Question: Why are there so many mutual funds?

Answer: mutual fund providers tend to make lots of money on each fund so they create more products to sell.

The large number of mutual funds has little to do with serving your best interests. Below are three red flags you can use to avoid the worst mutual funds:

- Inadequate Liquidity

This issue is the easiest to avoid, and our advice is simple. Avoid all mutual funds with less than $100 million in assets. Low levels of liquidity can lead to a discrepancy between the price of the mutual fund and the underlying value of the securities it holds. Plus, low asset levels tend to mean lower volume in the mutual fund and larger bid-ask spreads.

- High Fees

Mutual funds should be cheap, but not all of them are. The first step here is to know what is cheap and expensive.

To ensure you are paying at or below average fees, invest only in mutual funds with total annual costs below 2.27%, which is the average total annual costs of the 682 U.S. equity Sector mutual funds we cover. The weighted average is lower at 1.18%, which highlights how investors tend to put their money in mutual funds with low fees.

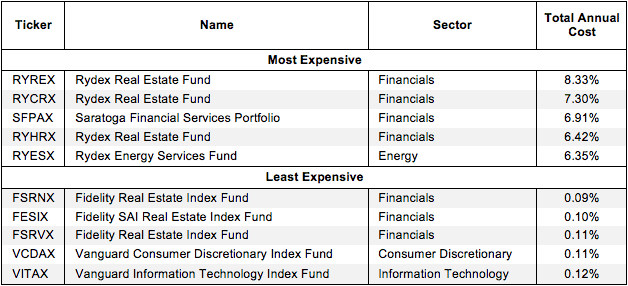

Figure 1 shows Rydex Real Estate Fund (RYREX) is the most expensive sector mutual fund and Fidelity Real Estate Index Fund (FSRNX) is the least expensive. Rydex (RYREX, RYCRX, RYHRX, RYESX) provides four of the most expensive mutual funds while Fidelity (FSRNX, FESIX FSRVX) funds are among the cheapest.

Figure 1: 5 Least and Most Expensive Sector Mutual Funds

Investors need not pay high fees for quality holdings. Vanguard Financials Index Fund (VFAIX) earns our Very Attractive rating and has low total annual costs of only 0.12%.

On the other hand, Vanguard Energy Index Fund (VENAX) holds poor stocks and receives our Dangerous rating, yet has low total annual costs of 0.12%. No matter how cheap a mutual fund, if it holds bad stocks, its performance will be bad. The quality of a mutual fund’s holdings matters more than its price.

- Poor Holdings

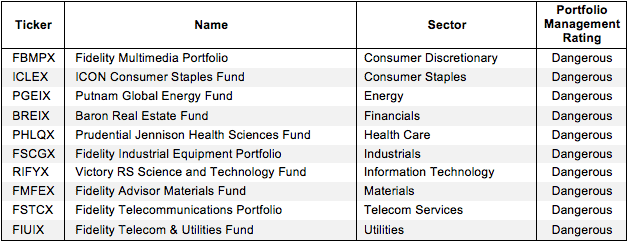

Avoiding poor holdings is by far the hardest part of avoiding bad mutual funds, but it is also the most important because a mutual fund’s performance is determined more by its holdings than its costs. Figure 2 shows the mutual funds within each sector with the worst holdings or portfolio management ratings.

Figure 2: Sector Mutual Funds with the Worst Holdings

Fidelity (FBMPX, FSCGX, FMFEX, FSTCX, FIUIX) appears more often than any other providers in Figure 2, which means that they offer the most mutual funds with the worst holdings.

Fidelity Telecommunications Portfolio (FSTCX) is the worst rated mutual fund in Figure 2. Victory RS Science and Technology (RIFYX), Putnam Global Energy (PGEIX), Baron Real Estate Fund (BREIX), Prudential Jennison Health Sciences Fund (PHLQX) and Fidelity Telecom & Utilities Fund (FIUIX) also earn a Very Dangerous predictive overall rating, which means not only do they hold poor stocks, they charge high total annual costs.

Our overall ratings on mutual funds are based primarily on our stock ratings of their holdings.

The Danger Within

Buying a mutual fund without analyzing its holdings is like buying a stock without analyzing its business and finances. Put another way, research on mutual fund holdings is necessary due diligence because a mutual fund’s performance is only as good as its holdings’ performance. Don’t just take our word for it, see what Barron’s says on this matter.

PERFORMANCE OF MUTUAL FUND’s HOLDINGs = PERFORMANCE OF MUTUAL FUND

This article originally published here on November 16, 2016.

Disclosure: David Trainer, Kyle Guske and Kyle Martone receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.