Recap from August Picks

Our Most Attractive and Most Dangerous stocks for September were made available at midnight last Thursday. We saw strong performances from picks in August. Last month’s featured stock, NetApp, Inc. (NTAP) gained 8.5% and Most Attractive Small Cap stock Inteliquent Inc., (IQNT) was up over 21%. 26 out of the 40 Most Attractive stocks outperformed the S&P 500.

Our Most Dangerous Stocks (3.1%) increased by less than the S&P 500 (3.3%). Most Dangerous Small Cap Stock LoJack Corporation (LOJN) fell by 21%. In a month that saw record performances from many indices, 7 out of the 40 Most Dangerous stocks saw declines in share price.

The successes of both Most Attractive and Most Dangerous picks highlight the value of our diligence. Being a true value investor is an increasingly difficult, if not impossible, task considering the amount of data contained in the ever-longer annual reports. By analyzing every word in these SEC filings, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

10 new stocks make our Most Attractive list and 11 new stocks fall onto the Most Dangerous list this month.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied in their market valuations.

Most Attractive Stock: NVR Finding Value at $1,150 per share

NVR Inc. (NVR) is one of the additions to our Most Attractive stocks for September. NVR’s stock price has failed to keep up with this homebuilder’s improving fundamentals. High revenue and after-tax profit (NOPAT) growth along with a cheap valuation make this stock one to watch.

Since 2009, NVR has grown both revenue and NOPAT by 11% compounded annually. Revenue growth has continued into 2014, with NVR announcing 9% growth YoY in their latest quarterly report, on the back of a 7% YoY increase in home prices.

Along with this revenue growth, NVR continued their recent trend of increasing economic earnings, and also increasing free cash flow to $158 million, the highest levels since 2009. Increasing free cash allowed NVR to repurchase $554 million in stock in fiscal year 2013, which equals a 12% buyback yield.

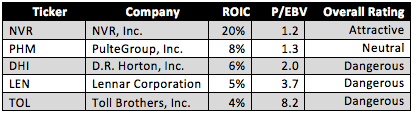

In 2013, NVR earned a return on invested capital (ROIC) of 20%, which is not only the highest of any homebuilder we cover, but also places it in the top quintile of over 3000 companies we cover. Figure 1 lists the five largest homebuilders by market cap, along with their ROIC and price to economic book values (PEBV).

Figure 1: NVR is The Best Among the Largest Homebuilder Stocks

Sources: New Constructs, LLC and company filings.

Despite a somewhat sluggish recovery in the housing market, NVR has grown revenue and profits at an impressive rate. Yet, the market is unwilling to grant the stock a valuation as high as its peers. At its current price of ~$1,151/share, NVR has a PEBV ratio of 1.2. This ratio implies that the market expects NVR to grow NOPAT by no more than 20% from its current level for the remainder of its corporate life.

These expectations seem rather low, especially given that the market expects more from other home builders with a lower ROIC. As stated above, NVR has grown NOPAT by 11% compounded annually over the last five years. Barring another housing slump in the near term, it is hard to imagine how NVR would not be able to exceed the expectations in its current stock price.

In a frothy market, one must dig deep to find truly undervalued companies, and NVR looks like quite a good find.

Most Dangerous Stock Feature for September: AngioDynamics Inc. (ANGO: ~$14/share)

AngioDynamics Inc. (ANGO) is one of the additions to our Most Dangerous stocks for September. ANGO is very overvalued given its recent history as well as some other issues going forward.

Since obtaining an ROIC of 13% in 2006, ANGO’s ROIC has dwindled down to a bottom quintile 2% in 2014. ANGO has not generated positive economic earnings for eight consecutive years. Economic earnings represent the true value created for equity investors, and are free of any accounting distortion.

Operating in the medical instruments segment of the HealthCare industry can be extremely profitable. However, it can also be extremely risky. Industry leaders such as Medtronic, Covidien, and Stryker all generate much higher returns as well as economic earnings. Direct competitor C.R. Bard (BCR) earns a double digit ROIC on top of positive economic earnings. To date, ANGO has shown no promise of being able to match the performance of its peers.

Reported earnings signal an improving outlook for ANGO as the company appeared to swing from a loss to a slight profit in 2014. However, GAAP accounting and earnings management distort reported earnings. Removing over $23 million in non-operating expenses, such as acquisition/restructuring costs and interest expenses from the 2013 income statement revealed that ANGO’s NOPAT was higher than reported earnings would suggest. Consequently, NOPAT actually declined from ~$20 million in 2013 to ~$15 million in 2014.

Why ANGO is not a Stock to Consider Buying

Taking everything into account, ANGO’s overvaluation is rather obvious. To justify its current price of ~$14/share, ANGO must grow NOPAT by 15% compounded annually for the next 16 years. Since 2008, ANGO has only grown NOPAT by 8% compounded annually. It would be difficult for any company to double their historical NOPAT growth rate and much more difficult to sustain that unusually high growth for 16 years. Add into the equation a declining ROIC, and it’s clear that the expectations embedded into ANGO’s stock price are dangerously high.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.