Picking from the multitude of style ETFs is a daunting task. In any given style there may be as many as 49 different ETFs, and there are at least 260 ETFs across all styles.

Why are there so many ETFs? The answer is: because ETF providers are making lots of money selling them. The number of ETFs has little to do with serving investors’ best interests. Below are three red flags investors can use to avoid the worst ETFs:

- Inadequate liquidity

- High fees

- Poor quality holdings

I address these red flags in order of difficulty. Advice on How to Find the Best Style ETFs is here. Details on the Best & Worst ETFs in each style are here.

How To Avoid ETFs with Inadequate Liquidity

This is the easiest issue to avoid, and my advice is simple. Avoid all ETFs with less than $100 million in assets. Low levels of liquidity can lead to a discrepancy between the price of the ETF and the underlying value of the securities it holds. In addition, low asset levels tend to mean lower volume in the ETF and large bid-ask spreads.

How To Avoid High Fees

ETFs should be cheap, but not all of them are. The first step here is to know what is cheap and expensive.

To ensure you are paying at or below average fees, invest only in ETFs with an expense ratio below 0.48%, which is the average expense ratio of the 260 US equity ETFs I cover. Weighting the expense ratios by assets under management, the average expense ratio is lower at 0.18%. A lower weighted average is a good sign that investors are putting money in the cheaper ETFs.

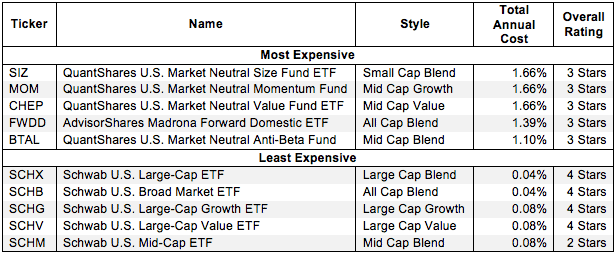

Figure 1 shows the most and least expensive style ETFs in the U.S. equity universe based on total annual costs. QuantShares provides four of the most expensive ETFs while Schwab ETFs are among the cheapest.

Figure 1: 5 Least and Most-Expensive Style ETFs

QuantShares U.S. Market Neutral Size Fund ETF (SIZ) and QuantShares U.S. Market Neutral Momentum Fund (MOM) are the second and third most expensive U.S. equity ETFs I cover. Schwab U.S. Large Cap ETF (SCHX) and Schwab U.S. Broad Market ETF (SCHB) are the least expensive.

However, investors need not pay high fees for good holdings. SCHX is my highest-rated style ETF and earns my Attractive rating. It also has low total annual costs of only 0.04%.

On the other hand, Schwab U.S. Mid-Cap ETF (SCHM) holds poor stocks and receives my Dangerous rating. No matter how cheap an ETF, if it holds bad stocks, its performance will be bad.

This result highlights why investors should not choose ETFs based only on price. The quality of holdings matters more than price.

How To Avoid ETFs with the Worst Holdings

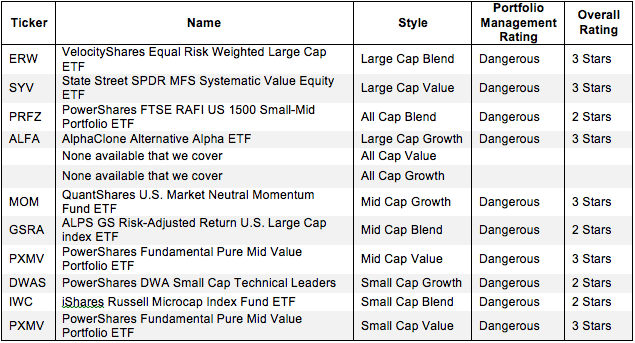

This step is by far the hardest, but it is also the most important because an ETF’s performance is determined more by its holdings than its costs. Figure 2 shows the ETFs within each style with the worst holdings or portfolio management ratings. The styles are listed in descending order by overall rating as detailed in my 3Q Style Ratings report.

Figure 2: Style ETFs with the Worst Holdings

My overall ratings on ETFs are based primarily on my stock ratings of their holdings. My firm covers over 3000 stocks and is known for the due diligence done on each stock we cover.

PowerShares appears more often than any other providers in Figure 2, which means that they offer the most ETFs with the worst holdings. AlphaClone Alternative Alpha ETF (ALFA) has the worst holdings of all Large Cap Growth ETFs. DWAS, MOM, GSRA, and IWC all have the worst holdings in their respective styles.

Find the ETFs with the worst overall ratings on my ETF screener. More analysis of the Best Style ETFs is here.

The Danger Within

Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. As Barron’s says, investors should know the Danger Within. Put another way, research on ETF holdings is necessary due diligence because an ETF’s performance is only as good as its holdings’ performance.

PERFORMANCE OF ETF’s HOLDINGs = PERFORMANCE OF ETF

Best & Worst Stocks In these ETFs

Cheniere Energy, Inc. (LNG) is one of my least favorite stocks held by MOM and earns my Dangerous rating. In 2010, LNG earned after-tax profit (NOPAT) of $114 million while earning a return on invested capital (ROIC) of 4%. Since then, the company has been in a downward spiral. LNG lost -$258 million in NOPAT and earned a -4% ROIC in 2013. The company’s lack of growth has continued into 2014, with LNG reporting net losses in Q1 and Q2. However, investors haven’t valued the stock accordingly as LNG is up over 75% year to date. This rise has made LNG extremely overvalued. To justify its current price of ~$70/share, LNG needs not only to attain a pretax margin of 30%, last achieved in 2010, but also grow revenues by 15% compounded annually for the next 67 years. One must be very optimistic to believe that any company, let alone the unprofitable LNG, can maintain such profit growth for over six decades. Declining NOPAT and ROIC and highly inflated expectations make LNG a stock to avoid.

Eli Lilly and Co. (LLY) is one of my favorite stocks held by SCHV and earns my Very Attractive rating. LLY has consistently grown NOPAT by 8% compounded annually over the past 9 years. LLY generates an ROIC of 17%, which puts it in the top quintile of all companies I cover. In addition, LLY has generated positive economic earnings every year since 1998. One might expect a strong company such as LLY to command a high valuation, but that’s not the case. At its current valuation of ~$61/share, LLY has a price to economic book value (PEBV) ratio of 0.9. This ratio implies that the market expects LLY’s NOPAT to drop by 10% from current levels and never increase again. This expectation is very pessimistic given the consistent profit growth shown by LLY and should be easily surpassed.

Kyle Guske II contributed to this article

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.