Seldom do value investors get a chance to have their cake and eat it too. And that is exactly what we have with Cisco (CSCO) stock.

True, the stock has underperformed significantly year-to-date. Concerns about economic growth at home and abroad undoubtedly weigh on the stock. And as the company has matured, it no longer attracts the momentum-investing groupies that love to play high-flying growth stocks.

The investment paradigm for CSCO has changed. In “Apple Bears Have It Wrong”, I explained how investors should see AAPL as a value stock not a momentum-driven growth stock. The same is true for CSCO.

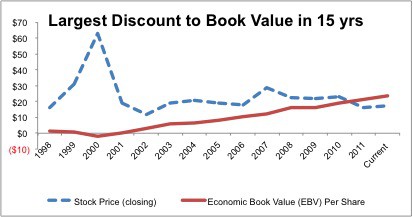

At ~$17.35, the stock trades at a 30% discount to its economic book value, the value of the stock if its profits never grow from current levels. In other words, the current valuation implies the company’s profits (NOPAT) will permanently decline by 30%. That is a nice margin of safety. Per Figure 1, that is the steepest discount at which the stock has traded since at least 1998, when my model begins.

Another strong value signal is this stock’s free cash flow yield at 11.4%, also the best since 1998.

Investors’ qualms in advance of the company’s imminent 4Q earnings call are overdone.

Figure 1: Rare Buying Opportunity For Such Deep Value

I think that establishing this stock is cheap is fairly easy.

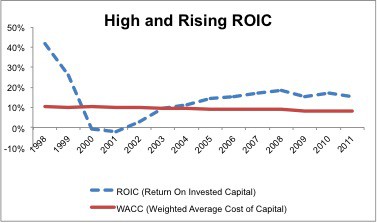

Next, I show why it should not be so cheap. First, per Figure 2 below, the stock has a high and steady ROIC. At around 15%, CSCO’s ROIC ranks in the top quintile of the 3000+ stocks we cover. Sure, the ROIC was much higher in the late 1990s during the tech boom. And, yes, the ROIC collapsed soon after the tech bubble imploded along with the stock price. Ever since then, however, the ROIC has made a sure and steady climb. Clearly, management has allocated capital intelligently over the last decade. I do not see that trend changing.

Figure 2: Stock Price Is Only About 60% of Economic Book Value

The key remaining questions are (1) is CSCO in a growing business and (2) can the company maintain its market share. I think the answers to both are yes.

CSCO may not be the sexy tech play it once was, but that is a good thing. Instead of having to rely on consistently rolling out fancy new products or devices, CSCO enjoys the steady business of providing the infrastructure for a market that is growing, i.e. the market for bandwidth.

I think it is difficult to make a straight-faced argument that demand for bandwidth is not going to continue to grow. The counter argument is easy.

CSCO provides the infrastructure, including security, that distributes bandwidth. They are the plumbers of the internet. These plumbers, unlike their counterparts in housing, will continue to enjoy strong and steady demand for the foreseeable future.

Some key drivers of bandwidth demand are tablet computers and smart phones. The more functionality provided by an iPad, iPhone or any other smart device, the more people want to use them, and they, most of the time, need to access the internet when they use them. Consider the constantly growing number of apps now available for both Apple and Android devices as a leading indicator of bandwidth demand.

Another driver of bandwidth demand is cloud computing. If you outsource your computing, you need a lot of bandwidth to send and receive data from your computing cloud.

The more people and businesses telecommute, the more bandwidth they need. And if they choose not to travel, then they rely on video or audio conferencing – again more bandwidth needed.

We live in an increasingly connected world. That trend is not likely to change over any time frame I can imagine. And as long as it is in place, internet plumbers will be busy.

With an already dominant competitive position, I expect CSCO to grow in step with the demand for bandwidth. And with $45+ billion of excess cash, I expect them to be able to maintain their dominant position via acquisition or a hard-to-match budget for R&D.

We have entered a new era for many technology stocks. Note that I do not say we have entered a new era for all tech stocks. Investors, as always, cannot categorically invest in a sector without parsing out the good from the bad. However, the tech sector consistently ranks as one of the best sectors for stocks, ETFs and mutual funds as detailed in my quarterly Sector Roadmap reports. The sector earns that distinction not because of high-flying growth stocks that momentum traders love to play. Instead, I see deep value in the form of outsized profitability and cheap valuations.

My rating on CSCO is Very Attractive. Click here for more details on my ratings on CSCO, AAPL and MSFT and the list of ETFs and funds that allocate 5% or more to CSCO.

Below are two funds that get my Attractive-or-better rating and allocate significantly to CSCO.

- Lazard Funds, Inc: Lazard US Equity Concentrated Portfolio (LEVIX) – Attractive Rating – 9% allocation to CSCO

- Putnam Funds Trust: Putnam Global Technology Fund (PGTYX) – Attractive Rating – 6% allocation to CSCO

Disclosure: I am long CSCO, MSFT and AAPL. I receive no compensation to write about any specific stock, sector or theme.

2 replies to "Buy CSCO: A Treat For Value Investors"

David:

I am sorry I have not responded to you regarding my subscription.

I am now ready to do the annual subscription. Please let me know how to pay you, and get re-authorized.

Thanks,

Mike Lacey

505-326-9325

Mike:

I sent you an email with details and calling too.