Dividends offer great benefits such as income generation and a greater return on your investment when the stock price appreciates during your holding period.

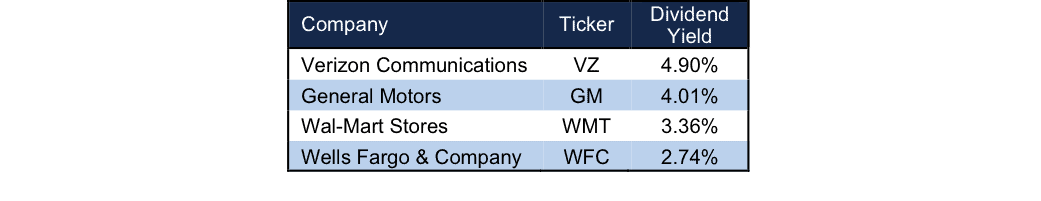

Some of our recent Long Ideas provide investors an excellent dividend yield and, most importantly, these companies have the cash flows needed to sustain the dividend.

Quality Stocks With Quality Dividends

Sources: New Constructs, LLC

Unfortunately, the correlation between dividends and cash flows does not always hold true. What happens when a high dividend-yielding stock, which seems attractive to dividend-seeking investors, is not supported by a business with the cash flows needed to pay the dividend?

Identifying these troubled companies, and avoiding them regardless of how high their dividend is at the moment, is key to building a strong portfolio.

Don’t get burned buying a stock without business operations that can support the dividend. Chasing yield could leave you holding the bag once dividends get cut and share prices fall. Find out how to avoid these traps in this week’s webinar “How To Avoid Dividend Traps.”

CEO David Trainer, a Wall Street veteran, will discuss why investors must be wary of high dividend yielding stocks. He’ll go over how dividends are not always correlated to cash flows, how unprofitable companies can continue paying dividends, and discuss some of the findings in our recent special report “4 Dividend Traps to Avoid.” Watch the webinar below:

Photo Credit: John Beales (Flickr)