Picking from the multitude of sector mutual funds is a daunting task. In any given sector there may be as many as 231 different mutual funds, and there are at least 630 mutual funds across all sectors.

Why are there so many mutual funds? The answer is: because mutual fund providers are making lots of money selling them. The number of mutual funds has little to do with serving investors’ best interests. Below are three red flags investors can use to avoid the worst mutual funds:

- Inadequate liquidity

- High fees

- Poor quality holdings

I address these red flags in order of difficulty. Advice on How to Find the Best Sector Mutual Funds is here. Details on the Best & Worst mutual funds in each sector are here.

How To Avoid Mutual Funds with Inadequate Liquidity

This is the easiest issue to avoid, and my advice is simple. Avoid all mutual funds with less than $100 million in assets. Low levels of liquidity can lead to a discrepancy between the price of the mutual fund and the underlying value of the securities it holds. In addition, low asset levels tend to mean lower volume in the mutual fund and large bid-ask spreads.

How To Avoid High Fees

Mutual funds should be cheap, but not all of them are. The first step is to know what is cheap and expensive.

To ensure you are paying at or below average fees, invest only in mutual funds with total annual costs below 1.97%, which is the average total annual costs of the 630 U.S. equity mutual funds I cover. Weighting the total annual costs by assets under management, the average total annual costs are lower at 1.31%. A lower weighted average is a good sign that investors are putting money in the cheaper mutual funds.

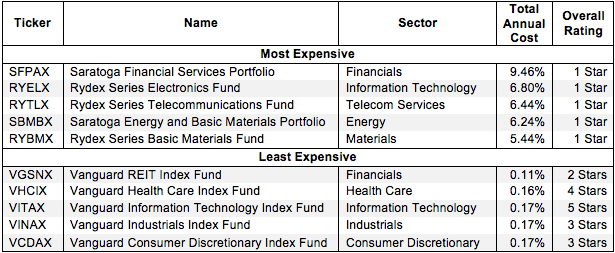

Figure 1 shows the most and least expensive sector mutual funds in the U.S. equity universe based on total annual costs. Rydex provides three of the most expensive funds while Vanguard’s are among the cheapest.

Figure 1: 5 Least and Most Expensive Sector Mutual Funds

Saratoga Financial Services Portfolio (SFPAX) and Rydex Series Electronics Fund (RYELX) are two of the most expensive U.S. equity mutual funds I cover. Vanguard REIT Index Fund (VGSNX) is the least expensive.

However, investors need not pay high fees for good holdings. Vanguard Information Technology Index Fund (VITAX) is my highest-rated sector mutual fund and earns my Very Attractive rating. It also has low total annual costs of only 0.17%.

On the other hand, VGSNX holds poor stocks. No matter how cheap a mutual fund, if it holds bad stocks, its performance will be bad.

This result highlights why investors should not choose mutual funds based only on price. The quality of holdings matters more than price.

How To Avoid mutual funds with the Worst Holdings

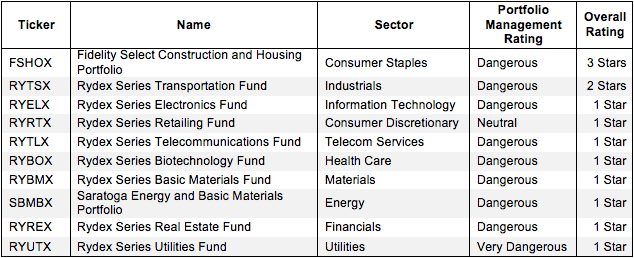

This step is by far the hardest, but it is also the most important because a mutual fund’s performance is determined more by its holdings than its costs. Figure 2 shows the mutual funds within each sector with the worst holdings or portfolio management ratings. The sectors are listed in descending order by overall rating as detailed in my 3Q Sector Ratings report.

Figure 2: Sector Mutual Funds with the Worst Holdings

My overall ratings on mutual funds are based primarily on my stock ratings of their holdings. My firm covers over 3000 stocks and is known for the due diligence done on each stock we cover.

Rydex Series appears more often than any other providers in Figure 2, which means that they offer the most mutual funds with the worst holdings. Rydex Series Utilities Fund (RYTUX) has the worst holdings of all Utilities mutual funds. RYBOX, SBMBX, FSHOX, and RYRTL all have the worst holdings in their respective sectors.

Find the mutual funds with the worst overall ratings on my mutual fund screener. More analysis of the best sector mutual funds is here.

The Danger Within

Buying a mutual fund without analyzing its holdings is like buying a stock without analyzing its business and finances. As Barron’s says, investors should know the Danger Within. Put another way, research on mutual fund holdings is necessary due diligence because a mutual fund’s performance is only as good as its holdings’ performance.

PERFORMANCE OF MUTUAL FUND’s HOLDINGs = PERFORMANCE OF MUTUAL FUND

Best & Worst Stocks In these Mutual Funds

Valero Energy Corp (VLO) is one of my least favorite stocks held by SBMBX and earns my Very Dangerous rating. Since 2009, VLO’s after tax profit (NOPAT) has declined by 9% compounded annually. Over the same timeframe, the company’s return on invested capital (ROIC) has fallen from 11% to 6% in 2013. The last time VLO generated positive economic earnings was 2009. Despite its declining profits and ROIC, VLO is valued as a profit-growing company. To justify its current price of ~$51/share, VLO must grow NOPAT by 8% compounded annually for the next 10 years. While this expectation isn’t out of reach for some companies, the recent trend in profits makes these expectations for Valero’s future seem rather high. Investor should avoid VLO.

Ford Motor Company (F) is one of my favorite stocks held by VCDAX and earns my Attractive rating. F also lands on my Most Attractive list for August. Since 2007, F has grown NOPAT by an impressive 42% compounded annually. In addition, the company has increased its ROIC to 9% from 1% in 2007. With the release of 16 new models in the U.S. this year, including the best-selling F-150, Ford looks to continue this profit growth. However, the market has failed to see any profit growth potential in Ford. At its current price of ~$17/share, F has a price to economic book value (PEBV) ratio of just 1.0. This ratio implies that the market expects F’s NOPAT never to grow meaningfully from current levels. While F may not continue to grow profits as fast as it has these past few years, it should easily surpass the market’s low expectations. Investors should give F a serious look.

Kyle Guske II contributed to this article

Disclosure: David Trainer owns F. David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.