Slack Technologies (WORK) – Closing Short Position – up 11% vs. S&P up 25%

We put Slack Technologies (WORK: $43/share) in the Danger Zone on June 17, 2019, just a few days before it went public via direct listing. At the time, WORK received an Unattractive rating. Our report focused on rising competition in the industry, poor corporate governance, and the high expectations baked into WORK’s expected valuation.

This report, along with all of our research[1], utilizes our superior data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

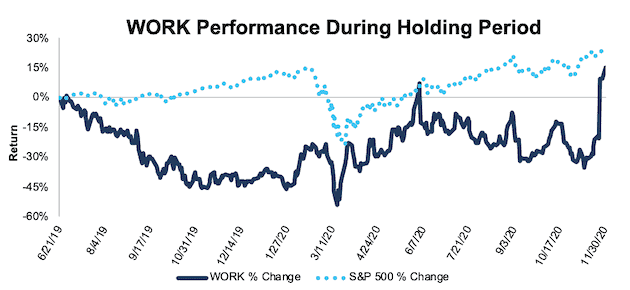

During the one-and-a-half-year holding period, WORK outperformed as a short position, rising 11% from its opening price of $38.50/share compared to a 25% gain for the S&P 500.

While the firm’s fundamentals remain poor, with negative economic earnings and return on invested capital (ROIC), multiple sources have reported that Salesforce (CRM) is in advanced talks to acquire Slack at a premium to the current price. The stock has already jumped over 40% since word of a possible acquisition was reported on November 25, 2020 and an official announcement could send shares even higher. As a result, we are closing this short position.

Figure 1: WORK vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on December 1, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan and the Journal of Financial Economics. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).