Picking good stocks is hard, which is why many investors are drawn to ETFs and mutual funds as an easy way to own a well-researched diversified portfolio of stocks.

The problem with that strategy is that most ETFs and mutual funds are not good deals. Their managers do not do good research or pick good stocks all the while charging substantial fees. History shows that funds are great at making fund companies money, but they lose money for investors compared to index investing.

This week’s Danger Zone pick is a fund whose managers aren’t living up to the fund’s methodology. They talk a big game about using return on capital and DCF models, but the stocks they pick don’t look good to us. Maybe, these managers have their own version or return on capital or DCF models or, maybe, they want to charge high fees and do little work. We can’t speak to their motivations, but we can say this fund charges way too much to allocate capital to bad stocks.

Investors are getting the worst of both worlds.

To kick off our quarterly ETF and mutual fund sector and style rankings, we’ve identified a mutual fund that, despite a seemingly sound methodology, fails to invest in quality stocks.

Past performance is not an indicator of future performance, yet past performance drives nearly all fund ratings. We think the quality of the fund’s underlying individual stocks matters more. Strong holdings are what ultimately drive fund performance, and if you hold bad stocks, performance is likely to be bad too.

This fund allocates too much capital to companies with lower profitability and expensive valuations (relative to the benchmark). To make matters worse, it charges well above-average fees, especially considering its subpar portfolio. Vaughan Nelson Mid Cap Fund (VNVAX) is this week’s Danger Zone pick.

Forward-Looking Research Protects Investors

While legacy fund research is backward-looking, our fund research is forward-looking and based on proven-superior fundamental analysis and ratings on each individual holding.

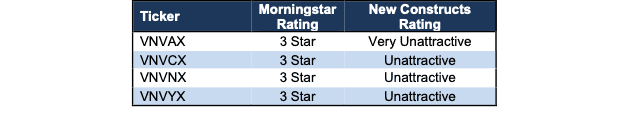

VNVAX earns our Very Unattractive (equivalent to Morningstar’s 1 Star) rating while Morningstar gives the fund a 3 Star rating. Figure 1 shows how our forward-looking Fund Ratings compare to Morningstar’s (MORN) ratings.

VNVCX, VNVNX, and VNVYX, the other share classes of the mutual fund, earn a 3 Star rating while we rate each Unattractive.

Figure 1: Vaughan Nelson Mid Cap Fund Ratings

Sources: New Constructs, LLC, company filings, mutual fund filings, and Morningstar

Fund Methodology Sounds Strong, But Holdings Reveal Otherwise

Vaughan Nelson Mid Cap Fund invests in “medium capitalization companies with a focus on those companies meeting Vaughan Nelson’s return expectations.” The subadvisor, Vaughan Nelson Investment Management, uses a “bottom-up value-oriented investment process” that sounds good on paper.

Specifically, Vaughan Nelson seeks companies with the following characteristics:

- Companies earning a positive return on capital with stable-to-improving returns.

- Companies valued at a discount to their asset value.

- Companies with an attractive and sustainable dividend level.

Further, the fund’s prospectus mentions how Vaughan Nelson (emphasis added) “selects stocks selling at a relatively low value based on business fundamentals, economic margin analysis, and discounted cash flow models.

Normally, we’d love to see a fund selecting companies based on return on capital, economic margin, and discounted cash flow models. These metrics sound just like the return on invested capital (ROIC), economic earnings, and reverse DCF models we use in our Stock Ratings and our Fund Ratings.

However, when we analyze the stocks held by VNVAX, we find that the holdings do not live up to the methodology. In fact, our analysis reveals VNVAX’s investment process finds stocks with lower returns on invested capital (ROIC), lower cash flows, and more expensive valuations than its benchmark and the S&P 500, as we’ll show below.

Holdings Research Reveals a Low-Quality Mid Cap Blend Portfolio

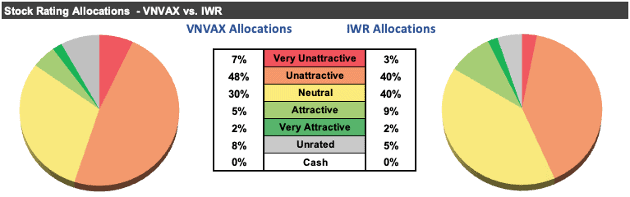

Our holdings analysis, which leverages our Robo-Analyst AI Agent[1], reveals that VNVAX holds lower-quality stocks than its benchmark iShares Russell Mid-Cap ETF (IWR). For reference, IWR earns a Neutral rating.

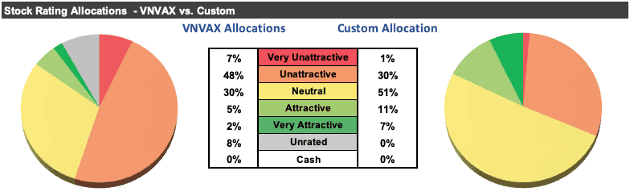

Per Figure 2, VNVAX allocates 55% of its portfolio to Unattractive-or-worse rated stocks compared to 43% for IWR. On the flip side, VNVAX allocates only 7% of its assets to Attractive-or-better rated stocks compared to 11% for IWR.

Figure 2: Vaughan Nelson Mid Cap Fund Allocates to Far Worse Stocks than IWR

Sources: New Constructs, LLC, company, ETF, and mutual fund filings

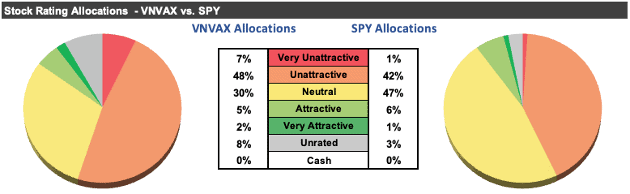

Per Figure 3, our holdings analysis also reveals VNVAX’s portfolio is lower quality than the S&P 500, as represented by State Street SPDR S&P 500 ETF (SPY), which earns an Attractive rating.

At 43% of its portfolio, SPY allocates less to Unattractive-or-worse rated stocks compared to VNVAX (at 55%). SPY and VNVAX allocate equally to Attractive-or-better rated stocks, at 7% of their portfolios.

Figure 3: Vaughan Nelson Mid Cap Fund Allocates to Worse Stocks than SPY

Sources: New Constructs, LLC, company, ETF, and mutual fund filings

Given VNVAX allocates just 7% of assets to Attractive-or-better rated stocks, it appears poorly positioned to generate the outperformance required to justify higher active management fees.

Expensive Stocks Drive Very Unattractive Risk/Reward Rating

Figure 4 shows our detailed rating for VNVAX, which includes each of the criteria we use to rate all ETFs and mutual funds under coverage. These criteria are the same for our Stock Rating Methodology, as the performance of a mutual fund equals the performance of its holdings minus fees. Figure 4 also compares VNVAX’s rating with those of IWR and SPY.

Figure 4: Vaughan Nelson Mid Cap Fund Rating Details

Sources: New Constructs, LLC, company, ETF, and mutual fund filings

As Figure 4 shows, VNVAX is inferior to IWR in four of the five criteria (and three of five vs. SPY) that make up our Portfolio Management rating. Specifically:

- VNVAX’s holdings generate positive economic earnings, same as IWR and SPY.

- VNVAX’s ROIC is 10%, which is lower than IWR’s (12%) and SPY’s (35%) ROIC.

- VNVAX’s 2-yr average free cash flow (FCF) yield of 0% is lower than IWR’s at 2% and SPY’s at 1%.

- The price-to-economic book value (PEBV) ratio for VNVAX is 6.8, which is worse than the 4.0 for IWR and 4.1 for SPY.

- Our discounted cash flow (DCF) analysis reveals an average market-implied growth appreciation period (GAP) of 65 years for VNVAX’s holdings compared to 59 years and 76 years for IWR’s and the S&P 500’s holdings.

In other words, market expectations for stocks held by imply profits will grow substantially more than the stock’s held by IWR and SPY (measured by PEBV ratio), despite VNVAX’s holdings being less profitable (as measured by ROIC).

This rigorous holdings analysis reveals that VNVAX provides exposure to less profitable companies, while taking much more valuation risk than the benchmark and S&P 500.

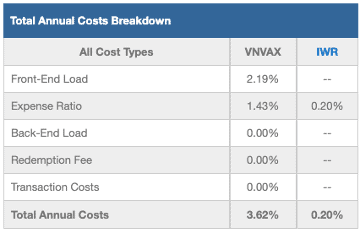

High Fees Make Owning VNVAX Worse

At 3.62%, VNVAX’s total annual costs (TAC) are higher than 89% of Mid Cap Blend mutual funds under coverage. For comparison, the simple average TAC of all the Mid Cap Blend mutual funds under coverage is 1.77% and the asset-weighted average is 0.53%. IWR charges just 0.20% and SPY has total annual costs of just 0.10%. Why pay higher fees for inferior stock selection?

Our TAC metric accounts for more than just the expense ratio. We consider the impact of front-end loads, back-end loads, redemption fees, and transaction costs.

Figure 5 shows our breakdown of VNVAX’s total annual costs, which we provide for all ~6,100+ mutual funds and ~1,000+ ETFs under coverage.

Figure 5: Vaughan Nelson Mid Cap Fund’s Total Annual Costs Breakdown

Sources: New Constructs, LLC, company, ETF, and mutual fund filings

To justify charging higher fees, VNVAX must outperform its benchmark by 342 basis points annually over three years.

However, VNVAX’s load-adjusted 3-year quarter-end average annual total return has underperformed IWR by 134 basis points and SPY by 862 basis points. VNVAX has also underperformed IWR over the 1-year and 10-year periods.

Given that 55% of its assets are allocated to stocks with Unattractive-or-worse ratings, and 85% are allocated to stocks with Neutral-or-worse ratings, VNVAX is likely to continue underperforming.

Get an Edge from Holdings-Based Fund Analysis Based on Superior Stock Research

We offer clients in-depth reports for all ~7,100+ ETFs and mutual funds under coverage. Click below for a free copy of our VNVAX standard mutual fund report.

Smart fund (or ETF) investing means analyzing each of the holdings of a fund. Failure to do so is a failure to perform proper due diligence. Simply buying an ETF or mutual fund based on past performance does not necessarily lead to outperformance. Only thorough holdings-based research can help determine if a fund’s methodology leads managers to pick high-quality or low-quality stocks.

Our Robo-Analyst technology analyzes the holdings of all 454 ETFs and mutual funds in the Mid Cap Blend style and 7,100+ ETFs and mutual funds under coverage to avoid “the danger within”.

Easily Make Any Fund, Even VNVAX, Better

As we show in The Paradigm Shift to DIY ETFs, new technologies enable investors to create their own fund without any fees while also enabling better, more sophisticated weighting methodologies. For example, if we reallocate the fund’s capital to the companies with the best Core Earnings, our customized fund allocates more capital to better stocks:

- 18% of assets to Attractive-or-better rated stocks (compared to 7% for VNVAX)

- 31% of assets to Unattractive-or-worse rated stocks (compared to 55% for VNVAX)

Compare the quality of stock allocation in as-is VNVAX vs. our customed version of VNVAX in Figure 6. While we can’t fix the bad stock picks, we can, at least, be sure to allocate more capital to the better stocks.

Figure 6: Vaughan Nelson Mid Cap Fund Allocation Could Be Improved

Sources: New Constructs, LLC, company, and mutual fund filings

Note that our DIY ETF tool allows clients to pick and weight portfolio holdings based on multiple proprietary metrics, such as Core Earnings, Economic Earnings, ROIC, Net Operating Profit After Tax and more.

Check Out the Indices Based on New Constructs Research

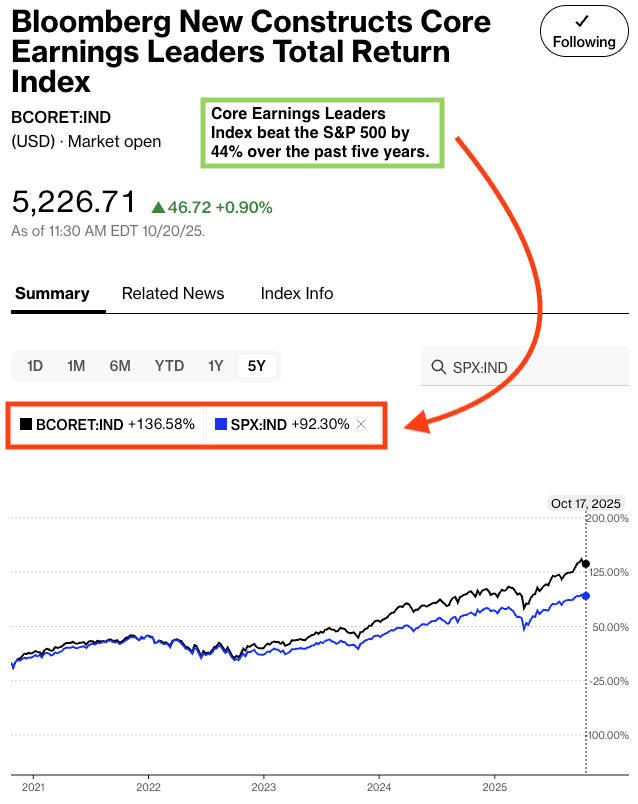

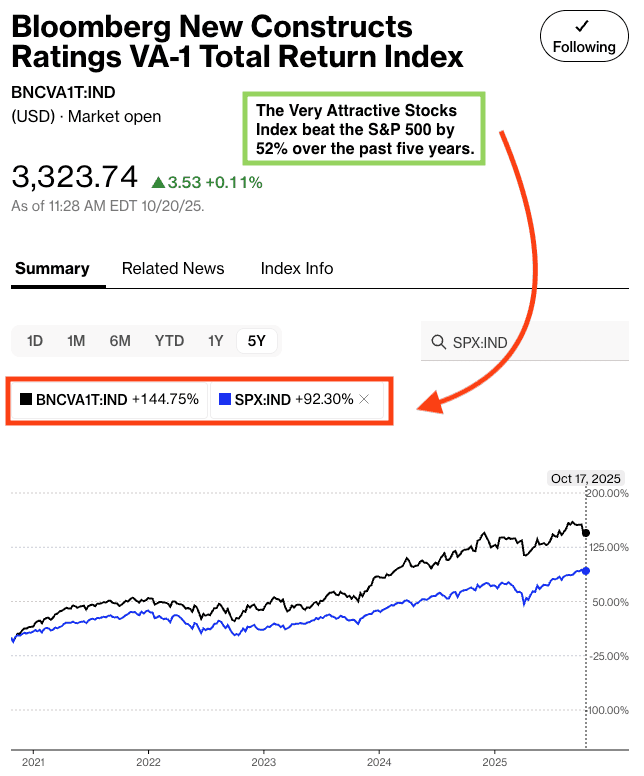

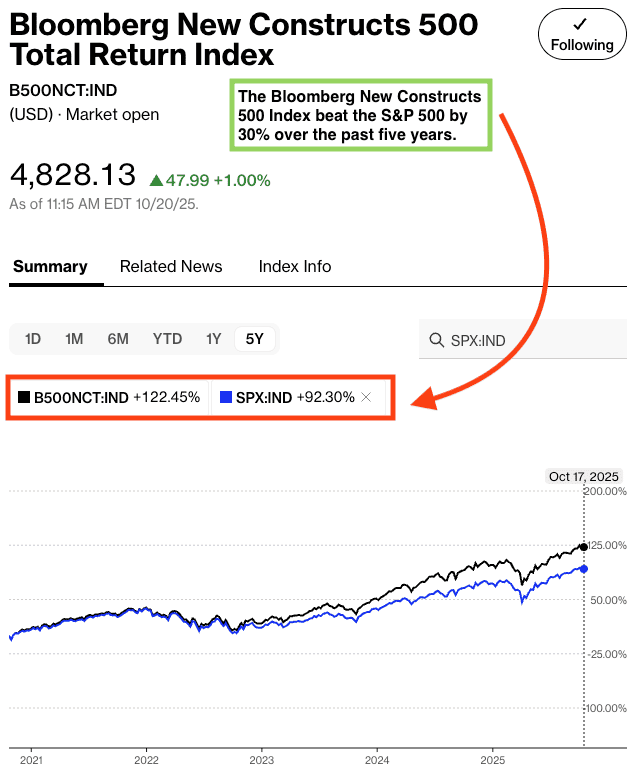

While we’re writing about creating your own fund, we should highlight the indices we’ve developed with Bloomberg’s Index Licensing Group. All three outperformed the S&P 500 over the past five years. See Figures 7-9.

- Bloomberg New Constructs Core Earnings Leaders Index (ticker: BCORET:IND)

- Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND)

- Bloomberg New Constructs 500 Index (ticker: B500NCT:IND)

The Bloomberg New Constructs Core Earnings Leaders Index beat the S&P 500 by 44% over the past five years. The Index (ticker: BCORET:IND) was up 137% while the S&P 500 was up 92%. See Figure 7 for details.

Figure 7: Bloomberg New Constructs Core Earnings Leaders Index Outperforms the S&P 500

Sources: Bloomberg as of October 17, 2025

Note: Past performance is no guarantee of future results.

The “Very Attractive Stocks” Index beat the S&P 500 by 52% over the past five years. Bloomberg’s official name for the index is Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND). Figure 8 shows it was up 145% while the S&P 500 was up 92%.

Figure 8: Very Attractive-Rated Stocks Strongly Outperform the S&P 500

Sources: Bloomberg as of October 17, 2025

Note: Past performance is no guarantee of future results.

Our “Core-Earnings Weighted S&P 500” Index beat the S&P 500 by 30% over the past five years. Bloomberg’s official name for the index is Bloomberg New Constructs 500 Total Return Index (ticker: BNCVAT1T:IND). Figure 9 shows it was up 122% while the S&P 500 was up 92%.

Figure 9: Bloomberg New Constructs 500 Index Strongly Outperforms the S&P 500

Sources: Bloomberg as of October 17, 2025

Note: Past performance is no guarantee of future results.

Better Options for Mid Cap Blend Funds

Below we present Mid Cap Blend ETFs or mutual funds that feature an Attractive rating, >$100 million in assets under management, and below average TAC:

- Vanguard U.S. Multifactor ETF (VFMF) – 0.20% TAC and Very Attractive rating

- Boston Trust Walden Mid Cap Fund (WAMFX) – 1.13% TAC and Very Attractive rating

- Franklin U.S. Mid Cap Multifactor Index ETF (FLQM) – 0.33% TAC and Very Attractive rating

This article was originally published on October 20, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] See Harvard Business School case study: New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.