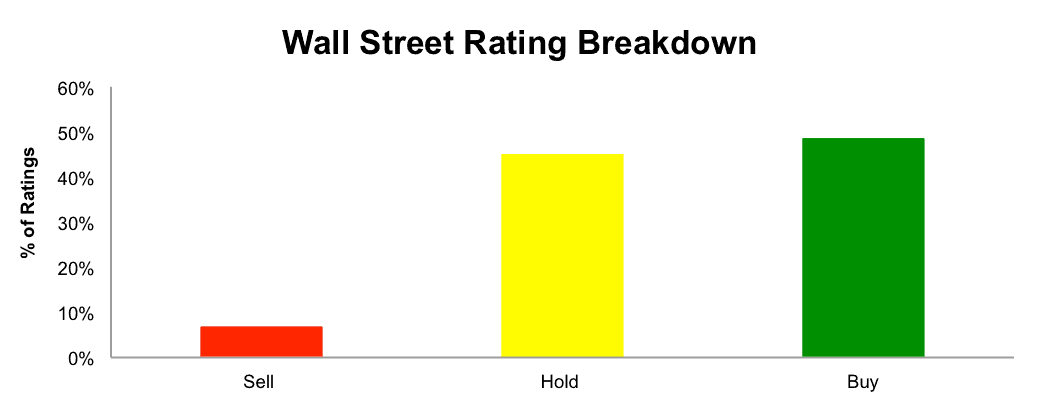

Sell-side analysts most often assign companies “buy” ratings and almost never tell investors to “sell.” An analysis from Bespoke Investment Group found that out of 12,122 ratings for all stocks in the broad market index, less than 7% were labeled sells, as shown in Figure 1. A more recent CNBC analysis reported that the percentage of newly issued ratings of “sell” or “underweight” was only 5% of the total. This phenomenon is not new to regular market followers, and it was on full display surrounding the IPO of Snapchat (SNAP).

Figure 1: Snapshot of Typical Sell-Side Investment Ratings

Sources: Bespoke Investment Group; ratings as of February, 2015

Are Underwriter Ratings Particularly Conflicted?

Research analysts are in a tough spot when it comes to ratings on IPOs their firm’s investment banking department has underwritten and sales/trading teams have distributed. They don’t want to risk:

- Angering clients that may have bought the IPO through the analyst’s firm.

- Offending the bankers (who typically run the firm) that worked hard to win the IPO deal.

In the words of Bloomberg’s Matt Levine:

“If you are publishing a research report weeks later, you know that a bunch of your investor clients bought SNAP in the IPO. You know others were pitched the stock in the IPO, and didn’t buy, and presumably won’t now. Putting a buy rating on the stock will help the former group (the stock will go up!), without much hurting the latter group (what do they care?).”

Exhibit A: Snapchat (SNAP) IPO

SNAP was our Danger Zone pick on February 6. The undue influence that an underwriter can potentially place on research, even when it is unspoken, at least appeared to be on display around this high-profile deal. The stark difference between research coverage issued prior to (by non-underwriters) and subsequent to (by underwriters) the actual IPO speaks for itself.

Eleven of the twelve analysts who initiated coverage prior to the IPO rated SNAP “hold” or “sell.” As soon as the publishing window for underwriters was open, 13 underwriters initiated coverage on March 27, 2017. Nine of the banks issued “buy” ratings, four issued “hold” ratings and none issued “sell” ratings. A summation of the underwriter’s sunny report roll out can be read here. Six additional, non-underwriter firms initiated coverage during April. All were “neutral” or “hold.”

There are now over 30 publicly visible analyst ratings on SNAP with an average recommendation of 2.8 on five-point scale, indicating a very slight overall positive bias. The average analyst price target of $23.50 (high: $31 / low: $10 implies upside of just 3% from current levels. We find it notable that projected appreciation is a mere fraction of the 99% 2018E revenue growth that analysts have used to craft these price targets.

Figure 2: SNAP’s Rating Distribution Evolution

Sources: New Constructs, LLC

An Insider’s Alternative View on Buy Ratings

Apart from ratings skewing towards “buy”, we’ve previously covered why some “buy” ratings are not truly “buy” ratings. Specifically, from a piece in the Financial Times, a former Credit Suisse analyst, Dan Davies, detailed scenarios when an analyst might issue a deceptive buy rating. The scenarios include:

- “Brown-Nosed Buy” – a buy rating to avoid upsetting the CEO of the firm under coverage.

- “Client-Driven Buy” – a buy rating for a stock that is a large holding of one of the analyst’s largest clients.

- “Industry Buy” – a buy rating for a stock because the analyst’s boss has made it clear that ratings are done on a sector relative basis and that at least one stock in an industry has to be a ‘buy.’

- “Neglect Buy” – a buy rating arising when an analyst fails to downgrade a stock even when he/she knows they should have; backtracking now would be embarrassing.

The most alarming detail in Mr. Davies’ confession is that buy/sell ratings are largely ignored by institutional investors but dangerous to retail investors.

Investors Need Independent Research

Though Wall Street may provide some of the best research in the world, the potential and actual conflicts are obvious, have always existed and are inherent in the sell-side business model. Not all the Wall Street research is conflicted. However, one can never know which reports are or are not conflicted since all the disclaimers in every report warn that each report may be conflicted in a myriad of ways. Equity research is a cost center and does not directly generate any revenue. Analysts provide value to the company, not by issuing accurate research reports, but by convincing clients to trade and companies to use the bank as an underwriter.

Independent due diligence is part of fulfilling fiduciary duties, and it tends to pay. Only by reading through the footnotes and making adjustments to reverse accounting distortions can advisors and investors meet the fiduciary duty of care.

This article originally published on May 8, 2017.

Disclosure: David Trainer, Kyle Guske II, Kenneth James and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Image: Solvency Ii Wire (Flickr)