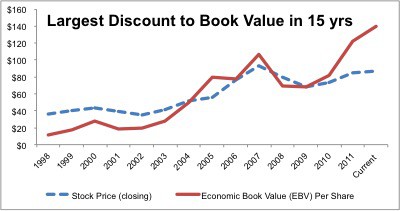

One of the biggest misconceptions in the investing world is that the merit of an acquisition should be judged by whether or not it is “earnings accretive”. The impact of an acquisition on a company’s accounting earnings is not indicative of its economic value to shareholders.

David Trainer, Founder & CEO