Brett Arends at MarketWatch published a great article on Thursday that highlighted the worst calls by Wall Street money managers so far in 2014. His article confirmed two of our long-standing arguments, that active management tends to underperform, and that buying assets based on past performance is a recipe for disaster.

In particular, Arends’ article noted that money managers came into 2014 overweight Japan and underweight emerging markets. These same money managers had been burned when they came into 2013 bearish on Japan and bullish on emerging markets only for the former to outperform and the latter to tank. Sure enough, the money managers got it wrong again this year. Japanese equities have been among the worst performing asset classes this year while emerging markets have comfortably outperformed.

This delayed reaction is not unique to money managers. Too often average investors fall into this same trap of buying stocks and ETFs based on past performance rather than on real research into earning and valuation. So, everyone who owned high momentum stocks that crashed this year can feel good about being in the same boat with the “smart money”. Unfortunately, the smart money is not always that smart.

So, how can investors avoid falling into the same trap?

The answer is simple. Do your own diligence and don’t pay attention to the noise surrounding high momentum stocks and assets. We don’t cover emerging markets or Japanese equities, but in the U.S. stock market we’ve seen several cases over the past few years where fundamental research was able to cut through the momentum buzz.

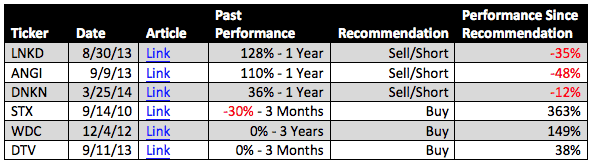

Figure 1 shows (1) momentum stocks that crashed from nearly all-time highs after we identified them as fundamentally unsound along with (2) less sexy stocks whose prices were stagnant when we recommended them but produced outstanding returns.

Figure 1: Fundamentals Beat Momentum

Doing your own fundamental analysis can be hard work, but as Figure 1 shows, it is worth it. Listening to the buzz on Wall Street only tells you what has outperformed, doing your own research can tell you what will outperform.

On that note, let’s look at some ETFs that look set to reverse recent trends and either over or underperform the market going forward. Unlike most ETF ratings that are based on past performance, our predictive ratings are based on our fundamental analysis of the holdings.

One underperforming ETF that we like going forward is the State Street SPDR Insurance ETF (KIE). KIE is down ~1%, this year, but it has an extremely strong portfolio. Over 50% of its holdings earn our Attractive or Very Attractive rating, led by its top holding, Aspen Insurance (AHL), one of our Most Attractive stocks.

On the other side of the coin, the iShares Dow Jones US Oil & Gas Exploration ETF (IEO) is up 11% in 2014 but earns our Very Dangerous rating. 88% of its holdings earn our Dangerous or Very Dangerous rating. On average its holdings have a price to economic book value ratio (PEBV) of 4.7, nearly double that of the S&P 500 at 2.5.

Oil and gas stocks may be hot right now, but following the crowd into this sector looks like a good way to lose money. No one is hyping up the insurance sector at the moment, but for long-run returns it looks like a good place to be.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.