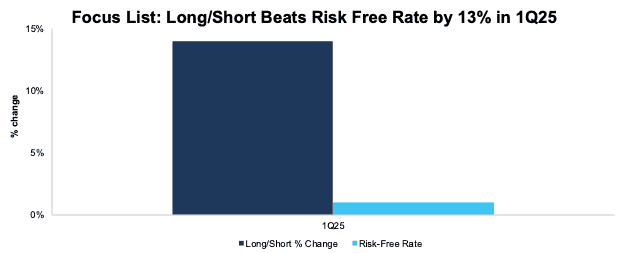

Our Focus List Stocks: Long Model Portfolio, the best of our Long Ideas, and our Focus List Stocks: Short Model Portfolio, the best of our Danger Zone picks, beat the Risk Free Rate (RFR) [1] as a long/short portfolio by 13% in 1Q25. See Figure 1.

The long portfolio was up 0.1% while the short portfolio fell 14% for a net return of +14% compared to the Risk-Free Rate at +1.0% in 1Q25. Note that short portfolios outperform when they fall more than the benchmark.

Figure 1: Focus List Stocks: Long/Short Performance vs. Risk-Free Rate: 1Q25

Sources: New Constructs, LLC

Note: Gain/Decline performance analysis excludes transaction costs, dividends and rebates. The Risk-Free Rate is based on the 3-month T-bill.

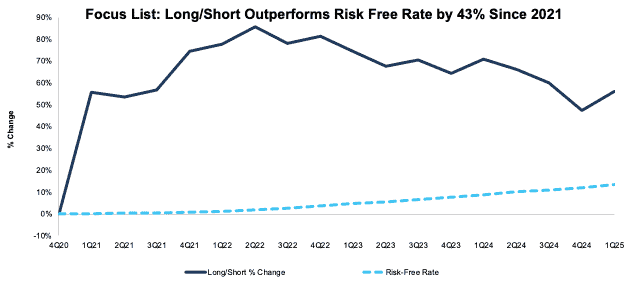

The Focus List Stocks Long & Short beat the RFR as a long/short portfolio by 43% from the start of 2021 through 1Q25. See Figure 2. This outperformance underscores just how important reliable fundamental research is in all markets.

Figure 2: Focus List Stocks: Long/Short Performance vs. RFR: 2021 Through 1Q25

Sources: New Constructs, LLC

Note: Gain/Decline performance analysis excludes transaction costs, dividends and rebates. The Risk-Free Rate is based on the 3-month T-bill.

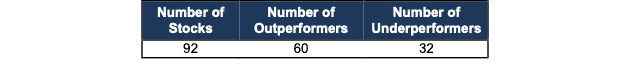

Figure 3 provides more details on the Model Portfolios’ performance, which includes all stocks present in the Model Portfolios at any point in 1Q25.

Figure 3: 1Q25 Long/Short Performance of Stocks in the Focus List Model Portfolios

Sources: New Constructs, LLC

Professional and Institutional members get real-time updates and can track all Model Portfolios on our site. The Focus List Stocks: Long Model Portfolio leverages superior fundamental data, which provides a new source of alpha.

We’re here to help you navigate these turbulent times. Our uniquely rigorous fundamental research consistently earns #1 rankings in several categories on SumZero.

Check Out the Indices Based on New Constructs Research

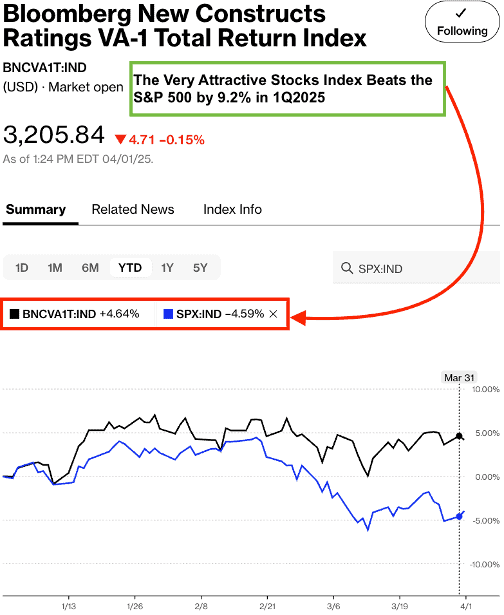

While we’re writing about how our Focus List Stocks: Short Model Portfolio finds overvalued stocks, we should highlight the indices we’ve developed with Bloomberg’s Index Licensing Group. Both outperformed the S&P 500 in 1Q25. See Figures 4 and 5.

- Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND)

- Bloomberg New Constructs 500 Index (ticker: B500NCT:IND)

Figure 4 compares the performance of the Very Attractive Stocks Index, managed by Bloomberg, to the S&P 500. In 1Q25, the Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND) was up 4.6% while the S&P 500 was down 4.6%.

Figure 4: Very Attractive-Rated Stocks Strongly Outperform the S&P 500 in 1Q25

Sources: Bloomberg

Note: Past performance is no guarantee of future results.

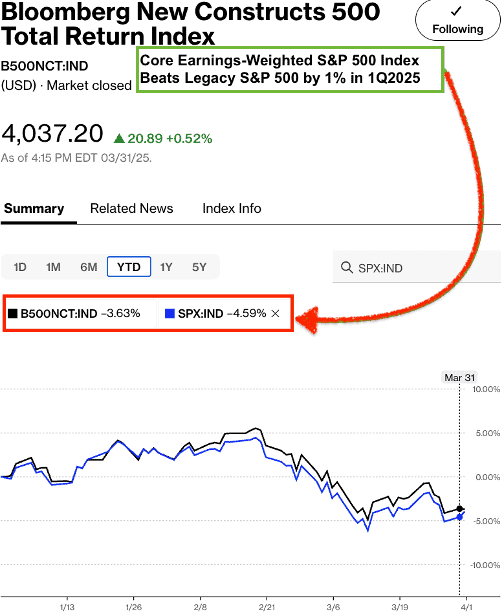

Figure 5 compares the performance of the Bloomberg New Constructs 500 Total Return Index, managed by Bloomberg, to the S&P 500. In 1Q25, the Bloomberg New Constructs 500 Total Return Index (ticker: BNCVAT1T:IND) was down 3.6% while the S&P 500 was down 4.6%.

Figure 5: Bloomberg New Constructs 500 Index Strongly Outperforms the S&P 500 in 1Q25

Sources: Bloomberg

Note: Past performance is no guarantee of future results.

This article was originally published on April 16, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] The Risk-Free Rate is based on the 3-month T-bill.